Rise of the next-gen bank CEO

(Full story

JPMorgan Chase's snarky tweet about financial wellness draws swift backlash

(Full story

Citi's latest executive moves in consumer analytics, private banking

(Full story

TD Bank's calculated shift to the cloud

(Full story

Inside Varo Money's three-year quest for a bank charter

(Full story

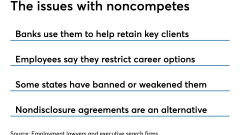

What ruling on noncompete clauses means for banks — and job hunters

(Full story

Goldman Sachs, Regions help raise $55M for construction-lending fintech

(Full story

After JPMorgan Twitter bungle, how should banks talk about personal finance?

(Full story

Hancock to buy MidSouth Bancorp for $213 million

(Full story

Critics fear shift at CFPB will let firms off the hook

(Full story