-

Nearly three years after NCUA passed the rule, credit unions are ready to broaden their reach, but the possibility of an appeal to the Supreme Court may put those efforts on hold.

August 26 -

A panel of federal appeals court judges reversed a district court’s decision on the NCUA’s controversial field-of-membership rule, but saw merit in bankers’ claims of potential redlining.

August 20 -

The Senate is also expected to pass a budget deal that will increase spending and suspend the debt ceiling.

July 29 -

Lawmakers will hear from a credit union executive on cannabis banking while also considering issues such as the use of alternative data in underwriting.

July 22 -

After FASB's decision to give most credit unions and banks extra time to prepare, lobbying groups are pushing for more.

July 18 -

The bench upheld a lower court's ruling that the plaintiff did not suffer an "injury-in-fact." Several judges previously made similar rulings.

July 17 -

NAFCU and CUNA expressed concerns about the social media giant's proposed cryptocurrency, including reiterating calls for Congress to act on data security.

July 16 -

Credit unions could have an answer about when a new credit loss standard will take effect, while the National Credit Union Administration will hold its monthly board meeting this week.

July 15 -

The accounting rules group is weighing whether to consolidate and push back deadlines for smaller firms to comply with credit-loss accounting change in light of concerns they will not be ready.

June 27 -

The American Bankers Association also argued that the definition of a low-income credit union was too broad.

June 26 -

As the Federal Credit Union Act turns 85, industry figures are working on issues related to executive compensation, UDAAP and more, all while girding for a slowdown in membership and loan growth.

June 24 -

In a hyper-competitive job market, credit unions are finding creative ways to keep staff engaged and sweeten the deal for potential new hires.

June 24 -

Executives and directors from across the industry discussed their concerns for the industry and priorities for the next year during this year's NAFCU and CUNA annual conferences.

June 21 -

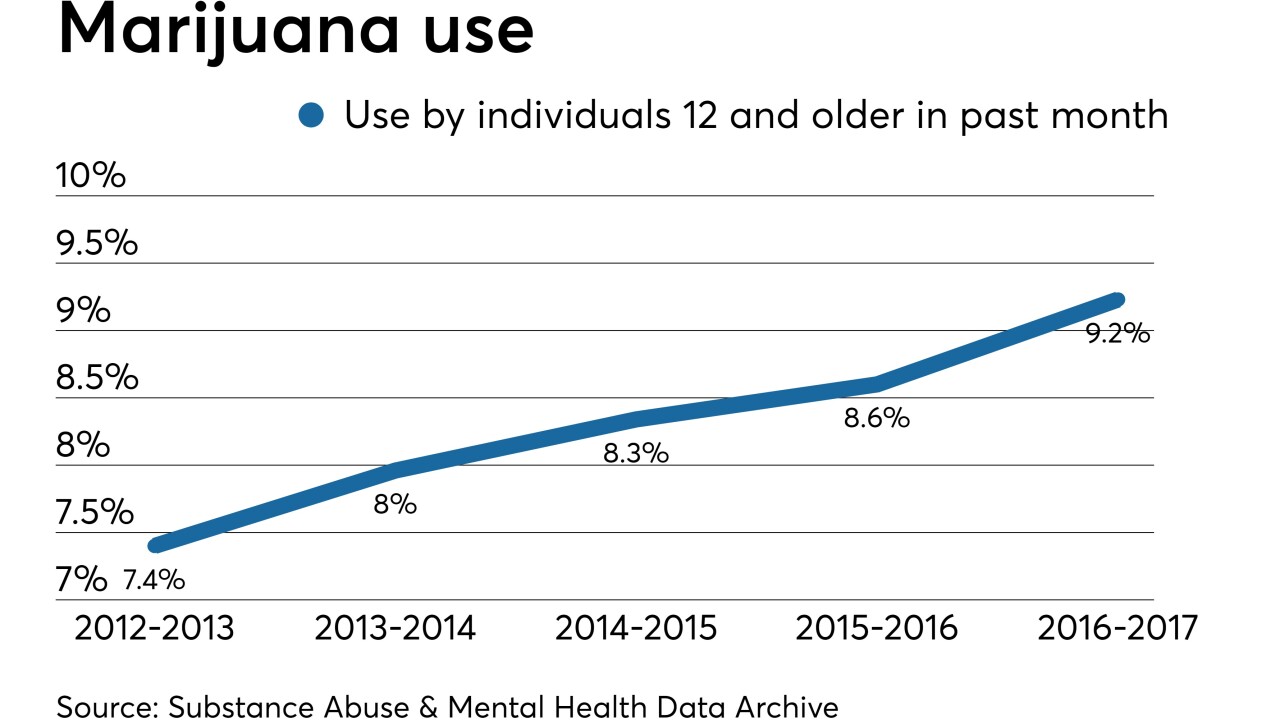

Credit union executives discussed serving the legal marijuana and hemp businesses during NAFCU's annual conference in New Orleans, including vastly different motivations for serving the industry.

June 20 -

The NCUA proposed Thursday to put off until 2022 implementation of a rule that would require larger credit unions to hold more risk-based capital.

June 20 -

As the National Association of Federally-Insured Credit Unions' annual conference kicked off, President and CEO Dan Berger emphasized the trust credit unions have built with members. But there have been a few recent stumbles.

June 20 -

Millions of Americans feel let down by the government and other trusted entities, but credit unions are stepping forward to fill the void.

June 19 National Association of Federally-Insured Credit Unions

National Association of Federally-Insured Credit Unions -

The National Credit Union Administration's controversial risk-based capital proposal could see further delays or changes as thousands of industry professionals head to CU conferences across the country.

June 17 -

Conference overload and sexual harassment response strategies are top of mind as CUNA and NAFCU prepare to simultaneously host their annual summer meetings.

June 17 -

With campaigning for the 2020 presidential election already underway, it could become increasingly difficult for the industry to move meaningful legislation through Congress.

June 12