-

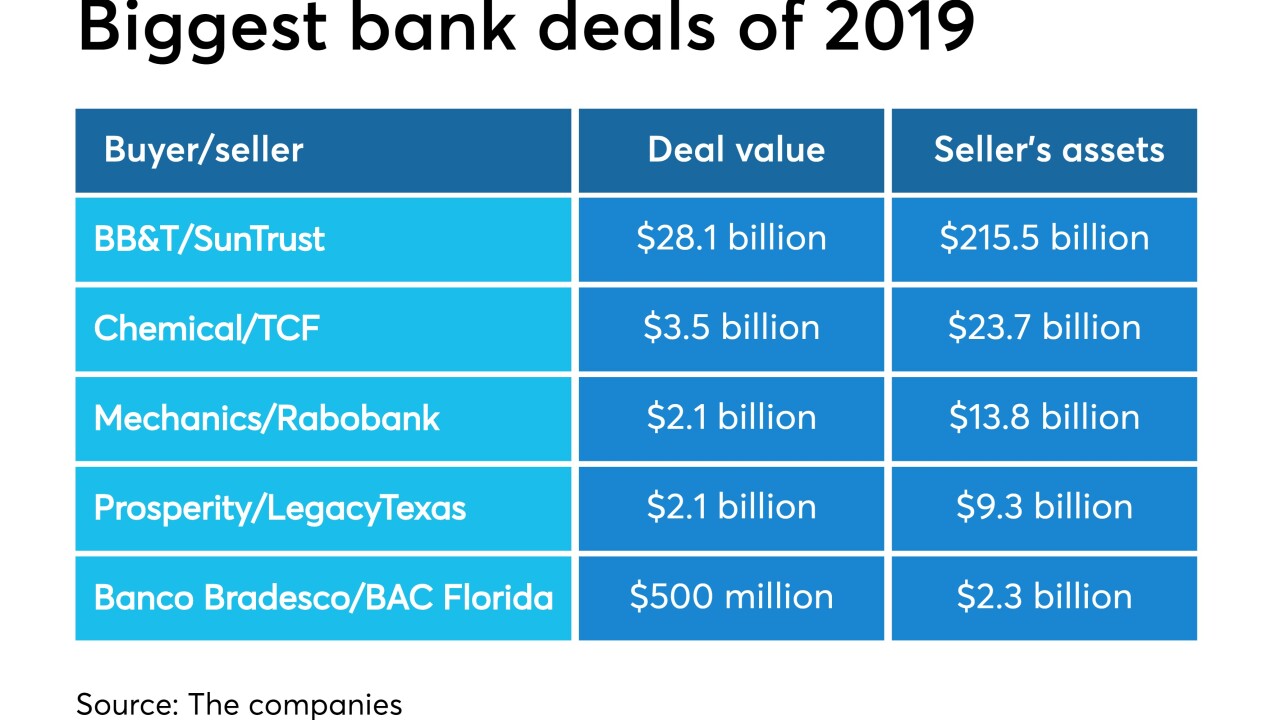

Deal values this year have been smaller than last year despite the hubbub over BB&T-SunTrust. Prosperity's agreement to buy LegacyTexas raises the possibility that the size of bank deals could start climbing.

June 17 -

The deal, among the four biggest bank acquisitions announced this year, would make Prosperity the second-largest bank based in Texas.

June 17 -

Eric Jenkins is taking over at the Amarillo-based institution as its president and CEO is set to retire.

June 13 -

Diverse economies and a limited number of sellers are making markets like Tampa, Fla., a hot spot for growth-minded banks.

June 6 -

Someone reportedly was burning paper at the Texas bank on a recent Saturday night, and a state regulator cited "insider fraud and abuse" after Enloe was closed.

June 3 -

Regulators closed The Enloe State Bank in Texas late Friday, marking the first failure in 17 months and the first in the Lone Star State in over five years.

May 31 -

Kerry Parker plans to retire from the Austin, Texas-based institution next month.

May 17 -

The new capital will allow the Austin bank to increase its lending limit.

May 14 -

Heightened regulatory scrutiny and a slowdown in commerce have raised concerns about the viability of doing business along the U.S.-Mexico border.

May 9 -

The coastal city quickly rebounded after being hit by Hurricane Harvey in August 2017.

