-

Software startups say bringing borrowers, builders and lenders onto one digital platform can remove some of the risks lenders faced during the crisis.

March 14 -

As major vendors consolidate, financial institutions should be looking to adopt emerging technologies, rather than relying solely on legacy firms to provide services.

February 11 CCG Catalyst

CCG Catalyst -

As major vendors consolidate, financial institutions should be looking to adopt emerging technologies, rather than relying solely on legacy firms to provide services.

February 6 CCG Catalyst

CCG Catalyst -

Fiserv’s $22 billion deal to acquire First Data creates pressure to scale core banking and payment processing that may force further industry consolidation.

January 25 -

Readers weigh in on the Consumer Financial Protection Bureau's payday rule, consider the gender wage gap in banking, debate restrictions to membership at the Federal Home Loan banks and more.

January 24 -

While the transaction will lower the cost of servicing First Data’s massive debt, the fintech and processing giant will be more complex and ponderous, writes Eric Grover, a principal at Intrepid Ventures.

January 24

-

CFPB to scrap key underwriting portion of payday rule; Fiserv-First Data — why small banks fear big fintech; banks, credit unions help federal workers hurt by shutdown; and more from this week's most-read stories.

January 18 -

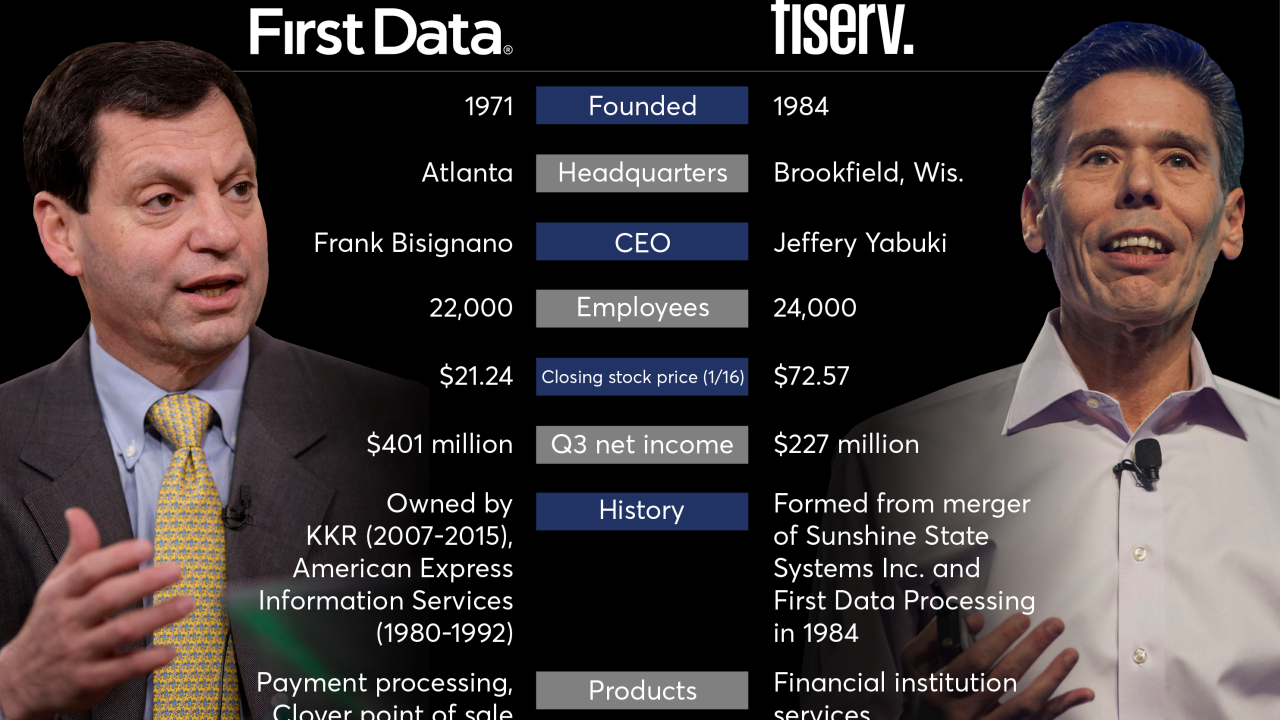

The Fiserv-First Data deal, valued at about $22 billion, will combine two of the financial services industry's largest technology and processing companies.

January 16 -

The large core banking software vendors are already criticized as large and slow-moving. Consolidations like these are only likely to make them more so.

January 16 American Banker

American Banker -

The large core banking software vendors are already criticized as large and slow-moving. Consolidations like these are only likely to make them more so.

January 16 American Banker

American Banker -

The numbers behind Fiserv's deal to acquire First Data are huge, particularly considering each company's existing tonnage still makes consolidation the best play when faced with nimble fintechs and mobile startups.

January 16 -

Fiserv will acquire First Data in an all-stock deal with a value of about $22 billion that will combine two of the financial services industry's largest technology and processing companies.

January 16 -

The deal, valued near $22 billion, will combine two of the financial services industry's largest tech and processing firms; both banks top expectations.

January 16 -

Banks using Fiserv technology will have access to an automated accounts receivable solution from DadeSystems that the companies say will improve accuracy and lower costs for business clients.

October 15 -

The $1.1 billion-asset credit union will move to Fiserv's DNA platform while implementing other services from the technology provider.

September 25 -

Fiserv Lending Solutions' rebrand to Sagent Lending Technologies reflects the company's focus on a more efficient process for mortgage and consumer lenders.

September 20 -

The company built a patch within 24 hours of being alerted to a vulnerability in messaging software used by many banks and credit unions. Fiserv is looking into how this happened while addressing speculation about whether consumer data is still threatened.

September 4 -

The company built a patch within 24 hours of being alerted to a vulnerability in messaging software used by many banks. Fiserv is looking into how this happened while addressing speculation about whether consumer data is still threatened.

August 31 -

Sioux Valley Community Credit Union and Coulee Dam FCU are set to convert to Fiserv's Portico platform.

June 26 -

Longtime payments industry executive Kim Crawford Goodman has been named president of card services at Fiserv, where she will oversee the payments and ATM services, including credit and debit processing.

April 12