-

Regional banks don’t pose risks to the financial system that have caused concern among policymakers, executives of 18 banks told top Republican and Democratic lawmakers in Congress.

February 13 -

Corporate borrowers aren’t ready just yet to pull the trigger on multimillion-dollar loans to buy fleets of trucks or scads of new inventory despite excitement about a more business-friendly Washington, lenders cautioned.

February 7 -

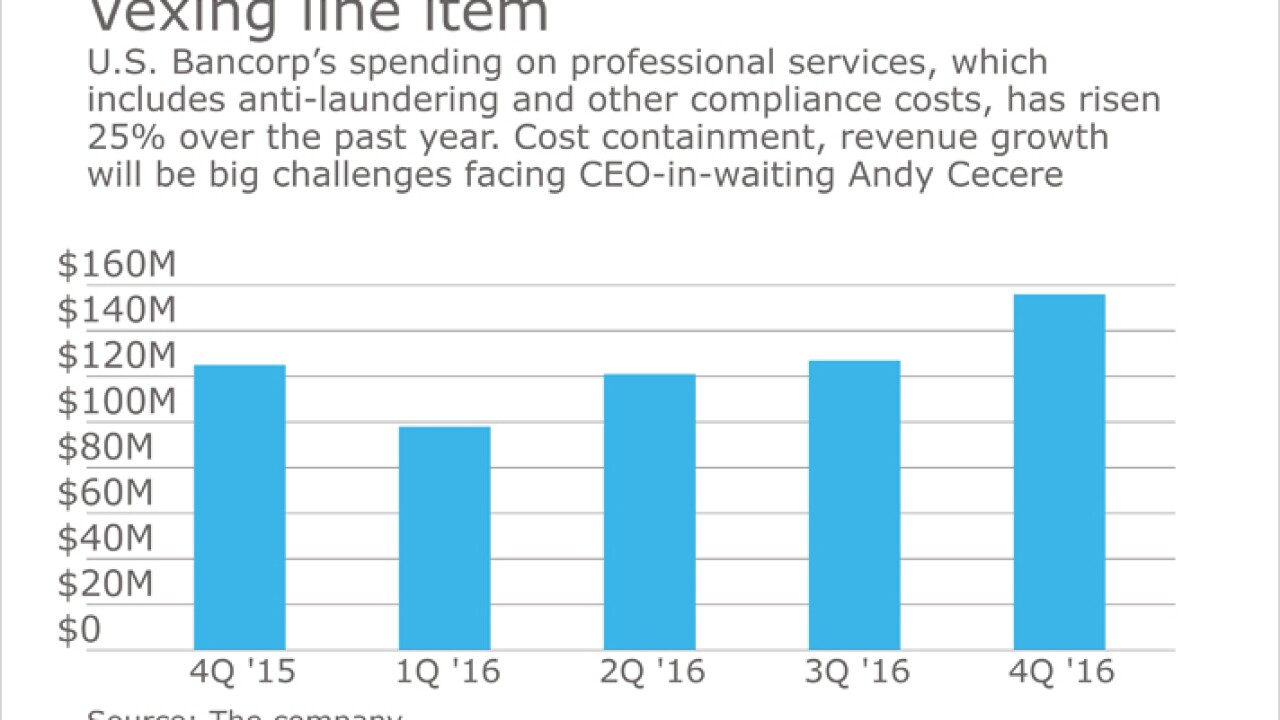

Andy Cecere is the new CEO-in-waiting at the Minneapolis bank, but interest in his future plans took a back seat as investors and others tried to get their heads around why the current boss, Richard Davis, is choosing to leave seven years before the typical retirement age.

January 18 -

While the Trump administration could relax other bank regulations, it is unlikely that it would ease up when it comes to money-laundering compliance.

January 18 -

The highly regarded and outspoken Richard Davis is a hard act to follow, but Andy Cecere, who will take over the successful Minneapolis company in a few months, is said to have the right blend of knowledge and judicious temperament for meeting the business challenges that lie ahead.

January 17 -

The Minneapolis company announced that Richard Davis will retire as CEO this spring. He will be succeeded by longtime deputy Andy Cecere.

January 17 -

Corporate clients are increasingly asking their banks to help digitize back-office processes. Such a move can help both parties save time and money.

January 13 -

The EMV migration has been sluggish, but it's a vital part of protecting cardholders.

November 21 US Bank

US Bank -

Platforms designed for face-to-face or paper transactions may not be the best enabler of payments through connected devices, but a system born out of the digital payments world could fare better.

November 10