-

More than six industry events have been cancelled or put on hold in five days, with more likely to follow.

March 12 -

Credit union groups are hailing the introduction of a bill to change the bureau’s leadership structure, but similar bills have been introduced in the past and gone nowhere.

March 5 -

Recent political controversies are forcing credit unions and industry groups to reconsider their support for lawmakers they previously endorsed.

February 26 -

Legislation introduced Monday would go beyond changes the National Credit Union Administration put in place last year and increase parity with state-chartered institutions.

February 25 -

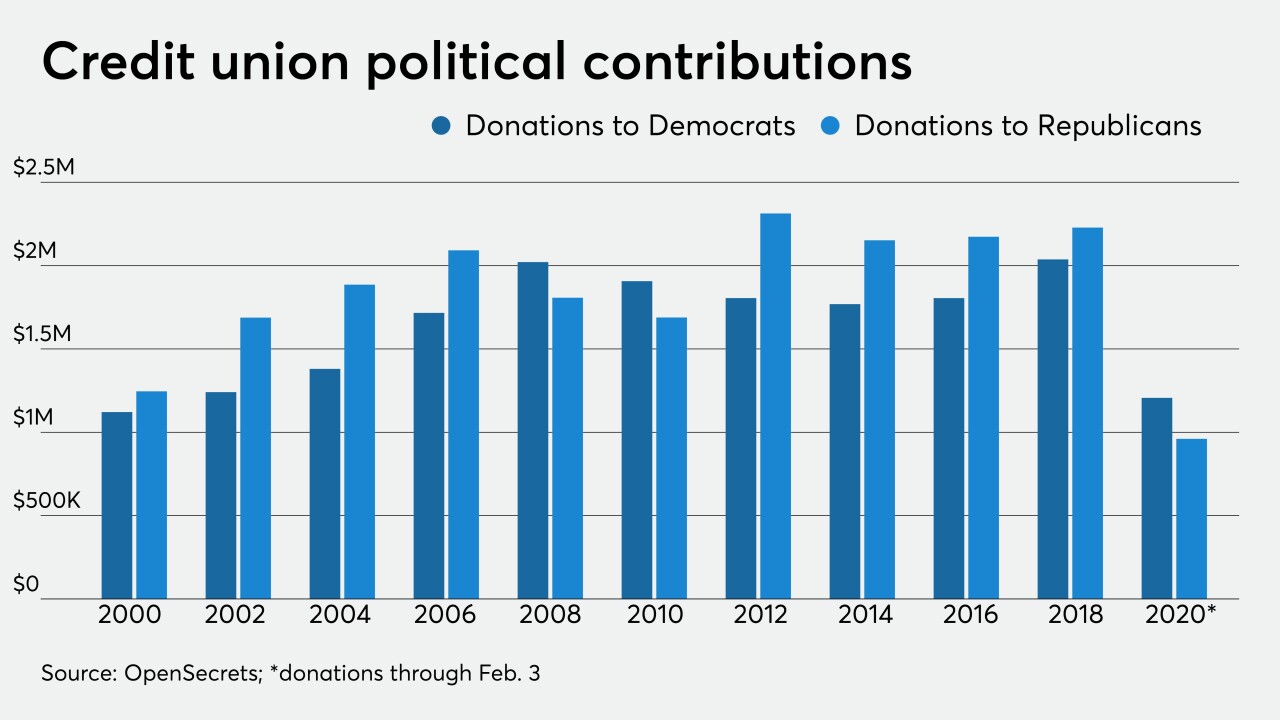

The industry loves to tout its bipartisanship, but it has very publicly embraced the Trump administration at times.

February 24 -

The National Taxpayers Union called on Congress to reevaluate the movement's tax structure, including citing the trend of CUs buying banks as a "textbook example of poor tax policy."

February 19 -

The community bank lobby has said the recent deals are another reason to rein in the credit union sector. Some House members are beginning to take notice.

December 22 -

An appeals court on Thursday denied bank groups an en banc hearing from all 11 appellate judges, but bankers said Friday that they're considering taking the case to the Supreme Court.

December 13 -

House and Senate lawmakers have denied a push by banking groups to grant banks the rent-free access to military installations that credit unions have.

December 10 -

Navy Federal Credit Union is Exhibit A in banks' case to tax the credit union industry. But it wasn’t always seen as the powerhouse it is today. Meet Adm. Cutler Dawson, the man who changed that.

December 5 -

The National Credit Union Administration board pushed back against criticisms about its rising budget by noting its oversight is still cheaper than that provided by other financial agencies.

November 20 -

The National Credit Union Administration's public budget briefings are a step in the right direction, but the institutions it regulates still have too little say over how those monies are spent.

November 19

-

A similar bill was introduced into the House earlier this year and both pieces of legislation have have bipartisan support.

November 13 -

As Cybersecurity Awareness Month draws to a close, Credit Union Journal queried industry leaders about the biggest threats facing their institutions.

October 29 -

The Corporate Transparency Act would require companies to report their true owners to the Financial Crimes Enforcement Network, removing the burden of financial institutions to collect beneficial ownership information about their clients.

October 23 -

Draft legislation would amend the Bank Service Company Act to give the National Credit Union Administration third-party vendor oversight, a power it has been requesting for the better part of two decades.

October 18 -

The court passed up a recent opportunity to clarify confusion about Americans with Disabilities Act requirements for business websites, raising concerns that credit unions could become an even more inviting litigation target.

October 10 -

As the industry increases its attempts to diversify its ranks, just 81 out of more than 5,000 CUs completed the regulator’s self-assessment last year.

October 2 -

Credit union priorities could take a back seat as Congress scrambles to pass a spending package to avoid a government shutdown. Here's a look at some of the proposals that could move forward.

September 25 -

The industry is waiting to see if banks will get the same no-cost land leases on military bases that credit unions currently enjoy.

September 23