A startup that attracted the investment of Citigroup with data-driven card controls to drive better onboarding and customer service is hoping the same pitch will earn it other bank customers.

The Silicon Valley company, Ondot Systems, develops card controls that give bank customers the ability to set a variety of limits and restrictions on their card use, such as allowing the card to be used only at certain merchants.

With a new strategic investment from Citi Ventures, Ondot will add a feature for banks to make its pitch more enticing: an offer to clean up their transaction data.

“The key thing that all banks are realizing is that payment is becoming increasingly embedded in commerce and it’s less of a separate category, more part of the overall experience,” said Todd Lesher, Ondot's chief revenue officer. “So consumers are expecting to be able to have a lot of detailed information about transactions and full transparency — to not only be able to control how their transactions occur, but be able to see how and where they took place.”

The company’s digital card services, which was launched in the summer of 2018, allows the customer to begin making payments minutes after being onboarded. The data enrichment and analytics package will be rolled out in the next six months. Lesher expects it to reduce calls into bank call centers around transactions that customers don’t recognize.

“We can use that exact latitude and longitude to know what store they were at when they made that purchase,” Lesher said. “We haven’t commercialized these fully, but we’re in discussions about how do we help issuers better understand their cardholders' purchase behavior and then be able to interact with them at the right time for offers that make sense.”

Founded in 2011, Ondot developed its software and partnerships with card processors before launching in 2013. It was this B2B2C model that drew Citi to begin using the company’s services more than two years ago. Citi declined to disclose the amount of its investment.

“They partner with key issuers and networks to create a process and then with banks to then provide and extend these services,” said Ramneek Gupta, managing director and co-head of venture investing at Citi Ventures. “They’ve laid out a pretty sophisticated effort that can engage with large banks.”

Serving 4,300 financial institutions across four continents, including six of the top twenty U.S. banks, Ondot has large enough client base to incorporate feedback from banks, according to Krista Tedder, head of payments at Javelin strategy and research.

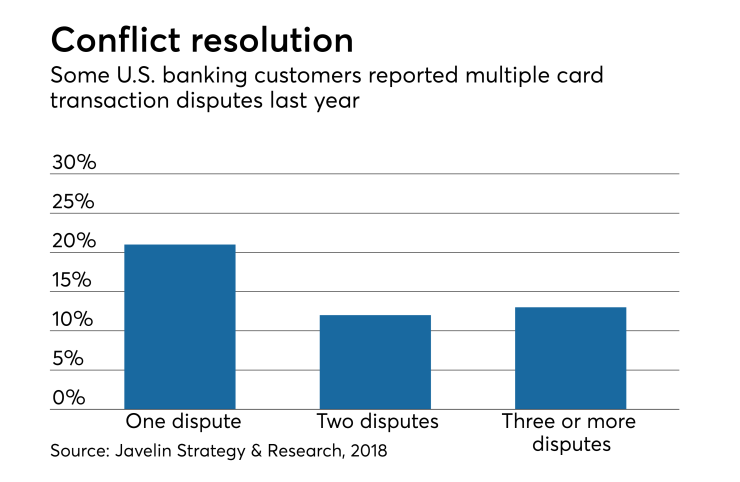

Transaction disputes is one of the highest reasons why customers call into call centers, said Tedder. With better data, banks can reduce that call volume and spot actual fraud more easily.

If banks can separate general categories like groceries or restaurants into individual merchants, they’ll be able to offer personalized rewards messaging based on each users spending habits, she said.

Cleaner transaction data will also mean more accurate personal finance management tools — a technology that banks could use to make their customers save more money but isn’t helpful to customers today.

“If you can figure out the difference between your customer base spending at Walmart versus spending at a local grocery store or even smaller chains, that can give you insight into who your customer base is,” said Tony Desanctis, senior director at Cornerstone Advisors. “Your Whole Foods customers tend to be different than your Walmart customers.”

It’s also why Ondot’s top competitor launched its own data enrichment platform in the spring of 2018. First Performance Global, based in Atlanta, Ga., reverse engineers geolocation data to get the latitude and longitude merchants, and then uses AI and crowd sourced data from Google and Yelp to clean and enrich the data.

“It could be that if it’s a mom-and-pop coffee shop and they haven’t registered each of their shops as a new merchant but it’s all one merchant — here we have an example of a single location merchant versus a multilocation merchant,” said Sosh Howell, chief technology officer at First Performance. “We also track merchants like a food trucks, where they could pretty much be anywhere.”

Data enrichment is a way for payments companies like Ondot and First Performance to provide a better product suite for their smaller bank clients.

In Tedder’s research on card controls, more than 70% of mobile wallet users would use card controls if it were made available to them, but usually only the largest financial institutions have the resources to offer the controls.

“The benefits are not meeting the cost of implementation or usage,” Tedder said. “Anytime you add complexity to a process that’s supposed to be available 24/7 and at 99.99% efficiency, people get concerned that if you add another component you will impact auth process and have a bad customer experience.”

Seeing one’s own bank data is one of the biggest challenges consumers have in their banking relationships, Tedder added.

“Real-time access to the [authentication] stream, which is the message that comes from when you swipe your card to the issuers, is usually only available to fraud and credit underwriting teams,” Citi's Gupta said. “Nobody else has access to that real-time stream because you have to respond under a few seconds, and it’s a very hard thing to do.”