-

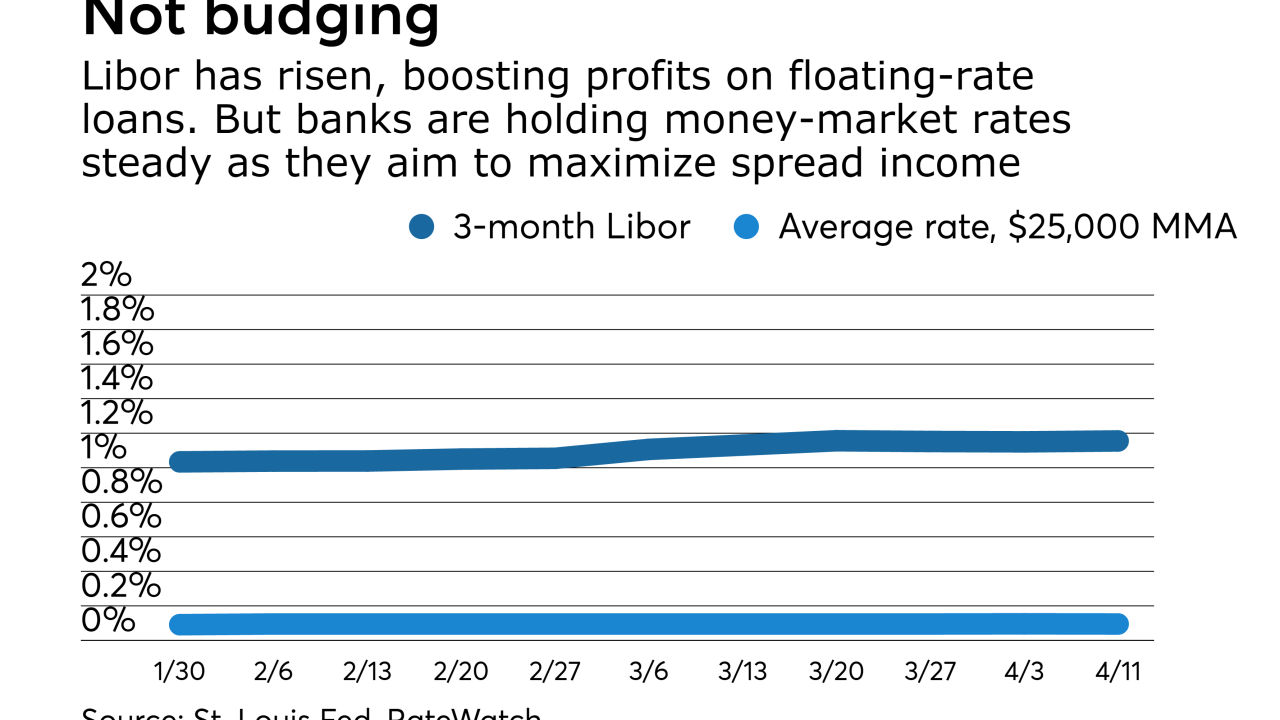

Even with net interest margins improving, banks are reluctant to raise rates on deposits until more floating-rate loans reprice. But how long can they wait before depositors start demanding higher yields?

April 24 -

The Atlanta company's profits rose on stronger net interest income and investment banking income as well as a tax maneuver.

April 21 -

Executives at BB&T, KeyCorp and Citizens are milking commercial lending niches and balancing cost control with new investments while waiting for more rate hikes to fatten margins.

April 20 -

First-quarter earnings at the Providence, R.I., company jumped 45% thanks partly to improvements in its net interest margin, 7% loan growth and stronger card and other noninterest income.

April 20 -

Bank of America beat expectations in several categories, including earnings per share, revenue and net interest margin.

April 18 -

A new accounting policy and improved profit margins fueled M&T Bank’s double-digit profit growth in the first quarter.

April 17 -

Earnings season kicked off with some banks capitalizing better than others on higher rates and still-low deposit costs. Banks will have to keep working on that balance as they contend with rising credit card losses, slower commercial lending and other issues.

April 13 -

A 9% increase in net interest income more than offset rising expenses at the Kansas City, Mo., company.

April 13 -

Business confidence remains high, but Fed data shows commercial borrowing actually decelerated during the first quarter. Fortunately for banks, rate hikes have fattened margins.

April 7 -

Banks eagerly raised their prime rates after the Federal Reserve’s latest rate hike, but the debate about how they should react on the deposit side is robust, and conversations are beginning on how to respond on the investment portion of the balance sheet. Here is a sample of the lively discussion that is emerging.

March 17