-

President Donald Trump has recruited Fiserv CEO Frank Bisignano and PayPal co-founder Elon Musk to streamline parts of the government. Their styles and experience could not be more different.

February 10 -

The technology vendor is going outside the company to hire PNC vet Michael Lyons to replace Trump administration-bound Frank Bisignano, leaving the Pittsburgh-bank without its heir apparent for the top role.

January 23 -

Morgan Stanley and ABN Amro tapped fintechs to improve cross-border transactions. That and a U.K. card fee cap highlight this week's roundup of payments news.

December 18 -

The long-time bank and financial services technology executive has a record for cutting costs and supporting rapid automation, skills that could be put to work at the 90-year-old agency.

December 6 -

President-elect Donald Trump is nominating Frank Bisignano, the chief executive officer of fintech and payments company Fiserv Inc., to be the commissioner of the Social Security Administration.

December 4 -

Card networks, fintechs and Walmart have started major account-to-account payment initiatives in the past few weeks.

October 25 -

The technology company faces fines over potential anti-competition practices; Takis Georgakopoulos is on his way to Fiserv.

June 26 -

To protect their own talent pipeline, financial companies need to make sure that they're not only protecting the entry-level roles that AI threatens to take over, but getting the enthusiastic buy-in of the people most likely to be affected, according to experts from Fiserv, Segpay and Featurespace.

April 11 -

Brazil's Pix network, at just three years old, now accounts for 15% of all global real-time payments — and its success is inspiring projects in other countries.

March 6 -

Fiserv's Money Network will officially start managing the state's prepaid debit card program for distributing unemployment and disability benefits to 850,000 beneficiaries. BofA had been trying to exit its contract for several years due to financial risks.

January 26 -

The technology company's move in Georgia could widen its processing relationships with merchants, but the company insists it won't become a traditional financial institution.

January 13 -

The move means companies can give consumers options other than ACH transactions or debit cards to receive disbursements for insurance claims, health care or gig work.

August 20 -

The bank is forming a joint venture with Fiserv to promote digital payments. It's a market that has evolved substantially — and become far more competitive — since Deutsche left it in 2012.

June 29 -

About 100 small banks have signed up for technology provided by the core software vendor Fiserv and the cryptocurrency custodian NYDIG that allows customers to buy, sell and hold bitcoin through their bank accounts.

June 23 -

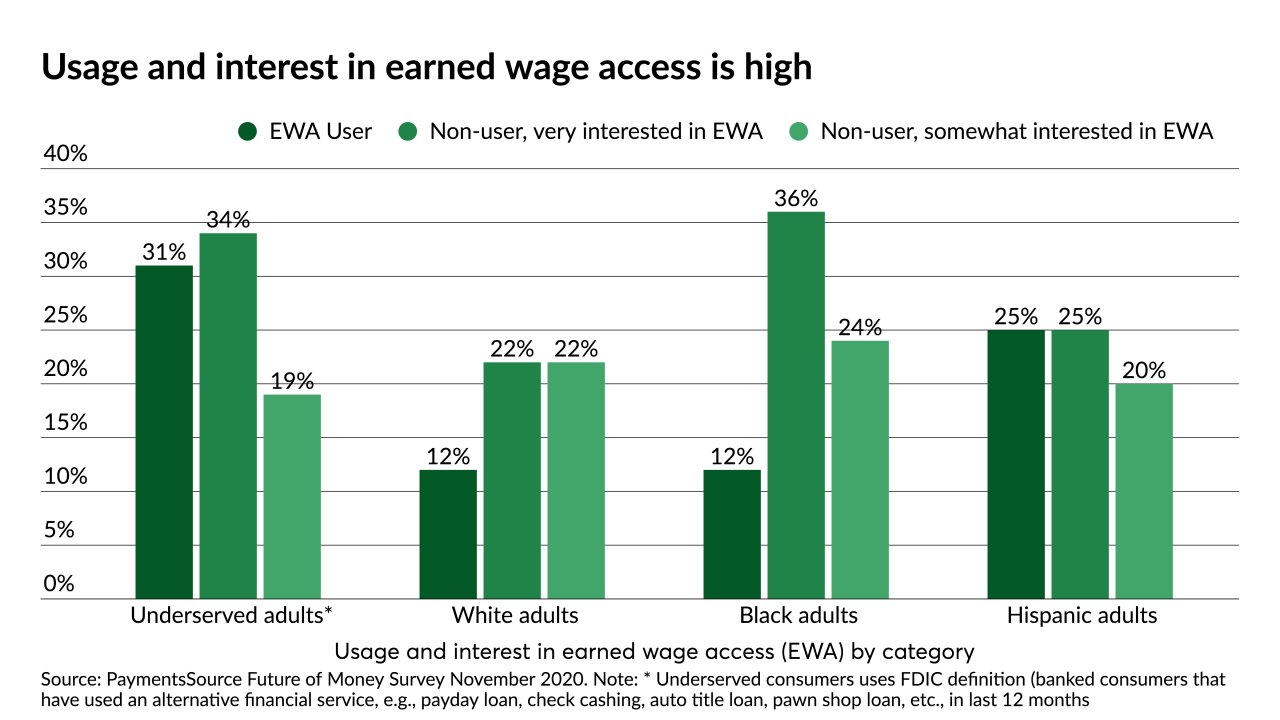

Fiserv is joining the increasingly crowded market for earned wage access in partnership with Instant Financial.

April 29 -

The tech vendor allows merchants using the Clover point-of-sale platform to accept PayPal and Venmo payments, a move that serves the company's continuing focus on full omnichannel experiences for its merchants.

April 27 -

It isn't lost on Fiserv that consumers increasingly are moving to digital financial services. Its deal to acquire Ondot Systems, a digital card solutions platform, aims to capitalize on the shift.

December 16 -

There’s no PSD2-style law requiring banks in the U.S. to share data with third-party payment apps, but the market is progressing as if there will be one, leaving some smaller banks at a disadvantage.

September 30 -

The pandemic-driven move to electronic payments isn't slowing down, and card issuers are finding an eager group of innovators promising a speedy migration to digital card production.

September 8 -

Many community banks, like Peoples Community in Wisconsin, say they proceeded despite the technological challenges presented by social distancing because the crisis has exposed the shortcomings of their digital systems.

September 3