-

The Mt. Pleasant, Wis.-based credit union has returned more than $7 million to members in the last three years.

December 3 -

The purchase of Michigan-based Compliance Systems Inc. is intended to better help credit unions stay on top of regulatory changes.

November 28 -

The Wisconsin-based institution has seen a 10 percent boost in loan volumes since implementing a new e-docs platform last year.

November 20 -

A new study from CUNA Mutual Group finds a disconnect between consumer sentiments and their financial behaviors.

November 14 -

Northern Oak Wealth Management is a registered investment adviser with $800 million in assets under management.

November 9 -

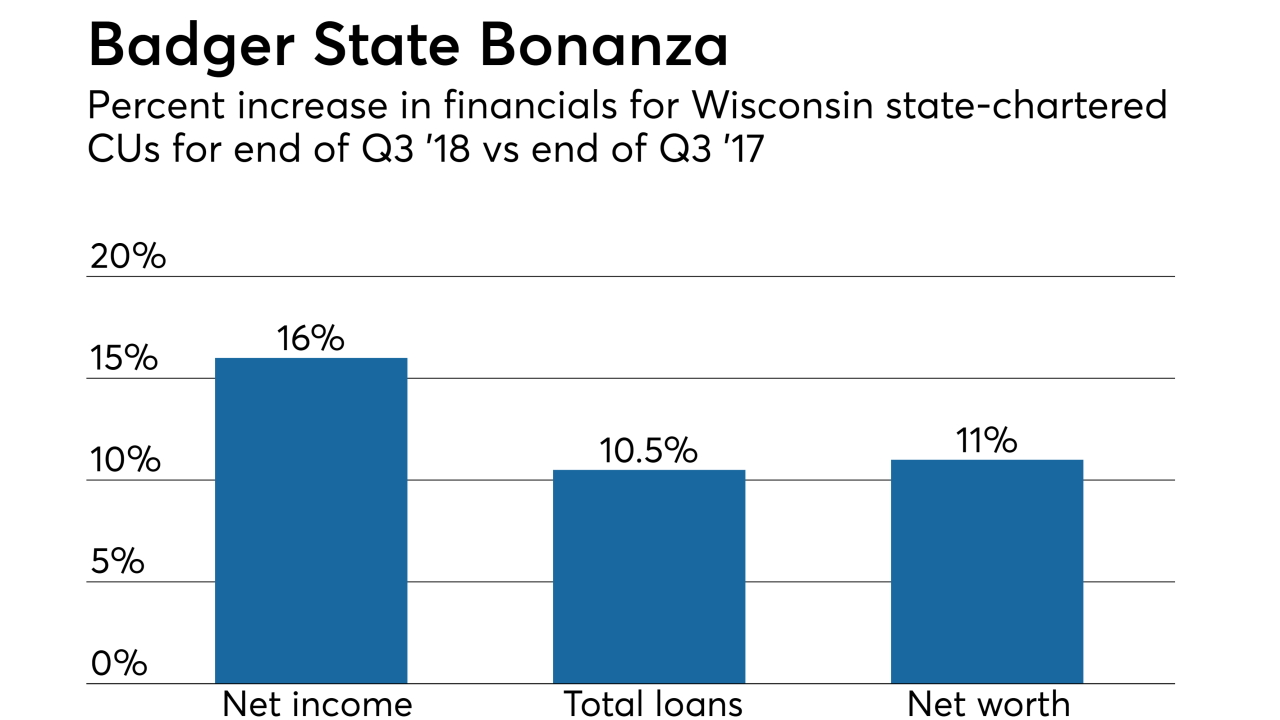

The state's Q3 numbers show a continuation of positive trends for Wisconsin's state-chartered credit unions.

November 9 -

U.S. Rep. Gwen Moore helped launch a credit union early in her career and today works to advance the movement's interests in Congress.

November 5 -

Credit unions have benefited from record car sales in recent years. But changing customer behavior and a new form of fraud could prove difficult headwinds to overcome in this area.

October 31 -

Van Wanggaard is running for re-election as a Wisconsin state senator by focusing on bringing more jobs to his state and fighting for victims’ rights.

October 30 -

Governors in Arkansas, Georgia, Oklahoma, Texas and Wisconsin used International Credit Union day as an opportunity to recognize the industry.

