-

The Australian firm agreed to pay around $1 million in connection with allegations that it broke the law by operating without a license in the nation's largest state.

March 17 -

A new law authorizes municipalities in the nation’s largest state to charter their own financial institutions to reinvest public funds into the community.

October 3 -

Officials said Thursday that they will not take regulatory action against state-chartered banks and credit unions solely for serving licensed cannabis businesses.

October 3 -

New plans for a ballot initiative in November 2020 threaten to overturn concessions that financial institutions, tech firms and other companies have won from state lawmakers.

September 26 -

A first-in-the-nation bill that drew unanimous support from the state Senate failed to get over the finish line this year. What happened?

September 19 -

The vote Friday was a victory for consumer advocacy groups that have been pushing for years to rein in lenders that charge triple-digit rates.

September 13 -

A legislative measure would have made the Golden State the first in the nation where aggrieved borrowers could sue their servicers. The bill was delayed until 2020 after banks and other financial companies expressed opposition.

September 6 -

Under a state proposal, annual percentage rates would have to be disclosed on nonbank commercial loans of $500,000 or less. Lenders' responses have been mixed depending on their business model.

August 18 -

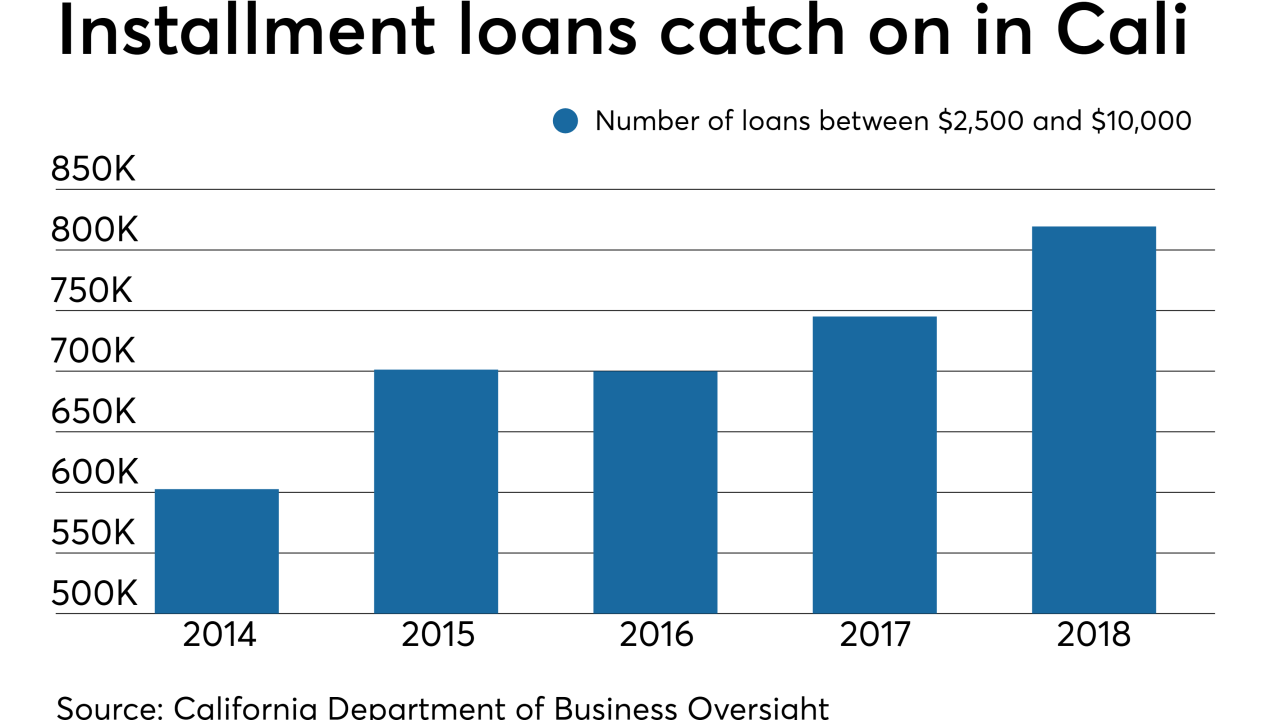

New data from the state shows that payday loans fell to a 12-year low in 2018. But the trend does not necessarily mean that consumers are paying less to borrow.

August 8 -

The legislation, which passed a key test in the state Senate on Wednesday, is the product of a compromise between consumer advocates and some lenders.

June 27 -

Readers weigh in on Wells Fargo's latest efforts to mollify regulators, debate the value of a "mini CFPB" in California, consider proposed changes to the Community Reinvestment Act and more.

May 9 -

The state should overhaul its Department of Business Oversight, but proposals to create a statewide financial protection bureau miss the mark.

May 3 California Department of Business Oversight

California Department of Business Oversight -

Among the three measures is a requirement for boards of publicly traded firms to include more women.

October 1 -

Gov. Jerry Brown’s administration sent letters Wednesday to 20 nonbank lenders that charge triple-digit annual percentage rates to try to determine if their use of online referrals is steering borrowers into larger loans than they want or need.

September 26 -

If Gov. Jerry Brown signs the legislation headed to his desk, it would be the first law of its kind in the U.S. It is designed to allow small-business owners to make comparisons between offers in the often bewildering world of online business lending.

September 5 -

Judges say a CashCall loan may have fit the state’s definition of an “unconscionable” interest rate.

August 13 -

Lobbyists for the payday loan industry are getting a warmer reception in state capitals in 2018 than they did last year. One of their key arguments is that the federal crackdown on payday loans, which is now on hold, requires a response from the states.

February 1 -

Merchants have been challenging surcharge bans in numerous states on free-speech grounds. They have the wind at their backs following another court victory on Wednesday.

January 3 -

Auditors performing a review of Ocwen Financial padded time sheets and claimed excessive and improper expenses, including lengthy travel and meals at strip clubs and casinos, according to a lawsuit filed against Fidelity Information Services.

May 30