-

Meetings between bank regulators and technology giants like Amazon and PayPal underscore Silicon Valley's growing involvement in the financial services arena, and may presage pursuit of a bank charter.

September 29 -

Washington Federal is the latest bank to pull an application after being flagged for insufficient Bank Secrecy Act compliance.

September 29 -

Acting Comptroller of the Currency Keith Noreika affirmed Thursday that the agency’s fintech charter, if implemented, could be granted to commercial firms like Walmart or Google.

September 28 -

The proposal is aimed at a simpler capital regime particularly for community banks, but some industry representatives and regulators themselves questioned whether the plan went far enough.

September 27 -

How most banks obtain deposits has changed radically over the past 30 years, thanks in part to innovation. It is time for regulators to rethink their notion of what constitutes a quality deposit portfolio.

September 27 MainStreet Bank

MainStreet Bank -

Acting Comptroller of the Currency Keith Noreika on Monday gave a ringing endorsement to online lenders seeking to expand into banking, suggesting they should consider taking deposits and seek out national bank charters as they mature.

September 25 -

Readers chime in on debates about ILCs, the CFPB’s arbitration rule, the financial services ambitions of tech firms and more.

September 22 -

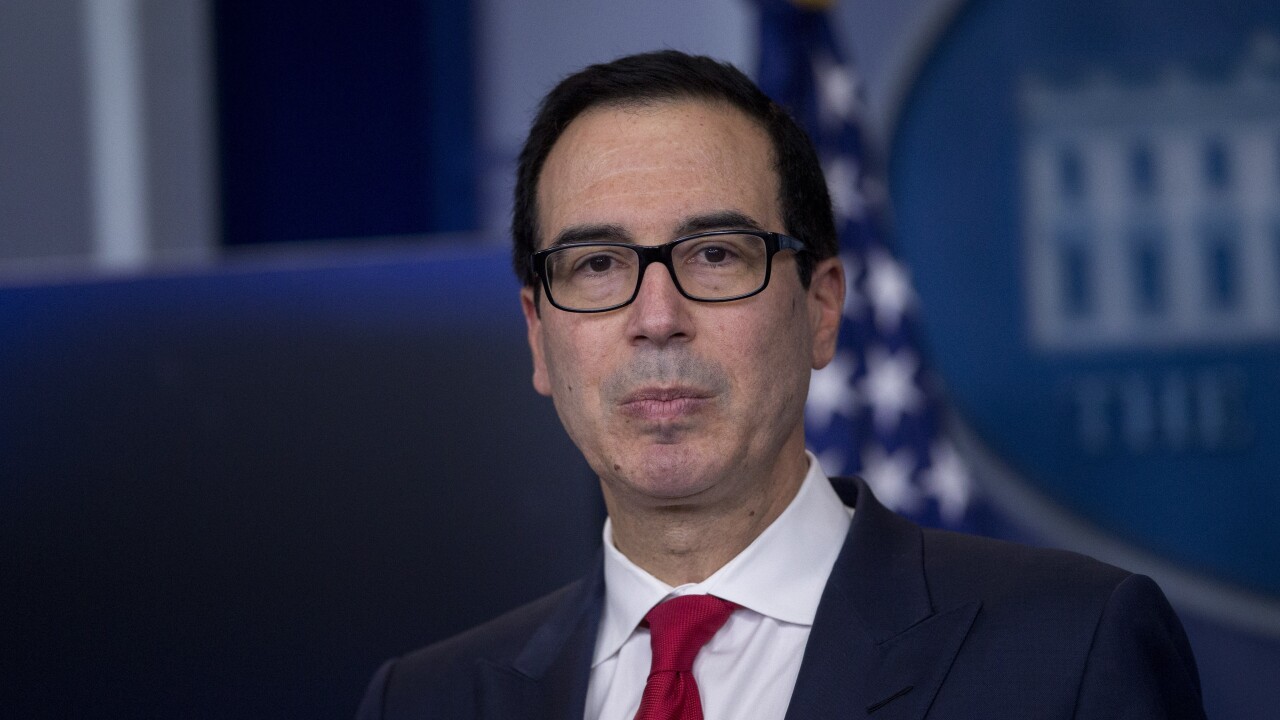

The Trump administration is prepping recommendations to address shortcomings in the capital markets in a report to be released next month, a top Treasury Department official said Monday.

September 18 -

David Dotherow, CEO of the newly formed Winter Park National Bank, stresses the need for strong management and a straightforward business plan when applying for a charter.

September 15 -

Few lawmakers have stated positions on fintech applications for industrial loan company charters. It may not stay that way.

September 13