-

At least 14 suits have been filed this year alone accusing banks of operating websites that violate the Americans with Disabilities Act. Some banks prefer settlements to investments in technological overhauls, but experts say that strategy could be costlier in the long run.

February 10 -

The bank says it has restored access, but it hasn’t explained how a fire-suppression system at one facility could cause a nationwide outage across all of its channels, or how its system as a whole could have been left so vulnerable to the incident.

February 8 -

The merged bank would set up an innovation and technology center in Charlotte as part of its bid to compete better against the largest institutions and fintech startups.

February 7 -

Customers reported being unable to access online banking, mobile banking or their debit cards.

February 7 -

Among the lessons David Hijirida learned at the online giant: Companies are often so focused on competitors that they neglect their own customers.

February 1 -

Gatsby, which has built an app to let novice investors buy puts or calls, has received funding from Barclays, Radius Bank and others. Radius is considering offering the service to its customers.

January 31 -

The 35-day partial government closing was a stark reminder that many Americans live paycheck to paycheck, and financial firms need to help solve that problem, the mobile banking firm’s CEO says.

January 29 -

The Pennsylvania company said it expects the digital bank to become profitable by the end of this year.

January 24 -

Its mobile banking app comes with bank accounts, merchant accounts, and instant credit on invoices. Behind it is a network of community banks that will gather the deposits the app brings in.

January 15 -

Americans are living longer yet retiring earlier and saving less, says Matt Fellowes, CEO and founder of United Income. But there's no need to panic.

January 15 -

Its savings, budgeting, spending and goal-setting tools, combined with artificial intelligence to add smart insights and advice, are a good example of how regional banks are trying to distinguish their mobile products from those of bigger banks with larger tech budgets.

January 14 -

Nicolas Kopp, head of N26 in this country, explains how the company plans to spend a chunk of the proceeds on its expansion here and add to the intensifying competition among fintechs.

January 10 -

The credit union service organization based in Florida has returned more than $500 million in patronage dividends since 1994.

January 8 -

As consumers continue to migrate to banking apps, it may be tempting for banks to focus solely on improving that channel experience. But doing so would be making the same mistake as focusing only on cards or cash at the point of sale.

January 7 -

As consumers continue to migrate to banking apps, lenders may be tempted to focus solely on improving that channel. But new data suggests consumers aren't abandoning other platforms just yet.

January 4 -

A partnership between the mobile carrier and BankMobile could help stripped-down banking and deposit transfer services find a footing among U.S. customers.

January 2 -

From the end of overdraft fees to the rise of banks that watch their customers' every move, there are several new banking trends on the horizon in 2019.

January 1 -

There are steps financial firms can take to protect their customers in the event a major wireless network is compromised, including reconsidering the use of SMS messaging for account authentication.

December 24 -

Among the most innovative CEOs of his generation, the former Umpqua chief and Pivotus founder is taking some of his best ideas to a new fintech as an adviser.

December 20 -

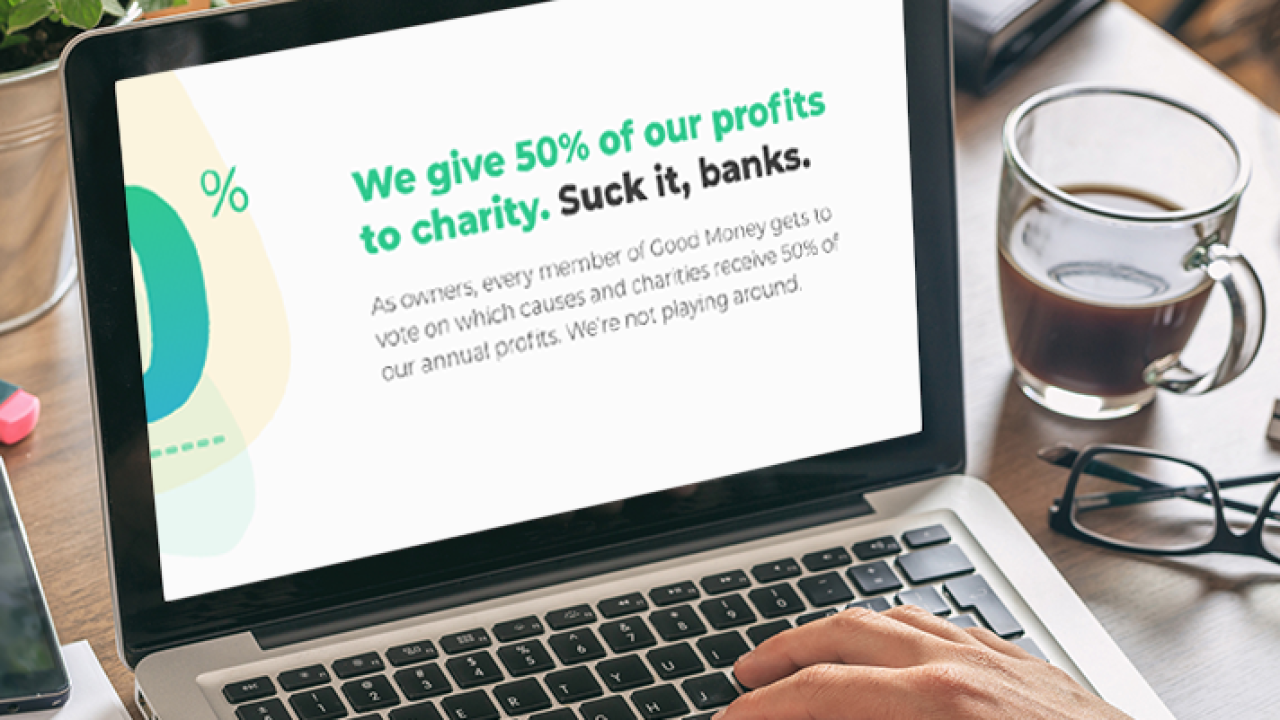

Good Money just raised $30 million and is a year away from launching, but already is raising concerns for its trash-talking of established players.

December 19