-

A proposal to give the Consumer Financial Protection Bureau jurisdiction over credit unions with $10 billion or more of assets has sparked a war of words between the longtime foes.

May 7 -

The credit unions, all of them small institutions, will pay a total of $4,069 in penalties for tardy submission of Q3 2018 all reports.

May 7 -

The National Credit Union Administration and the Small Business Administration have established a program to boost SBA lending by credit unions, which was very light last year. It is sure to irk bankers, who have raised competitive concerns.

May 3 -

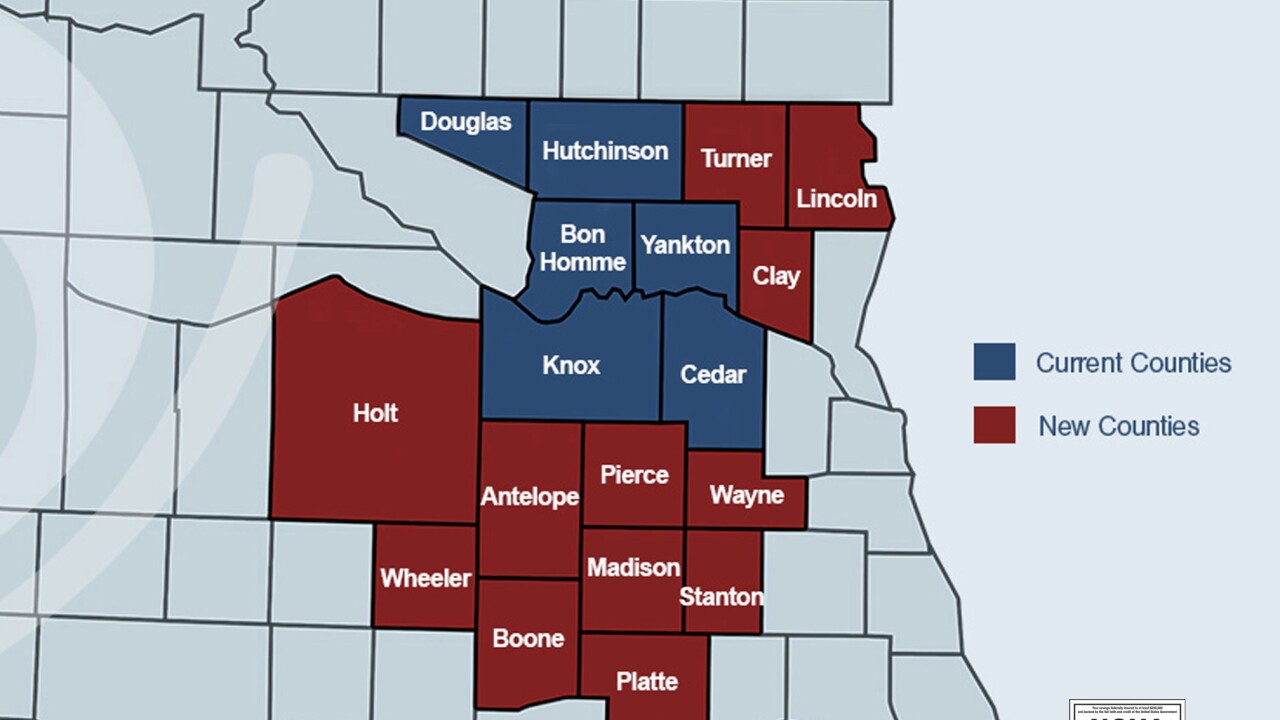

The Yankton, S.D.-based institution can now serve 18 counties across two states.

May 3 -

The National Credit Union Administration is aiming to clarify guidelines around incentive compensation, which could help the industry better attract top talent.

May 2 -

Three former CU employees are subject to the latest round of prohibitions from the National Credit Union Administration.

April 30 -

The NCUA is letting Union Yes in California raise capital by turning to temporary funding sources, which banks have complained is an example of the regulator's overreach.

April 29 -

The NCUA is letting Union Yes in California raise capital by turning to temporary funding sources, which banks have complained is an example of the regulator's overreach.

April 29 -

Congress has returned from its two-week vacation with plans to debate a number of issues important to the credit union industry.

April 29 -

The Decatur, Tenn.-based institution earned just $60,000 last year as its net worth ratio declined.

April 24 -

Between a decidedly younger user base and potential compliance risks, some financial institutions are wary of using the platform, but a handful say they have embraced it and found success.

April 24 -

The current compensation rule, which was last updated more than two decades ago, is confusing, industry experts said.

April 18 -

During the first full day of the National Credit Union Collections Alliance's annual conference, speakers discussed what regulators are focusing on and shared best practices for debt collections.

April 17 -

While NCUA lawyers fielded questions about the possibility of redlining, a three-judge appeals panel showed skepticism about other elements of the ABA's arguments against changes to credit union membership rules.

April 16 -

Last-minute arguments from the American Bankers Association have put the National Credit Union Administration on the back foot in advance of an appeal hearing more than a year in the works.

April 15 -

Last-minute arguments from the American Bankers Association have put the National Credit Union Administration on the back foot in advance of an appeal hearing more than a year in the works.

April 15 -

A federal court this week will hear arguments in NCUA's appeal of a a judge's split decision on its 2016 field of membership rule while the new NCUA board meets later in the week.

April 15 -

Hood was recently confirmed to the board after having previously served with the regulator from 2005 to 2010. He takes over for Mark McWatters, who often generated controversy.

April 8 -

Alliance Bank Central Texas may have found a way around National Credit Union Administration regulations that make it difficult for banks to buy credit unions.

April 4 -

National Credit Union Administration regulations make it difficult for banks to buy credit unions, but one Texas bank may have found a partial way around that.

April 4