Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

Competition for deposits is heating up as summer approaches, and banks are responding in all sorts of ways — from launching digital-only platforms to raising CD rates to reviving debit rewards. But rising interest rates could weaken demand for loans, especially mortgages.

June 14 -

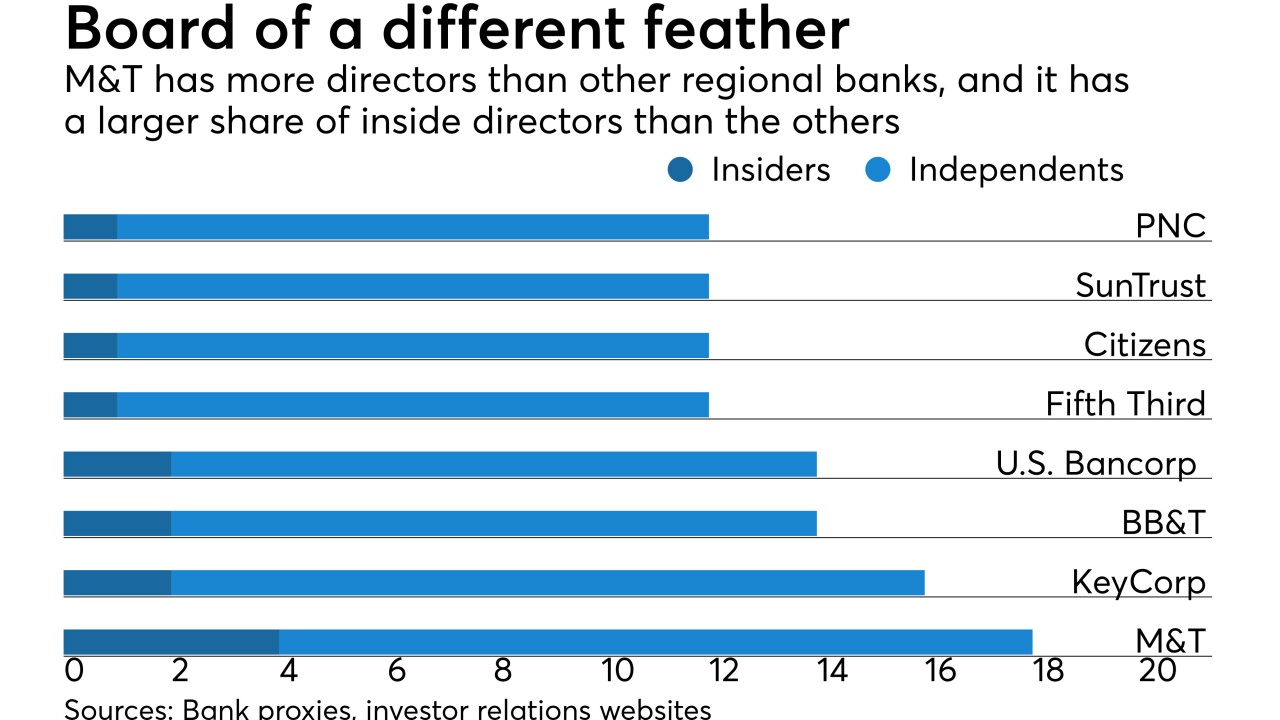

Everyone agrees good corporate governance involves a board that is just the “right” size and has a “good mix” of knowledgeable insiders and independent watchdogs. But setting bright-line rules for banks as varied as M&T, Wells Fargo and Eastern Bank is hard.

June 13 -

In his inaugural hearing as comptroller of the currency, Joseph Otting defended his decision not to publicly rebuke banks for Wells Fargo-like problems.

June 13 -

The simplified pricing of fintechs like Square and Stripe has finally caught up with banks' more complex fees, prompting Wells Fargo to restructure its billing for small businesses. Other banks will also face consequences—particularly community banks that depend on local merchants.

June 13 -

The changes are designed to remove the complex set of fees that could vary from one mercant to another.

June 12 -

USAA's lawsuit accusing Wells of infringing on its remote-deposit patents is new territory: bank-on-bank fights over intellectual property.

June 11 -

Wells Fargo & Co. customers hoping to use their credit cards to buy Bitcoin will have to look elsewhere.

June 11 -

The OCC finds that Wells Fargo was not alone in its sales abuse practices (though it's not naming names); Fifth Third's Tim Spence is our Digital Banker of the Year; the CFPB acting director wipes out the agency's Consumer Advisory Board; and more from this week's most-read stories.

June 8 -

When asked if other banks were being sued, USAA said the lawsuit names only Wells Fargo because the bank is one of the biggest adopters of remote mobile deposit capture and has failed to license the technology.

June 8 -

Institutions that have been opening consumer accounts without consent need to prepare for the fallout, even if the OCC has said it won't name names.

June 8 -

U.S. banks reduced their holdings of state and local government bonds for the first time since 2009 after the federal government slashed corporate tax rates, according to figures released by the Federal Reserve Thursday.

June 7 -

The firm graded bank and credit card apps on customer satisfaction, appearance, navigability, and availability and clarity of information.

June 7 -

The city wanted to sever its relationship with the bank, but it ran into a big obstacle.

June 6 -

The OCC finds widespread problems in bank retail sales practices; Ripple and Swift competition for payments pits technology against convention.

June 6 -

An inquiry into the sales practices of more than 40 banks launched in the wake of the Wells scandal found several systemic issues and hundreds of problems at individual institutions. The OCC completed the review in December but is not making the results public.

June 5 -

The low-cost deposits that come with the deal for 52 Wells branches in four states should fund the Michigan company's effort to become a commercial lender.

June 5 -

Most big banks are launching robo-advisers to compete for a new breed of wealth management customer. The risk is that automated services will disappoint traditional customers.

June 5 -

The Michigan company will buy 52 branches and $2.3 billion in deposits from the San Francisco banking giant.

June 5 -

A change in House leadership in midterms would slow down regulatory relief initiatives and put more heat on Trump-appointed regulators.

June 1 -

A change in House leadership in midterms would slow down regulatory relief initiatives and put more heat on Trump-appointed regulators.

May 31