JPMorgan Chase

JPMorgan Chase is one of the largest and most complex financial institutions in the United States, with nearly $4 trillion in assets. It is organized into four major segmentsconsumer and community banking, corporate and investment banking, commercial banking, and asset and wealth management.

-

Following are notable cases where banks were tripped up by the Fed's stress tests either by flunking the numbers (or quantitative) part of the test or raising red flags on a qualitative basis.

June 19 -

U.S. C&I loan growth has dropped below that of the eurozone for the first time in six years; bank employee says Chase discriminates against fathers when it comes to family leave.

June 16 -

With the first half of 2017 drawing to a close, bank executives gathered this week at the Morgan Stanley Financial Services conference to discuss their companies’ performance thus far and, more important, outline their priorities for the rest of the year and beyond. Here are some of the highlights.

June 15 -

The eight winners of an annual fintech competition will receive $250,000 in capital and resources.

June 15 -

The American Civil Liberties Union is accusing JPMorgan Chase of violating the Civil Rights Act by discriminating against fathers when they ask for parental leave.

June 15 -

The nation's largest bank is dominant in New York, California and Texas, but it has little presence in the Mid-Atlantic and upper Midwest.

June 13 -

JPMorgan Chase’s partnership with OnDeck Capital was expected to augur a wave of similar agreements between banks and online business lenders. But so far, most banks have avoided joining forces with companies they also view as competitors.

June 13 -

While banks are in various stages of development when it comes to distributed ledger technology, the industry is further along than many would assume, big-bank technology executives say.

June 13 -

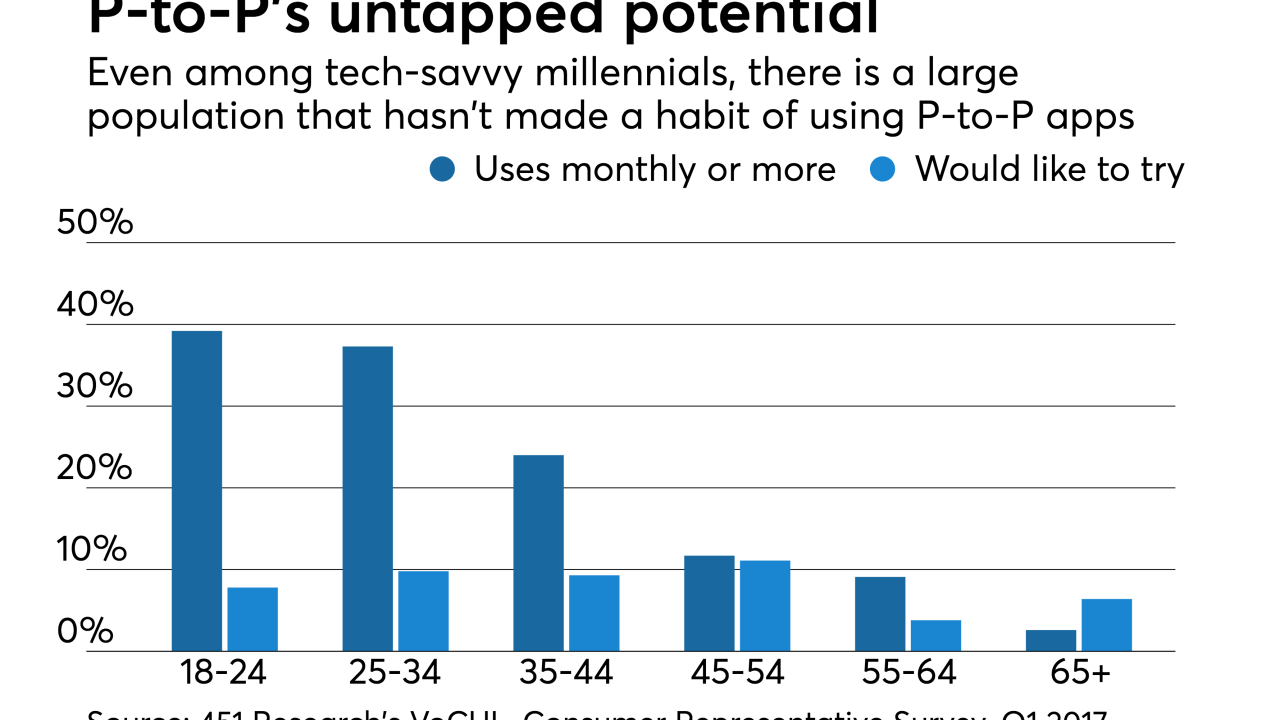

The financial institution-owned person-to-person network formally went live Monday, enabling direct transfer of funds across 30 U.S. FIs. There are a lot of questions around whether it can compete with the current kings of P-to-P — Venmo and PayPal — but Zelle may not be aiming to take them head-on just yet.

June 12 -

The bank-owned person-to-person network formally went live Monday, enabling direct transfer of funds across 30 U.S. financial institutions. There are a lot of questions around whether it can compete with the current kings of P-to-P — Venmo and PayPal — but Zelle may not be aiming to take them head-on just yet.

June 12