Comerica Bank

Comerica Bank

Comerica Inc is a financial services company headquartered in Dallas. It is primarily focused on relationship-based commercial banking.

-

The Texas bank, which partners with the U.S. Treasury to dispense federal benefits via prepaid cards, is alleged to have dropped the ball as hundreds of cardholders say their money was forwarded to fraudsters posing as them.

August 26 -

If President Trump’s tariffs on steel and other products stay in place long, big U.S. importers would be hurt and pass on the pain to their midsize and small-business suppliers — which are the bread and butter of commercial lending.

August 3 -

In addition to leading the company’s national business banking efforts, Peter Sefzik will also oversee small-business banking. Brian Foley, the chief credit officer for the Texas market, will succeed him as market president.

July 25 -

Comerica faced aggressive questioning Tuesday about how it could use freed-up capital now that it’s no longer considered a systemically important financial institution. It won’t be the last small regional to get such a grilling this earnings season.

July 17 -

Declines in corporate banking and energy loans were part of the reason loan growth was light, but the Dallas bank reported strong earnings thanks heavily to fatter margins.

July 17 -

SigFig was among an early crop of digital advice firms that shifted their focus to serving wealth managers and banks. It has raised more than $100 million from a variety of investors.

June 19 -

The divide highlights a lingering question about how much commercial and retail depositors value cutting-edge technology over price — and whether midsize banks can keep pace with bigger rivals when it comes to tech investments.

April 17 -

Profits soared at the Dallas bank as recent interest rate hikes and ongoing expense cuts outweighed weakness in the company’s loan book and in its fee income.

April 17 -

Look for banks to boost dividend payouts, expand into new markets, increase their tech spending and, eventually, ramp up their C&I lending. But don't expect much in the way of M&A.

January 21 -

Though business owners are more optimistic about the direction of the economy since the tax law was passed, it's doubtful their borrowing will increase meaningfully until they see more signs of more robust growth, bankers say.

January 16 -

Apart from a one-time adjustment for deferred taxes, the Dallas company reported strong gains in net interest income and meaningful improvement in all of its key performance ratios.

January 16 -

Barros has no answer for Senate committee on encryption; a bitcoin network split won’t happen … for now.

November 9 -

Comerica's chief accounting officer since 2010, Carr will replace David Duprey, who is retiring early next year.

November 8 -

The Dallas company reported strong profits in the third quarter as higher yields on loans and improved cost control more than offset slight declines in loan balances and earning assets.

October 17 -

The Dallas company has extinguished talk of a potential sale after aggressively cutting costs over the past year. But concerns about its future — including its ability to find new sources of revenue — remain.

September 18 -

Flush with cash, many commercial firms are also opting to pay down debt rather than take on new loans, and those seeking financing aren’t always turning to banks to meet their needs.

September 15 -

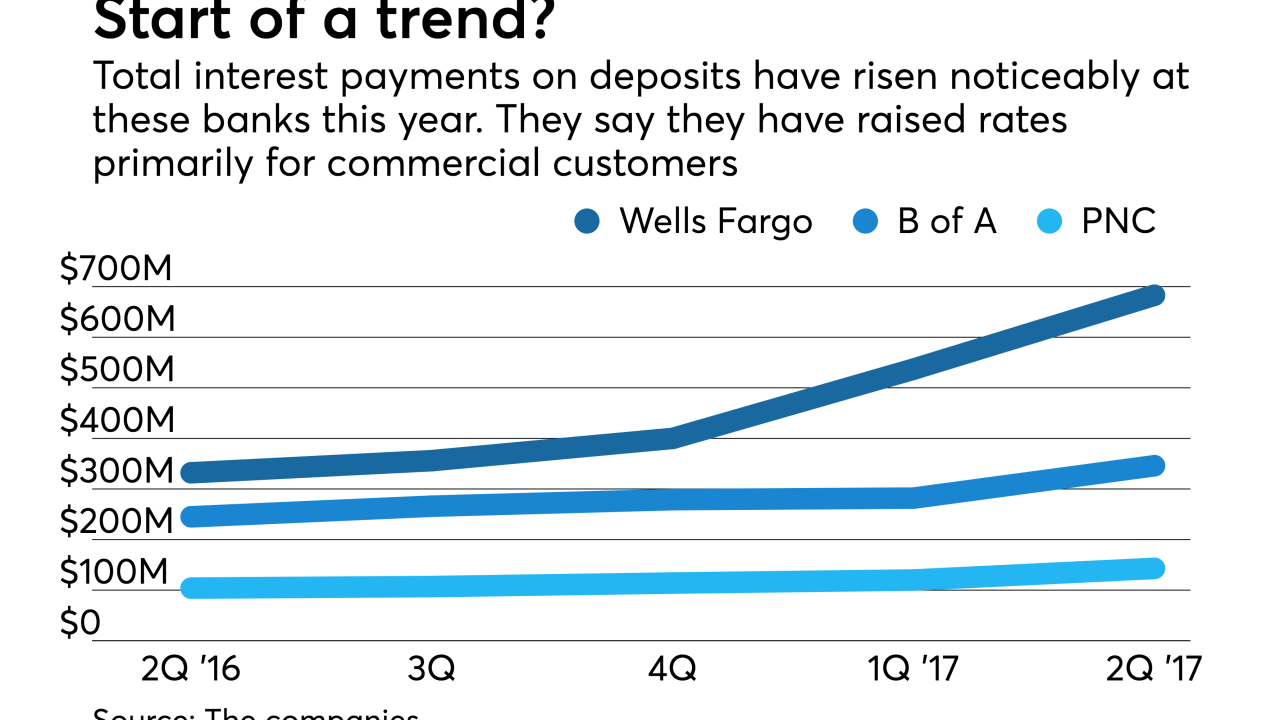

Now that the Federal Reserve has raised short-term rates four times in the past 18 months, all eyes are on deposit costs as banks seek to keep pricing low and fatten margins. But that effort is complicated by the fact that banks must prepare for the unwinding of the Fed's balance sheet and consumers' rapid adoption of mobile deposits.

July 21 -

In a sign of broader competition ahead, bigger banks are raising the interest they pay on deposits held by business customers. The big question is how hard will it be for banks to maintain margins and to stave off consumer demands for better rates.

July 18 -

A yearlong effort to slash costs boosted profits at the Dallas company.

July 18 -

Oil prices are dropping again, but some lenders think now is the time to recommit to energy lending as long as they underwrite them a certain way for certain borrowers in certain regions.

June 20