-

The regulator completed a thorough process, which included ensuring investors would treat borrowers well, before settling on a buyer.

February 25 -

NCUA board member Mark McWatters defended the agency's position on credit union-bank purchases and called out the ongoing sniping on both sides of the argument.

February 25 -

The Credit Union National Association is submitting a FOIA request to get more information about the National Credit Union Administration's recent portfolio sale, but further action could be necessary if those answers aren't satisfactory.

February 24 -

Rep. Gregory Meeks is unhappy with the National Credit Union Administration's recent sale of more than 4,000 taxi medallion loans to a hedge fund.

February 24 -

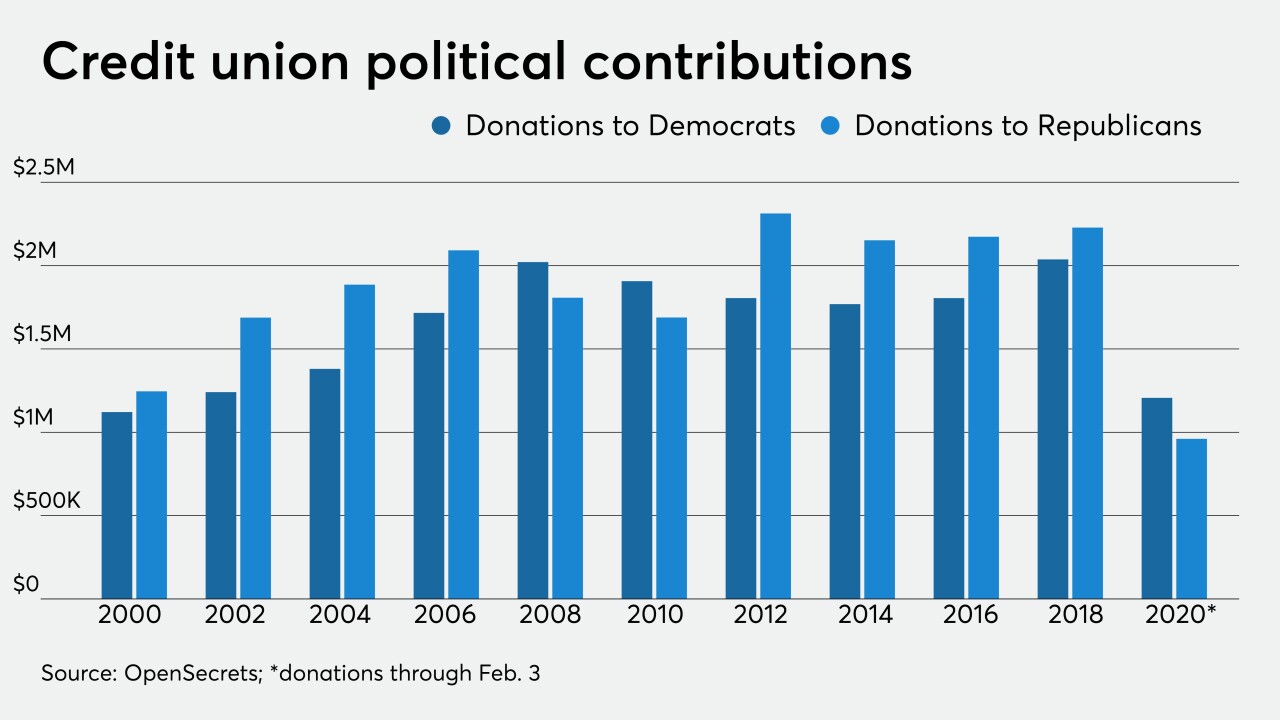

The industry loves to tout its bipartisanship, but it has very publicly embraced the Trump administration at times.

February 24 -

The credit union regulator's portfolio sale dashed the hopes of a group of New York taxi drivers looking for relief.

February 20 -

$13 billion deal will get Morgan Stanley "ready for prime time"; Ralph Hamers will replace Sergio Ermotti later this year.

February 20 -

The credit union regulator had amassed the loans following the liquidation of several New York-area credit unions with high concentrations of taxi medallion loans.

February 19 -

More than two years after NCUA OK'd securitization deals, the Tampa-based credit union is moving ahead with a transaction that could pave the way for others in the industry.

February 18 -

The conclusion of President Trump's impeachment trial last week means both chambers of Congress are back to regular business.

February 10 -

Each of the half-dozen institutions has $15 million or less in assets and has filed its 5300 late at least once before.

February 4 -

After maintaining a $250,000 exemption threshold for real estate appraisals for nearly 20 years, the National Credit Union Administration is set to raise that limit to $400,000.

January 31 -

The regulator's most recent prohibitions include multiple charges of fraud, theft and embezzlement.

January 31 -

The head of the small-bank trade group called for hearings to discuss tougher limits on credit union acquisitions of banks.

January 30 -

The benefits include improved financial inclusion, the chairman of the NCUA argues.

January 30

-

The benefits include improved financial inclusion, the chairman of the NCUA argues.

January 30

-

Bankers may not want to hear this, but communities benefit when credit unions buy banks.

January 24 National Association of Federally-Insured Credit Unions

National Association of Federally-Insured Credit Unions -

Larry Fazio, longtime head of the agency’s examinations division, has been promoted to executive director. He will succeed Mark Treichel, who will retire later this year.

January 24 -

Two major banking organizations objected to a proposal by the agency that would expand the pool of investors in subordinated debt issued by credit unions. They fear it could provide credit unions more financing to buy banks.

January 23 -

There are no provisions in a new NCUA plan that outright bar credit unions from leveraging subordinated debt to acquire a bank. The long-awaited rule on bank purchases, also released Thursday, merely clarifies existing regulations rather than adding new components.

January 23