-

Hove, who spent 11 years on the Federal Deposit Insurance Corp. board, was the agency's acting chairman three different times during the 1990s. He held several jobs in banking, including chairman and CEO of Minden Exchange Bank & Trust, which had been led by his father.

August 20 -

Acquiring the Nebraska bank would give CIT Group access to billions of low-cost deposits to fuel a go-it-alone growth plan. CEO Ellen Alemany says it could also make her company "more valuable" to potential buyers if it ever wants to sell.

August 13 -

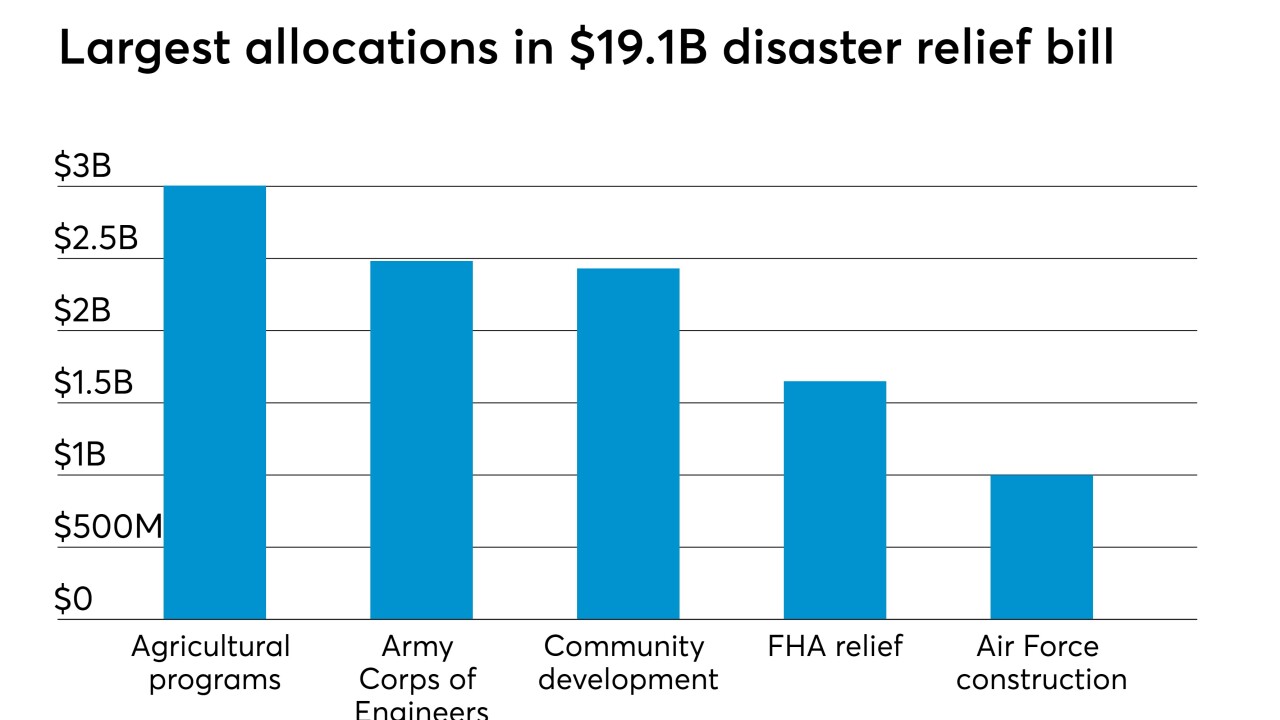

A $19.1 billion aid package signed into law earlier this month is welcome news for credit unions in Nebraska and a host of other regions that have suffered from recent natural disasters.

June 18 -

April Tompkins has been chief operating officer at the South Dakota-based institution for three years.

June 4 -

Credit union executives reported seeing an uptick in car loans as the weather improved but some predicted lending would be down this year.