October 19 -

The Wisconsin company expects outstanding loans to decreased from current levels, particularly due to paydowns tied to commercial real estate loans.

October 18 -

Shay Santos, who has been with the Madison, Wis.-based credit union for nearly three decades, succeeds John Lowrey, who passed away in June.

September 28 -

Two credit unions are part of a fintech pilot program to help borrowers set aside money to pay down student debt faster.

September 28 -

This Madison, Wis.-based credit union recognizes that professional development outside of the branch is just as important as skills learned on the job.

September 24 -

Credit unions in 45 cities in Wisconsin and Minnesota will offer the prize-linked saving incentive.

September 4 -

The deal, announced earlier this year and set to close on Aug. 31, will expand the credit union's branch network and boost its membership.

August 30 -

The $2.7 billion-asset credit union is mobilizing support for relief efforts following floods in the southern central portions of the Badger State.

August 28 -

The company will enter the Iowa cities of Des Moines and Dubuque as part of the $170 million acquisition.

August 23 -

NCUF working with California Credit Union League to distribute disaster relief funds where needed.

August 15 -

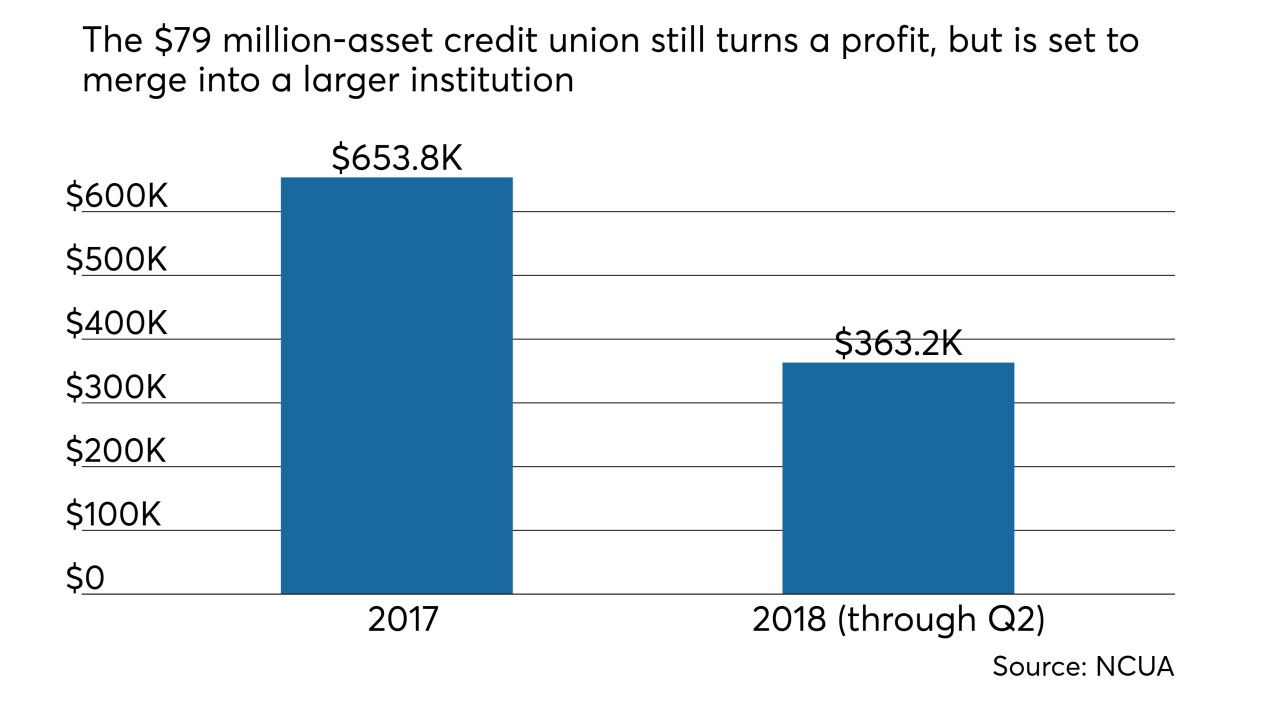

Both Wisconsin-based credit unions are profitable, but in vastly different asset classes.

August 14