Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

Retail banking chief Christian Sewing will become CEO immediately; higher deposit rates could trim lending margins as banks head into earnings season.

April 9 -

GSE reform a likely scratch from this year’s to-do list; banks’ difficulties in speaking emoji; reactions to Mick Mulvaney’s plans for the CFPB; and more.

April 6 -

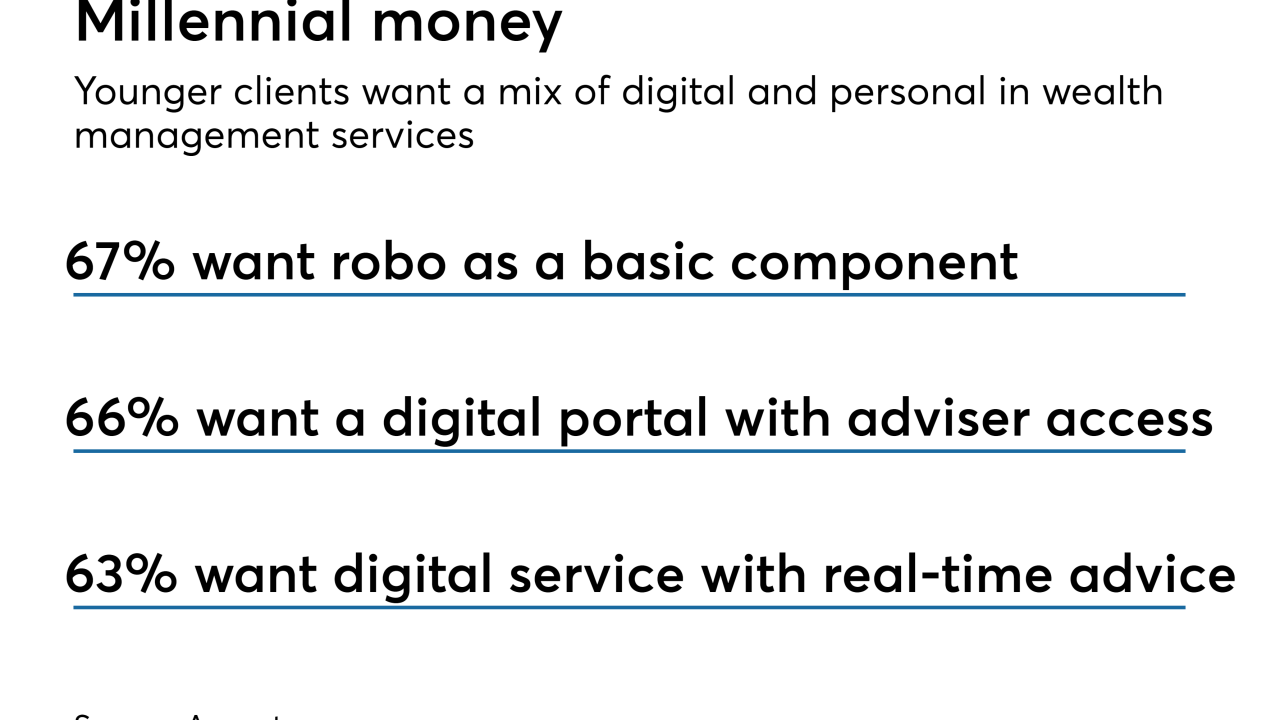

BMO Wealth Management aims to modernize its investment service and give advisers better equipment. Others offering automated advice solutions include UBS, Wells Fargo and JPMorgan.

April 6 -

KPMG has been the bank's auditor since 1931. Critics say it's time for a change.

April 5 -

Some clients of Wells Fargo's wealth management division were steered into investments that weren't always in the best interests of clients, according to several people familiar with the unit.

April 5 -

San Francisco Fed President John Williams is not suited to lead the most important of the regional Fed banks, given his inability to detect the phony-accounts problems at Wells Fargo. He also lacks Wall Street experience.

March 28 -

San Francisco Fed chief is reportedly leading candidate to replace Dudley in New York; four senior officers to retire as OCC readies penalties against the bank.

March 26 -

Wells Fargo announced changes to its risk-management leadership this week as some executives plan to retire, according to a person familiar with the situation.

March 23 -

Some top bank executives — at big and regional institutions alike — enjoy premium perks, including personal travel on corporate aircraft and minimal wait times for fancy medical exams. Here’s an overview of the special items disclosed to investors so far this year.

March 21 -

Many of the industry’s top executives — at big and regional banks alike — enjoy premium perks, including personal travel on corporate aircraft and minimal wait times for fancy medical exams. Here’s an overview of the special items disclosed to investors so far this year.

March 21 -

One fintech has a new twist on gamification — tie savings contributions to achievement in the most popular games.

March 20 -

The bank is the latest to report required pay discrepancies in their British units; the DOJ and SEC are looking into sales practices at the bank’s wealth management unit.

March 19 -

The FBI has reportedly interviewed employees at the bank’s wealth management unit.

March 16 -

Readers opine on the prospect of regulatory relief, weigh in on the need for regulators to become more tech savvy, react to HSBC hopping back into U.S. mortgage lending and more.

March 15 -

CEO Tim Sloan was paid $17.4 million, though he was denied a cash bonus, as the San Francisco bank continued to contend with scandal fallout.

March 14 -

With rate hikes aplenty expected this year, Wells Fargo and Bank of America are said to be subdividing key markets to target deposit pricing in the future and minimize costs. These are among several innovative steps large banks are taking to prepare for more competition for deposits.

March 14 -

The top examiner of Wells Fargo at the Office of the Comptroller of the Currency improperly revealed to the San Francisco bank the existence of a government investigation, according to the Treasury's inspector general.

March 9 -

Wells has helped gun and ammunition companies access $431 million in loans and bonds since the 2012 Sandy Hook shooting. Other financial firms that are active as bookrunners for gunmakers include Morgan Stanley, TD Securities, Bank of America and JPMorgan Chase.

March 7 -

Wells Fargo agreed to publicly report on the root causes that led to a rash of ethical lapses in recent years, a group of investors, led by the Interfaith Center on Corporate Responsibility, said.

March 6 -

The estimated costs of recent digital glitches at BB&T, TD and Wells Fargo are in the hundreds of millions of dollars, but contractual and economic realities make it hard for banks to sue vendors for the money or fall back on insurance policies.

March 2