-

Power Financial Credit Union's deal for TransCapital Bank marks the fourth time this year a bank has agreed to be sold to a credit union in the Sunshine State.

March 27 -

Alex Sanchez acknowledges that the U.S. has a lot of banks and many failed in the crisis, but he says a healthy economy needs a fresh supply of community lenders to nurture entrepreneurs.

March 25 -

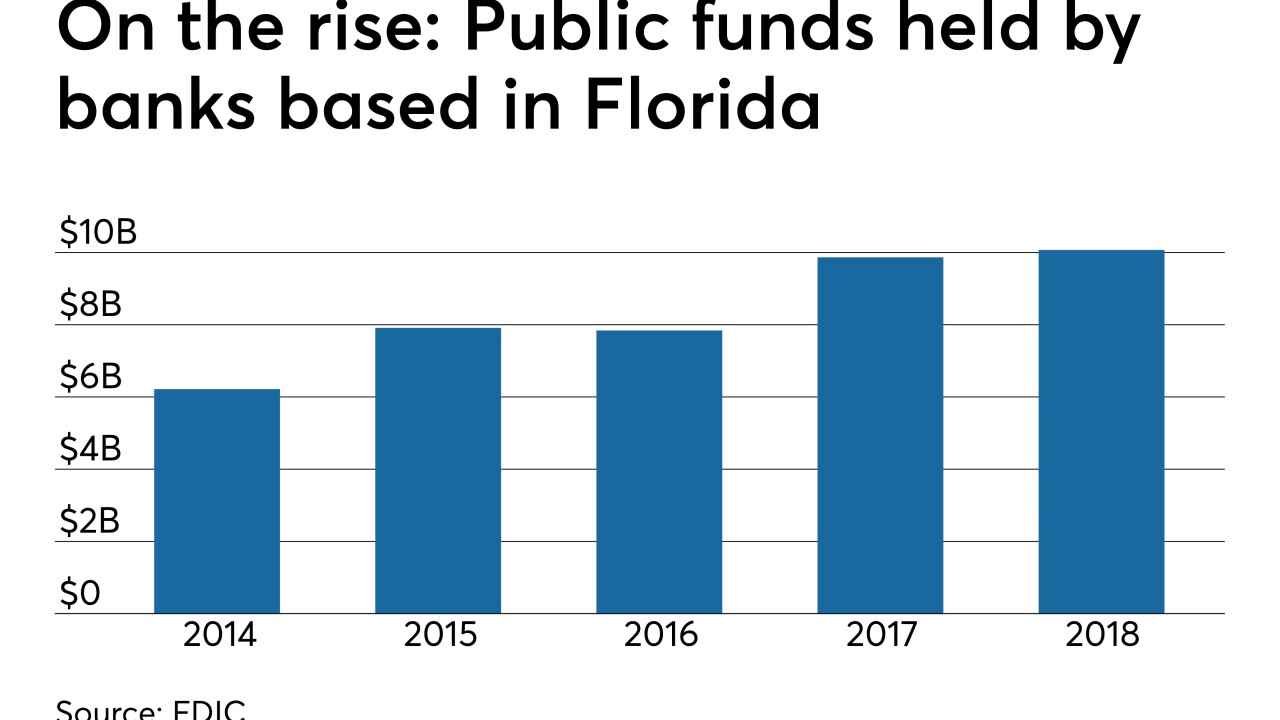

State law bars credit unions from accepting deposits from cities, counties and other government entities. Florida banks say it should stay that way unless tax advantages for credit unions are removed, but credit unions counter that banks are trying to stifle competition.

March 22 -

The credit union saw a 50 percent increase in mortgage originations, which helped spur a significant spike in net income last year.

March 21 -

Credit unions in those two states also posted double-digit growth in total loans and recorded lower delinquency rates.

March 19 -

Joseph Nowland will take over at the Jacksonville, Fla.-based institution after Gerri Sexsion retires later this month.

March 15 -

John Quill, a former deputy comptroller, had a key role deciding which banks could participate in the Troubled Asset Relief Program.

March 7 -

The Mississippi company will pay more than $200 million for the parent companies of Texas Star Bank and Summit Bank.

March 6 -

Gulf Atlantic Bank would be the eighth bank in the market, and just the second with local ownership.

March 5 -

Ronald Rubin, who was a CFPB enforcement attorney, will head an office overseeing nearly 200 state-chartered banks.

February 26 -

Fairwinds Credit Union in Orlando is set to buy Friends Bank, the third time this year a Florida-based bank has agreed to sell to a credit union.

February 20 -

Fairwinds Credit Union's deal for Friends Bank marks the third time this year that a Florida bank has agreed to be sold to a credit union.

February 20 -

OnApproach was launched in 2005, while Trellance was launched just two years ago as a division of CSCU

February 11 -

Boat sales have increased since the financial crisis, creating an opportunity for credit unions, but a number of risks mean institutions should tread carefully.

February 11 -

After a 50% increase in bank acquisitions by credit unions last year, analysts are predicting even more deals in 2019.

February 7 -

The former chief executive at Everglades FCU is banned from any involvement in federally insured financial institutions.

January 31 -

It could be time for credit unions to rethink emergency plans after a second active shooter struck a bank branch in about four months, industry experts said.

January 25 -

The Lake Mary, Fla., credit union has agreed to buy Fidelity Bank of Florida, which the SBA designated as a certified lender in 2017.

January 24 -

Police in Sebring, Fla., have yet to determine a motive for the attack in which four SunTrust workers and one customer were killed. The shooter, Zephen Allen Xaver, has been arraigned on five counts of first-degree murder.

January 24 -

The Florida company's earnings increased after it completed a big acquisition and produced strong year-over-year loan production.

January 22