Jack Kopnisky is ready to take another shot at turning a lackluster thrift into a thriving commercial bank.

Kopnisky reinvented Provident New York Bancorp in Montebello by diversifying its lending operations and steering it through several acquisitions, including its

The new objective for Kopnisky, Sterling’s president and CEO, is to do the same with Astoria Financial after his company buys the Lake Success, N.Y., thrift. The companies agreed on Tuesday to a

The first order of business is to ensure a smooth approval process. That wasn’t the case for Astoria’s recently terminated sale to New York Community Bank in Westbury; regulators dragged their feet signing off on that transaction.

Sterling kept its regulators in the loop the entire time it was in talks to buy Astoria, Kopnisky said Tuesday during a conference call to discuss the deal.

“We were very clear and transparent … with the regulatory agencies, both the national and local level,” Kopnisky said. “We took them through this before we actually did due diligence and then we took them through it after. … They are very clear about what we intended to do, what we found and what we intend to do in the future.”

Sterling’s deal will not be weighed down by the baggage that likely

That should be welcome news to Astoria shareholders still smarting over the demise of the New York Community deal, said Collyn Gilbert, an analyst at Keefe, Bruyette & Woods.

Sterling has “a very strong execution track record of being able to integrate deals and being able to do what they say,” Gilbert said. “I think if you’re going to bet on any management team, this is one to bet on.”

“I am very pleased that the president and the board of Astoria Bank executed a very attractive transaction,” Joseph Ficalora, New York Community's president and CEO, said in a statement. Ficalora had recently

Sterling also has a plan to get the most out of Astoria, a thrift with a 117% loan-to-deposit ratio, a 72% efficiency ratio and a big focus on residential and multifamily lending. Commercial-and-industrial loans make up just 1% of Astoria’s $10.4 billion portfolio.

The plan involves spending two to three years replacing Astoria’s lower-yielding assets with commercial-and-industrial credits, making its balance sheet look more like Sterling’s, said Luis Massiani, Sterling’s chief financial officer. The company also aims to be more aggressive recruiting lending teams in Astoria's home turf.

That strategy makes a lot of sense when applied to Long Island, where Astoria is based and where Sterling lacks a meaningful presence, Monte Redman, Astoria’s CEO, said during the call.

“When you combine [Sterling’s] diversified asset origination expertise with Astoria’s strong presence in the Long Island market … we will create a strong regional bank that will provide an exceptional value,” Redman said.

That view was shared by a number of analysts.

“While the deal is off-strategy for Sterling, it brings compelling strategic benefits … [and] comes with attractive financial metrics,” Casey Haire, an analyst at Jefferies, wrote in his research note. He called the transaction a “smart deal … with Sterling management taking advantage of their strong currency and status as lone buyer” in New York City.

“I understand why they would want to sort of scale [Astoria’s] Long Island franchise,” Gilbert said. “It brings a balance sheet that’s kind of under-levered with a lot of good liquidity and a lot of low-cost deposits.”

As a result, the acquisition should put Sterling in a better position to benefit from a rising interest rate environment, Anthony Polini, an analyst at American Capital Partners, wrote in a note to clients.

To be sure, the price tag, the biggest so far for a bank deal this year, shocked some, and Kopnisky outlined several ambitious goals. Once integration is complete in late 2019, he expects the company to earn $425 annually on $1.2 billion of revenue. Sterling is targeting a 1.5% return on tangible assets and a 16% return on tangible equity.

The efficiency ratio is expected to be below 45%. Sterling plans to cut annual noninterest expenses by $100 million by, among other things, closing up to a fifth of both companies’ branches.

“This is certainly going to move Sterling up to the big leagues,” said Theodore Kovaleff, a New York banking analyst who follows both banks.

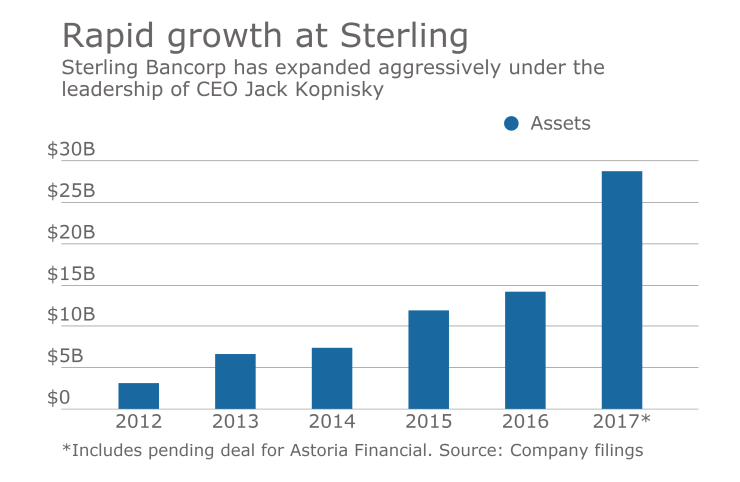

Astoria is the fourth major acquisition Sterling has announced since Kopnisky became CEO in 2011. Its last bank acquisition was the 2015 purchase of Hudson Valley Holding.

Though Astoria is nearly five times Hudson Valley’s size, its “straightforward” business model should make integration relatively easy, Kopnisky said. The goal is to complete the deal by the end of this year.

“They do mortgages and jumbo mortgages, as well as multifamily lending and deposit-driven branch banking,” Kopnisky said. “It’s actually less complicated from a business-model standpoint than the old Sterling was.”

Still, the deal is big enough that Kopnisky declared a moratorium on bank buyouts.

“I’m going to put [deals] on the sideline for the next two or three years,” he said.