Leaders of mutual banks have ideas on what it will take to keep their niche industry alive.

The beleaguered sector’s CEOs did more than bemoan their dwindling numbers at last week’s meeting of the Office of the Comptroller of the Currency’s Mutual Savings Association Advisory Committee. Rather, they discussed ways to stay relevant that included sharper marketing, supplemental capital and lowering regulatory hurdles for credit unions that want to convert.

“We have a high barrier to entry and shrinking numbers,” Dan Moore, CEO of the $269 million-asset Home Bank in Martinsville, Ind., said during the meeting. “We’re looking at innovation or a big idea to reboot ourselves. There’s no reason this should be a dying segment of the financial services industry. It’s a diamond in the rough.”

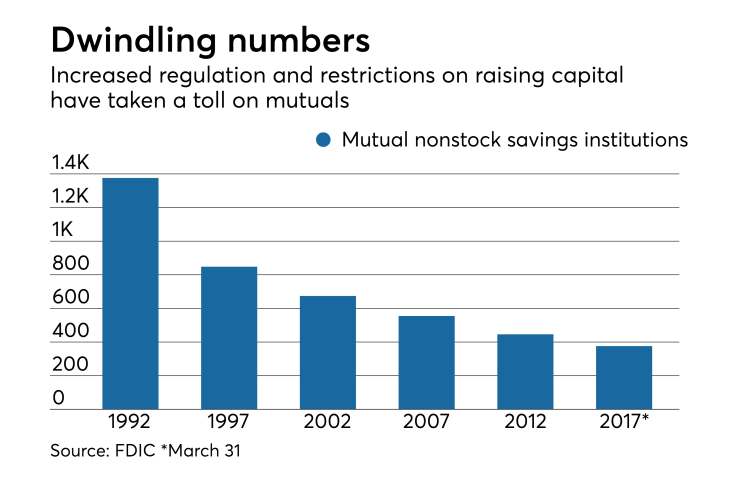

It’s no secret that the once-thriving mutual industry is struggling. The ranks of mutual nonstock savings institutions have fallen from nearly 1,400 in the early 1990s to less than 400 at March 31, according to data from the Federal Deposit Insurance Corp.

“If a class in Business 101 studied our industry it would probably conclude we’re on life support,” Moore said.

One way to slow the bleeding would involve a concerted effort to back more de novo activity.

Thomas Fraser, CEO of the $1.6 billion-asset First Federal Lakewood in Ohio, suggested that opportunities could exist to form mutuals to support immigrant communities, while encouraging OCC officials to do more outreach.

Absent such an effort, “community leaders wouldn’t know how to” form a mutual, Fraser said. He also suggested a plan where existing mutual should pledge a portion of their capital to support depositor-owned de novo banks.

“We’ve got to figure out a way to support a new mutual,” Fraser said. “Maybe we could all throw in $100,000 of capital to start one.”

Other financial institutions have experienced a charter drought, though there are signs that activity is picking up. Several groups have filed applications to open banks in a number of states, and the OCC has

Despite those promising signs, acting Comptroller Keith Noreika argued at the meeting that the de novo process remained daunting. “Not only do you have to come to us or a state agency, you’ve got to go to the FDIC — and that process has really bogged down,” he said.

That being said, attendees agreed that the mutual industry would benefit from more innovation.

The model is in need of “a bold idea,” Moore said, though he added that it is tough for bankers to brainstorm when they’re continually swamped with regulation.

“When you spend all your time thinking of compliance, your creativity gets diluted,” Moore said.