May 9 -

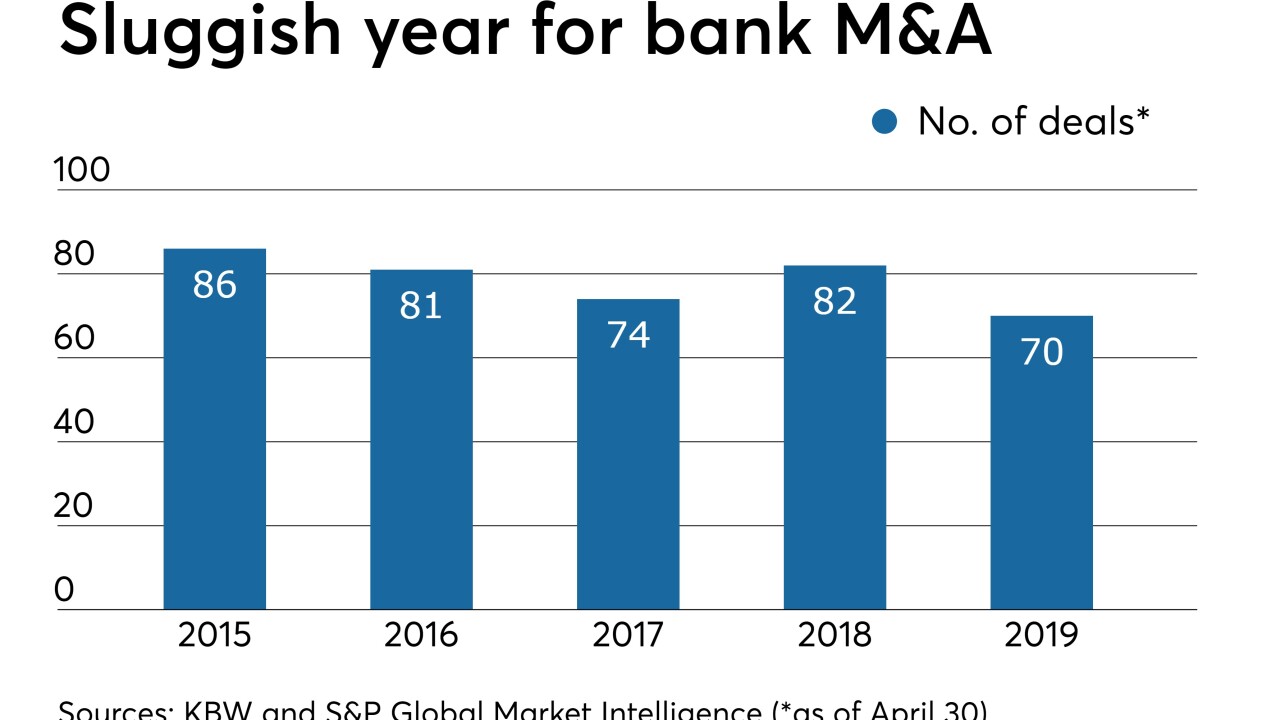

Consolidation activity was ho-hum for most of April before a burst of transactions — and notable ones at that — were announced in the month's final week.

May 8 -

It is comfortable with the deal for MidSouth despite the seller's lingering credit issues, given a shared history and the opportunity to add low-cost deposits.

May 1 -

The Houston company has already converted the systems and brand from January's acquisition, allowing it to focus more on bringing in business.

April 29 -

The San Antonio bank reported 6.8% growth in loans, but Phil Green said he was unwilling to match overly generous prices and underwriting terms that he is seeing in the market.

April 25 -

The Oklahoma company will pay $122 million for a bank with three branches in Dallas.

April 25 -

Investors seem to be betting that a long-rumored sale of the Dallas company is on hold now that it has named a new CEO, but analysts say it remains an attractive takeover target for a larger regional bank.

April 24 -

A surcharge-free ATM network among credit unions based in Central Texas has helped raise the profile of small CUs there – and some say it’s a strategy institutions in other cities could easily adopt.

April 18 -

The Dallas regional assured analysts that it has ample sources of liquidity to fund its expected loan growth.

April 16 -

Credit unions in the Lone Star State have been working with lawmakers on a series of bills but the clock is ticking since the legislative session ends in May and won't restart until 2021.

April 16 -

The Houston-based institution said investments in financial technology have led to operational efficiencies that enabled it to return more than $263,000 to members.

April 4