Bank merger and acquisition activity for the first few months of the year is just about keeping pace with last year.

A report from FIG Partners tallied 36 whole-bank deals totaling $4.6 billion announced through Feb. 27, compared with 38 deals totaling $5.6 billion for the same time frame a year earlier.

FIG's analysis also shows that pricing is ticking up. The sellers this year received a median price to tangible book value of 174%, based on the deals where that information was available. The median for the same period last year was 125%.

Core deposit premiums are up too. The median for deals announced in January was 10.4% and in February, 9.2%, according to FIG. In comparison, the median was 5% in January 2016 and 3.3% in February 2016.

Of the sellers this year, Pacific Continental Corp. in Eugene, Ore., fetched the highest price to tangible book value, at 313%, the FIG report showed. Pacific Continental also got one of the highest core deposit premiums, at 21.9%.

The $2.5 billion-asset company announced on Jan. 9 that it had an agreement to be

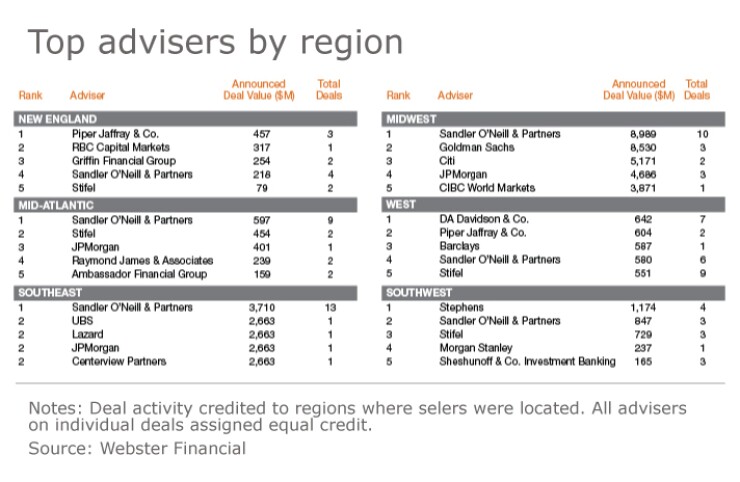

Check out the charts to see our annual roundup of the most active deal advisers on whole-bank and branch deals for each region during 2016, based on data from Dealogic.