Signs of growing weakness in the U.S. auto loan market are hurting the bottom line at one of the nation’s largest car lenders.

Ally Financial in Detroit said Tuesday that its 2017 profits will likely be dinged by rising delinquencies on subprime auto loans, as well as by falling used-car prices. The worsening industrywide trends were long predicted by observers who noted that car loans were becoming less affordable for American consumers, particularly those with poor credit scores.

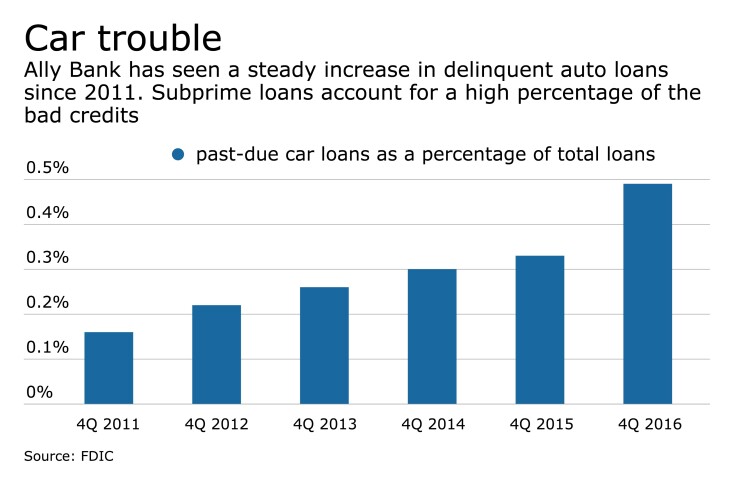

Some of those fears are now being realized. Industrywide data shows that the volume of auto loans at banks that were at least 30 days past due rose by 17% in the fourth quarter of last year, as compared with three months earlier, according to Federal Deposit Insurance Corp. data.

What’s more, used-car prices have been falling quickly in the wake of

The decline in what it costs to buy a used vehicle means less money for banks and auto-finance companies, which sell cars that have been repossessed or returned at the end of a lease period.

Negative trends in the auto-lending market figure to have an outsize impact at Ally, since the $186 billion-asset firm, which was spun off from General Motors in 2006, leans far more heavily on auto lending and leasing than other big banks do.

Ally earned $2.16 per share last year and previously predicted earnings per share growth of less than or equal to 15% in 2017. On Tuesday it adjusted the target to between 5% and 15% due in part to what it expects to be an uptick in losses on car loans. Ally said it expects losses in its auto portfolio to increase to 1.4% to 1.6% of total loans, up from 1.24% in 2016.

Ally's stock fell 2.9% Tuesday, to $20.51, and is down nearly 7% since March 14, when the bank first announced it would hold an investor presentation and investors sensed negative news was coming.

During a conference call with analysts, Ally Chief Risk Officer Dave Shevsky said that the weakening credit performance may be connected to later-than-usual processing of tax returns by the IRS. But he also acknowledged that some subprime borrowers are carrying more debt than they can afford.

Across the subprime auto sector, the net loss rate on securitized loans rose to 7.28% in 2016, its highest level since 2009, according to Standard & Poor’s. At Ally, roughly 40% of borrowers have a credit score below 660 or no score at all.

But the dark clouds in auto lending could have a silver lining for companies, including Ally, that are willing to stay the course. Ally executives said Tuesday that they expect to charge higher prices to consumers

“We’ve seen some banks really pull back from the market, which is typically what the big banks do,” said Chief Financial Officer Chris Halmy. “So we’re really seeing the ability to take more price.”

Looking ahead, Ally said that it expects to earn yields of 5.8% to 6.0% on retail auto loans held in portfolio in 2017, up from 5.52% last year.

Capital One Financial is another lender that sees opportunity in a market that is becoming less competitive. The McLean, Va.-based firm increased originations by 31% in the fourth quarter compared with a year earlier.

Christopher Donat, an analyst at Sandler O’Neill, said that it is not clear whether the sector’s mounting losses will prove to outweigh the additional revenue auto lenders earn from higher yields, or vice versa.

“I think there’s a wide variety of opinions,” he said.