-

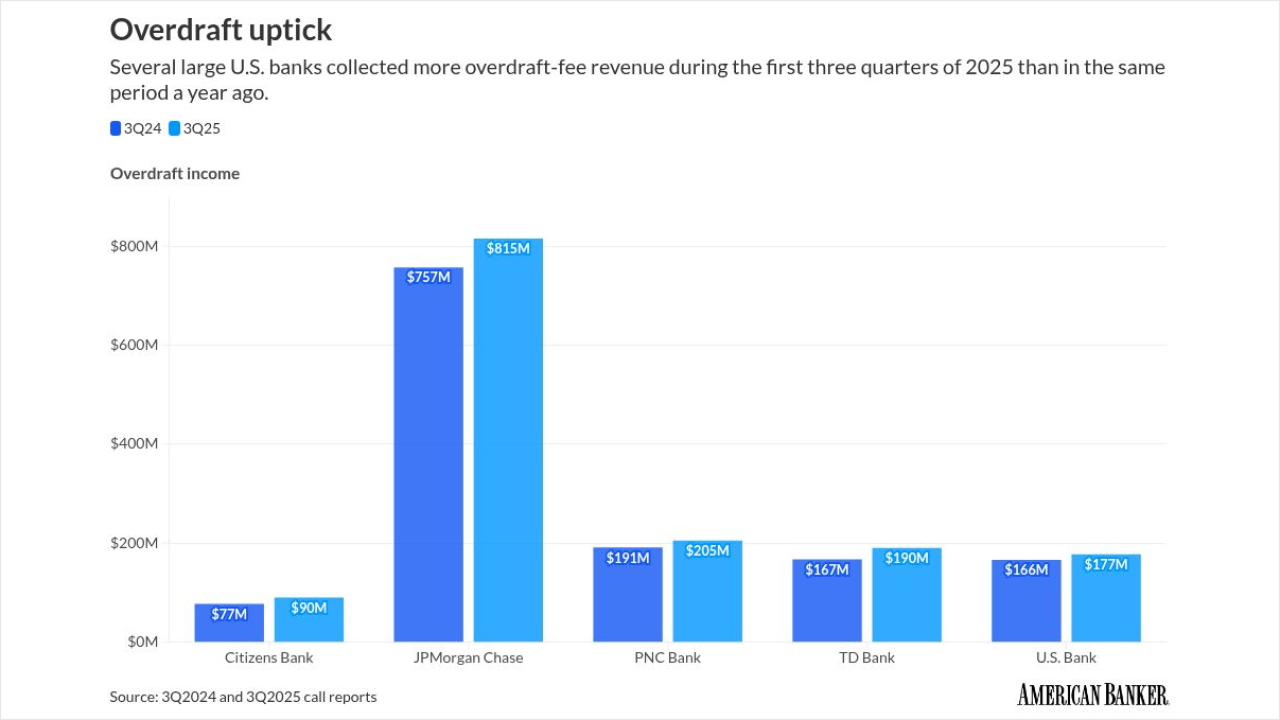

Several large U.S. banks reported an uptick in overdraft-related income for the first three quarters of 2025. Economic pressure on consumers may be to blame, some banks and industry observers say.

January 9 -

As the Federal Reserve's quantitative tightening efforts fade into history, the major engine of economic growth in the U.S. will be bank lending. Regulators should keep a close eye on where those dollars are going.

January 9

-

Employers added 50,000 jobs in December, with gains in service industries while broader sectors remained mostly flat, supporting the Fed's cautious stance on further rate cuts.

January 9 -

The proposed rule codifies the ability for trust companies to conduct non-fiduciary activities, something banks say Congress never intended, but that OCC says has long been the case.

January 8 -

The Federal Reserve will resume accepting pennies from banks and credit unions at all commercial coin distribution locations beginning Jan. 14. The central bank had ceased accepting pennies at some distribution centers late last year, but bankers praised Thursday's reversal.

January 8 -

The bank fired a manager for originating suspicious loans but later asked the SBA to forgive them, prosecutors say. The case ended in a $7.7 million settlement.

January 8 -

One of the leading makers of pre-packaged salads has acquired a 16.3% stake in Salinas, California-based Pacific Valley Bank. "It's a real vote of confidence," the bank's CEO said.

January 8 -

The deal ends more than a year of speculation of who would take over Apple's coveted credit card portfolio.

January 7 -

The bank is investing in Ubyx to help traditional financial institutions settle stablecoin payments and compete with nonbank fintechs.

January 7 -

The company's asset and wealth management business is completely cutting ties with proxy advisors, opting to build its own research and public company voting system. JPMorgan is the first bank to stop using firms such as Glass Lewis and ISS.

January 7 -

With fintechs and legal cases pressuring payment fees, the card companies are leaning more on revenue from other sources.

January 7 -

Industrial loan companies play a vital role in local economies across the country, providing liquidity in areas that other banks overlook. Restricting the availability of ILC charters would be bad for business.

January 7 -

The deal still faces a lawsuit from activist investor HoldCo Asset Management, which contends that Comerica didn't properly shop itself before agreeing to sell to Fifth Third.

January 6 -

The FDIC inspector general said internal and external reviews found little evidence to support a whistleblower's allegations of fraud, retaliation and abuse within the FDIC's watchdog office.

January 6 -

Earned wage access fintechs say the Consumer Financial Protection Bureau's advisory opinion provides important clarity on the finance product, but legal experts warn that its practical impact could be minimal.

January 6 -

The effort by the Consumer Financial Protection Bureau, meant to benefit borrowers, has instead led to higher delinquency rates, increased defaults and more loans being sent to collections.

January 6

-

The bank's Kinexys blockchain unit processes a fraction of the institution's overall payment volume. It's betting that an appetite for the technology's promise of speedy processing and liquidity will make that larger.

January 5 -

Just a handful of de novo banks opened in 2025. But there are signs of renewed activity, with eight banks currently actively in formation and more than 10 charter applications on file with the FDIC.

January 5 -

Minneapolis Federal Reserve President Neel Kashkari said on CNBC that both sides of the central bank's dual mandate show signs of imbalance, with the labor market appearing more vulnerable.

January 5 -

The real value of stablecoins lies in their ability to provide instant and secure transfers of value. But, in a world where every company has a bespoke stablecoin, that promise begins to break down quickly.

January 5