-

Nutmeg State Financial Credit Union is the first CU in Connecticut to offer in-branch DMV services — a move that could drive new growth at the credit union.

June 11 -

The company will snag its first branches in three towns in Connecticut and Rhode Island after buying locations from Webster Financial.

May 22 -

James Smith said his late enrollment in the state’s Republican Party meant he would be ineligible to be a candidate in its August primary and that he did not want to disrupt the nomination process.

April 11 -

James Smith said he would decide soon whether he’ll seek the Republican nomination for governor. He said he was inspired partly by his recent work on a commission tasked with recommending fixes to the state’s fiscal and economic problems.

April 6 -

CorePlus Federal Credit Union will acquire Connecticut Community CU in a merger expected to close later this year, pending regulatory and member approval.

April 4 -

Since stepping down as CEO of Webster Bank last month, James Smith has spent much of his time co-chairing a panel tasked with solving his home state’s fiscal and economic woes. Banks, and perhaps even fintechs, could be a part of its comeback story, he says.

February 26 -

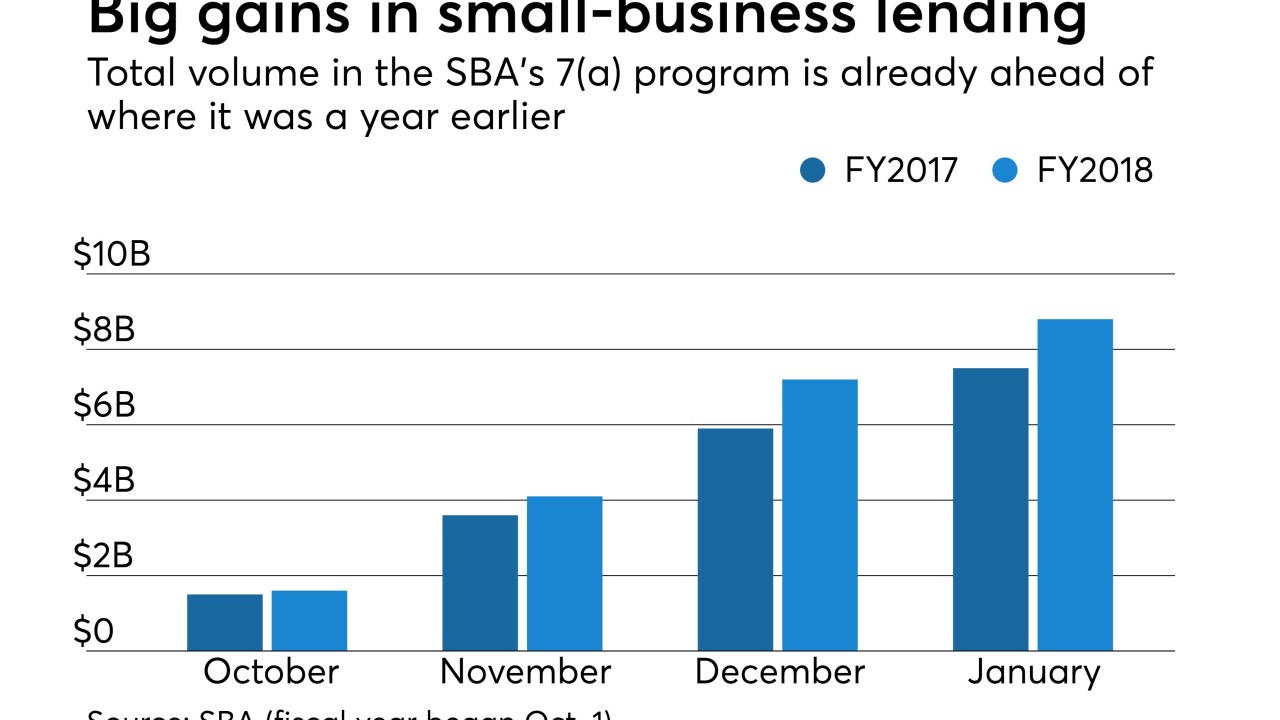

Patriot National in Connecticut planned to build a regional small-business lending operation on its own — until it had a chance to buy a national platform.

February 7 -

Patriot National in Connecticut would become the latest community bank to ramp up small-business lending with its $81 million deal to acquire Hana Financial's much larger SBA lending unit.

February 6 -

Nick Moalli succeeds John Keet, who is retiring from the credit union after nearly two decades there.

November 9 -

Here's a look at the 12 housing markets with the largest percentages of mortgages over $500,000 — the new threshold House Republicans have proposed for the mortgage interest deduction in their tax plan.

November 9 -

The Connecticut company, which is nearing the threshold to become a systemically important financial institution, has bought three businesses in the past year.

October 19 -

Connecticut-based CU surpasses 50,000 members just months after hitting $500 million in assets.

October 12 -

A double-digit increase in the size of the Connecticut company's commercial book factored heavily into its improved second-quarter results.

July 21 -

But the Connecticut company says the efficiencies of its recent acquisition of Suffolk Bancorp will begin to be realized soon.

July 20 -

Leaf Commercial Capital originates about $500 million in loans annually tied to equipment and software purchases.

July 20 -

Plimoth Investment Advisors, a firm owned by two mutuals in Massachusetts, is buying the business.

March 21 -

Joseph Greco previously served as CEO of Southern Connecticut Bancorp, which sold itself to Liberty Bank in 2013.

March 8 -

The Dorchester, Mass.-based CU liked COCC’s robust functionality.

February 15 -

The Massachusetts-based CU liked COCC’s cooperative business model.

January 27 -

The Connecticut bank said a spike in business lending and residential mortgages gave its fourth-quarter earnings a boost.

January 19