-

Vendors keep merging, and new ones keep forming. For banks, the change brings access to more options, but shorter relationships.

July 31 -

Small banks are being warned to slow down mobile tool development and check vendor arrangements, as researchers repeatedly find vulnerabilities that can be exploited by cybercriminals.

July 27 -

AWS's recent tech summit, with strobe lights and throbbing sound system may have felt more like a music festival than a conference, but one thing was clear: the symbiotic relationship between the online juggernaut and financial services runs deep.

July 27 -

Bank of America Merrill Lynch has launched a mobile application to support commercial prepaid card programs and their cardholders.

July 23 -

About 15% of Walmart’s workforce is budgeting and taking pay advances through the app.

July 19 -

The Fort Worth, Texas, company will be competing in a segment of the U.S. card market that has grown more competitive in the last few years.

July 19 -

Large card issuers began banning cryptocurrency purchases on their cards in February. But fintechs are allowing consumers to purchase and invest in digital currencies, and they say the risk is minimal.

July 18 -

The appointment of David Solomon, who will take over for retiring CEO Lloyd Blankfein, has not altered the bank's aggressive plan to build a mobile phone-based bank for consumers in the U.S. and beyond.

July 17 -

It ties checking accounts and cards to gaming and other apps to provide automated savings.

July 17 -

People's United in Connecticut pored over all the customer data it could find to persuade customers to give the midsize bank — instead of advisory firms and investment houses — a shot at managing their money.

July 13 -

The mobile microinvesting company offers five basic products because it wants to be known for helping customers manage saving and spending — and that's it, Noah Kerner said at In|Vest.

July 10 -

These teens and early 20-somethings are hardworking, frugal, prudent, debt averse and fiercely opposed to fees — much like their great-grandparents who grew up during the Depression.

July 9 -

These teens and early 20-somethings are hardworking, frugal, prudent, debt averse and fiercely opposed to fees — much like their great-grandparents who grew up during the Depression.

July 6 -

Founders of the startup digital bank Cogni say they have the formula for reaching Uber drivers and the like, but observers warn it's a group that won't be easily won over.

July 5 -

Digital Federal Credit Union developed a platform to accelerate fintech development that helps to bake in a valuable partnership between groups that might otherwise be competing with each other.

June 29 -

U.S. Bank is firmly committed to voice assistant technology, but remains cautious about enabling all forms of money movement via verbal commands.

June 29 -

The bank's Finn app is attracting users by removing complexity from mobile banking.

June 28 -

A new survey from J.D. Power shows that customers of digital-only banks, such as Capital One 360 and Ally Bank, are less satisfied with their banks' mobile channels than they were a year ago. Declining satisfaction among younger consumers is driving that trend.

June 28 -

Disruptive upstarts. Glitches galore. Open banking adoption. Financial institutions are being challenged on multiple fronts — here’s a look at how they’re coping.

June 28 -

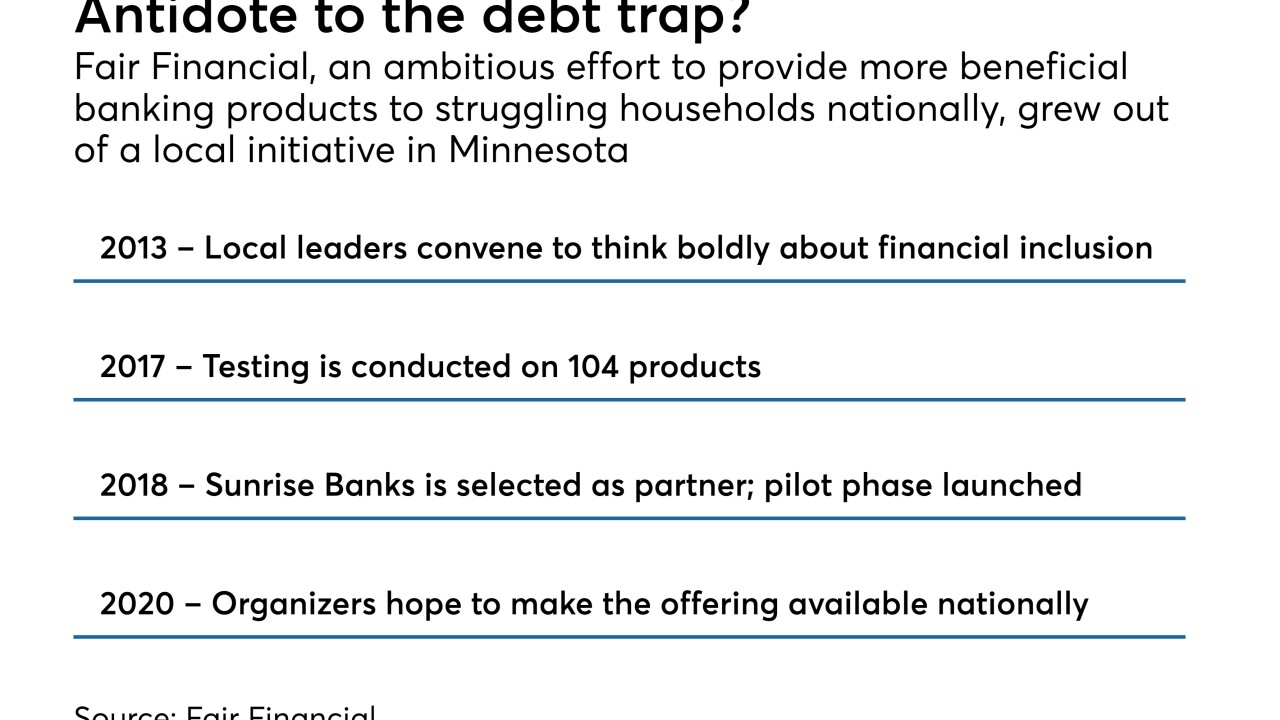

Fair Financial, a digital banking platform developed by a Twin Cities nonprofit in partnership with a local bank, launched a pilot program this week. By 2020, it plans to serve 5,000 customers across the country.

June 22