-

The South Carolina company also provided a timeline for heightened regulation tied to crossing the $10 billion asset threshold.

January 23 -

The company agreed to pay $18 million for Atlantic Bancshares in a deal that will increase its operations along South Carolina's coast.

December 13 -

John Kimberly, who was CEO of a bank that CAB bought in 2014, is set to take the helm on Jan. 1.

December 12 -

First Reliance in South Carolina, which recently announced its first bank acquisition, is angling to take advantage of disruption caused by bigger mergers in the Carolinas.

October 19 -

The company, which agreed to buy Independence Bancshares, also brought in $25 million by selling common and preferred stock.

September 26 -

Monday’s eclipse is an astronomer’s dream, but CUs’ responses range from trying to make hay while the sun isn’t shining to preparing for potential disaster.

August 18 -

Lynn Harton was finally named CEO of United Community Bank after a five-year apprenticeship, though Jimmy Tallent remains CEO of the parent company. The executives have long touted an ability to bounce ideas off each other as a reason for United's success.

August 17 -

The credit union’s new name and imagery are intended to represent financial empowerment for consumers.

June 27 -

Beacon Community Bank seeks to become the first new bank in South Carolina in roughly a decade.

June 19 -

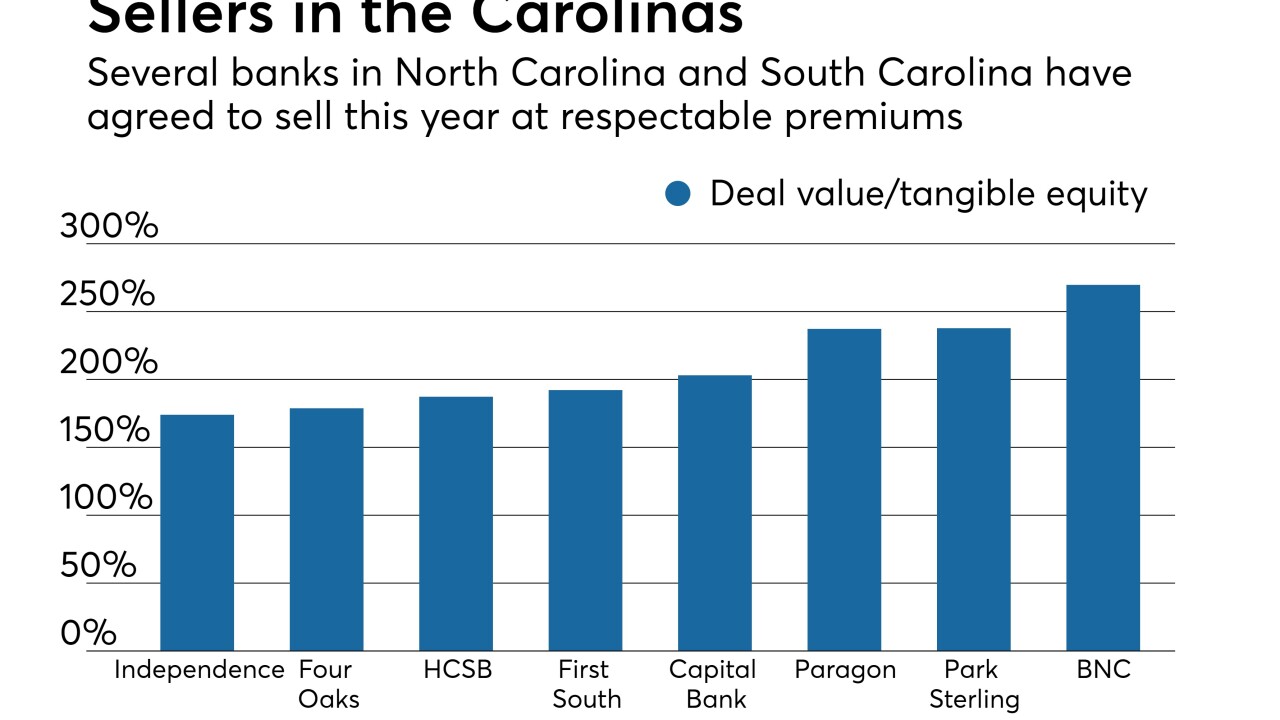

The company agreed to pay $162 million to buy First South Bancorp in Washington, N.C. It is the fifth time this year that a bank in North Carolina has agreed to be sold to a buyer from another state.

June 12