Santander

Santander

Banco Santander Rio SA is an Argentina-based financial institution (the Bank) principally engaged in the banking sector. The Bank's offer includes current and saving accounts, mortgage, consumer and commercial loans, fixed-term deposits, credit and debit cards, financial advisory, wealth management, banking guarantees, cash management, export and project financing, mergers and acquisition (M&A) transactions, custody, leasing, as well as securities brokerage, among others.

-

Emily Vaughan Alexanderson will lead a group focused on education, nonprofit, technology and life sciences clients.

January 15 -

Santander taps JPMorgan Chase exec Colleen Canny to lead retail network; can Trump actually fire Fed's Powell?; will 2019 bring long-awaited reform of Fannie Mae, Freddie Mac?; and more from the past two week's most-read stories.

January 4 -

As head of Santander Bank’s retail network, Colleen Canny will be in charge of more than 600 branches and over 4,100 employees across eight states.

December 24 -

Several banks are seeing significant changes in leadership as the year comes to a close.

December 11 -

The agency alleges the subprime auto lender violated consumer finance laws by misrepresenting the level of guaranteed insurance protection.

November 20 -

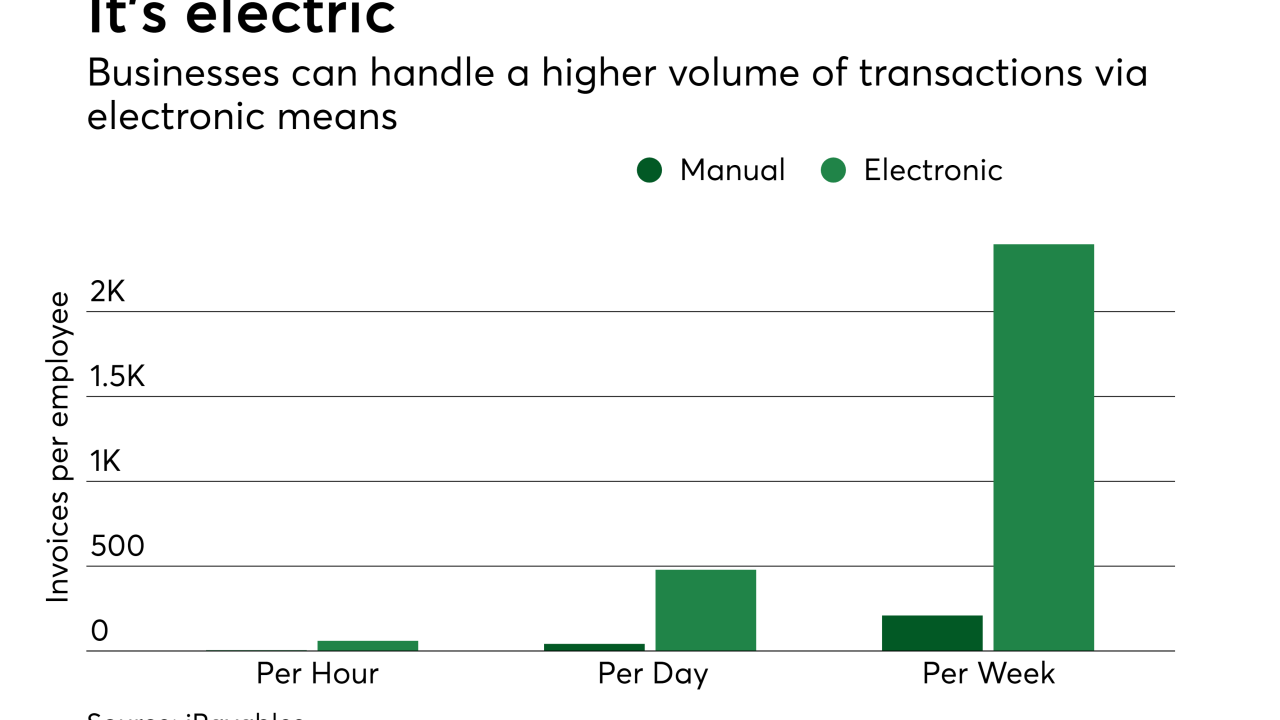

The ploys vary widely—digital tracking, fee incentives and "coopetition"—but banks are turning up the volume on innovation to pry businesses away from checks and keep them from signing up with rival tech startups.

November 12 -

A group of large banks is using its considerable size and influence to build standards for trade finance, including agreements on payments processes, documentation and risk—giving the consortium its own ecosystem to counter the myriad forces in technology and e-commerce that threaten to upend traditional practices.

October 26 -

Sen. Warren proposes a bill that would extend the law to credit unions while stiffening penalties; the Spanish bank taps UBS’s Andrea Orcel.

September 26 -

Scott Powell, the CEO of Santander Holdings USA, has spent years contending with a host of regulatory problems. He outlined a long-range vision that includes a branch-focused retail push and possible acquisitions.

September 4 -

Santander Bank said Wednesday that the OCC had terminated a 2015 consent order related to an identity protection product. It is one of several regulatory headaches the bank and its parent company have resolved lately.

August 29 -

Thieves stole more than $13 million from an Indian bank just days after an FBI warning; Fed’s special oversight restrictions from 2015 lifted.

August 17 -

The Federal Reserve had ordered improvements in compliance, board oversight, risk management, capital planning and liquidity risk management that spanned multiple subsidiaries.

August 16 -

The Boston bank said the digital lending platform has cut down the time it takes to deliver loan decisions by roughly 40%.

July 23 -

The Dallas auto lender might lose as much as one-third of its business if it severs ties with the automaker, raising fresh questions about whether its parent company will buy out shareholders and take full ownership.

June 8 -

Banks are at the forefront of blockchain innovation, disrupting cross-border payments, trade finance and product development worldwide.

May 25 -

Mahesh Aditya will immediately take over risk management for the U.S. subsidiary of Banco Santander, which is trying to turn the corner after several tough years on the regulatory and financial fronts.

May 22 -

Banks are at the forefront of blockchain innovation, disrupting cross-border payments, trade finance and product development worldwide.

May 21 -

Blockchain's potential for revolutionizing the world’s payment systems has captured the imagination in recent years, and last month Santander became the U.K.'s first bank to use the technology to create a new international payments service.

May 18 -

Europe's PSD2 data-sharing standards are meant to foster cooperation in the market, but banks are getting more competitive as they seek to plug a revenue drain the new rules threaten.

May 11 -

The Boston bank said Monday it received a "satisfactory" Community Reinvestment Act rating after being downgraded on its last exam.

April 30