May 21 -

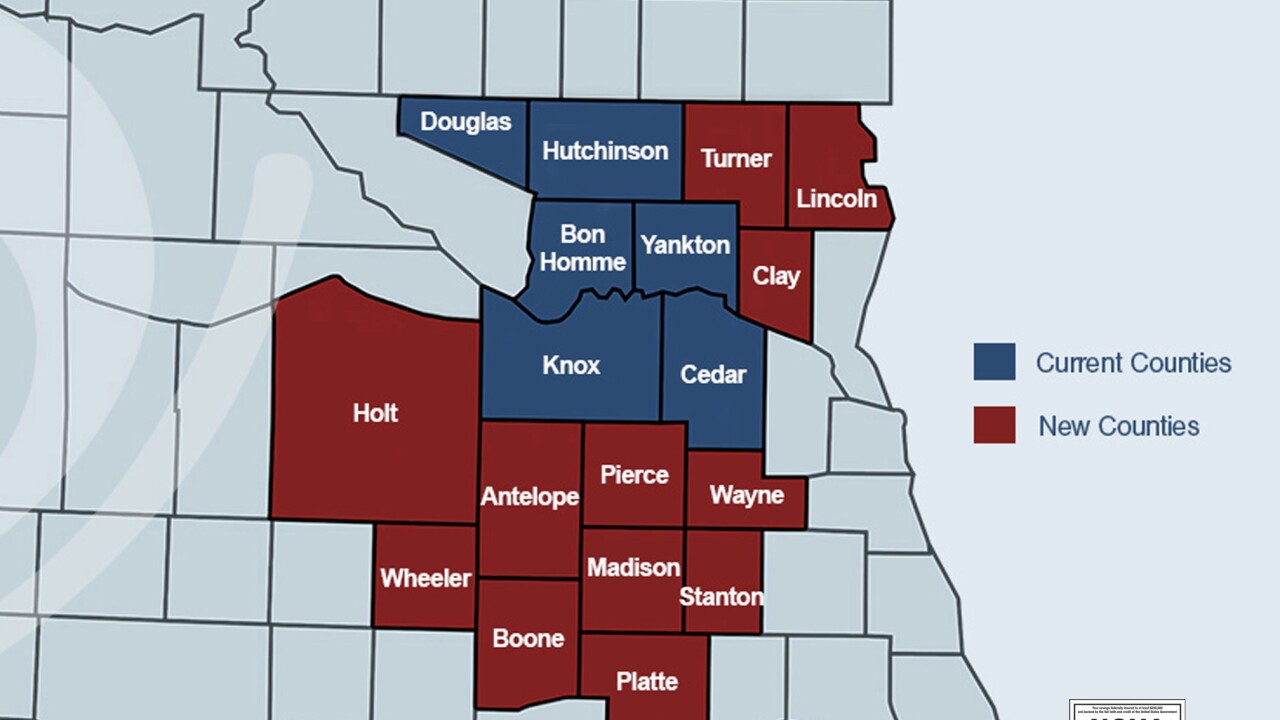

The Yankton, S.D.-based institution can now serve 18 counties across two states.

May 3 -

The disaster has caused billions of dollars in damages across several Midwestern states.

April 3 -

Rising waters in the Cornhusker State have already caused in excess of $1 billion in damages.

March 22 -

Two Iowa CUs had to come up with new names after a 2018 law prohibited them from using state universities as part of their brand identity.

March 3 -

Credit unions in the Cornhusker State are waiting to see whether lawmakers move forward on on a bill that would allow banks the opportunity to block field of membership expansions.

February 28 -

Credit unions in the Cornhusker State held the top two spots in a survey from Forbes and Statista, a marketing research firm.

July 6 -

The company will also sell $58 million in deposits to West Gate Bank.

March 21 -

Facing pressure to act on gun control laws, the bank said it would not "renew its contract with the National Rifle Association to issue the NRA Visa card."

February 22 -

Eight leagues/associations now are part of class action response to massive hack, with two leagues – representing CUs in Nebraska, Arizona, Colorado and Wyoming – joining on Halloween.

November 1 -

New clients will use vendor’s KeyStone core processing system.

September 13 -

The $1.5 million investment will help Grameen America make more small-dollar loans in the Midwest.

June 22 -

A Nebraska banking veteran put up $1 million of her own money to create a microlending program that doesn't require business owners to provide traditional collateral.

May 23 -

Banks already have a difficult time collecting data on mortgage lending to minorities. New data requirements scheduled to take effect in early 2018 could lead to even more mistakes and financial penalties not to mention higher compliance costs and longer delays in closing loans.

November 17 -

The president of the Kansas City Federal Reserve Bank is best known for her dissenting votes on monetary policy, but that's not the only way she stands out. Her background as a farmer and former bank examiner gives her a unique perspective among Fed officials.

October 30 -

Capital One Financial plans to start issuing credit cards for the outdoor equipment chain Cabela's under a deal connected with the retailer's expected sale to Bass Pro Shops.

October 3