Zions Bancorp.

Zions Bancorp.

Zions Bancorporation, National Association provides various banking and related services primarily in the states of Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, Washington, and Wyoming. The company offers corporate banking services; commercial banking, including a focus on small- and medium-sized businesses; commercial real estate banking services; municipal and public finance services; retail banking, including residential mortgages; trust services; wealth management and private client banking services; and capital markets products and services.

-

Zions Bancorp. appears to have found a novel approach to escape the added requirements for banks above the Dodd-Frank Act's systemic $50 billion asset threshold, but other banks in a similar position are more likely to wait for Congress to address the issue rather than following suit.

November 20 -

The $65 billion-asset company intends to shed its holding company and then will petition regulators to reconsider its designation as a systemically important financial institution.

November 20 -

The Salt Lake City bank reported strong 3Q results despite unexpected expenses tied to hurricane damage in its Texas market, and it vowed to stay on track in meeting its cost-savings goals.

October 23 -

When Zions Bancorp. in Salt Lake City decided to consolidate its seven bank charters into one, executives knew they would have to work hard to retain their most talented employees amid all the disruption.

September 25 -

Jennifer Smith is overseeing a core conversion that is the largest tech project in Zions' history.

September 25 -

The Salt Lake City company also benefited from increases in investment securities and several large loan recoveries during the quarter.

July 25 -

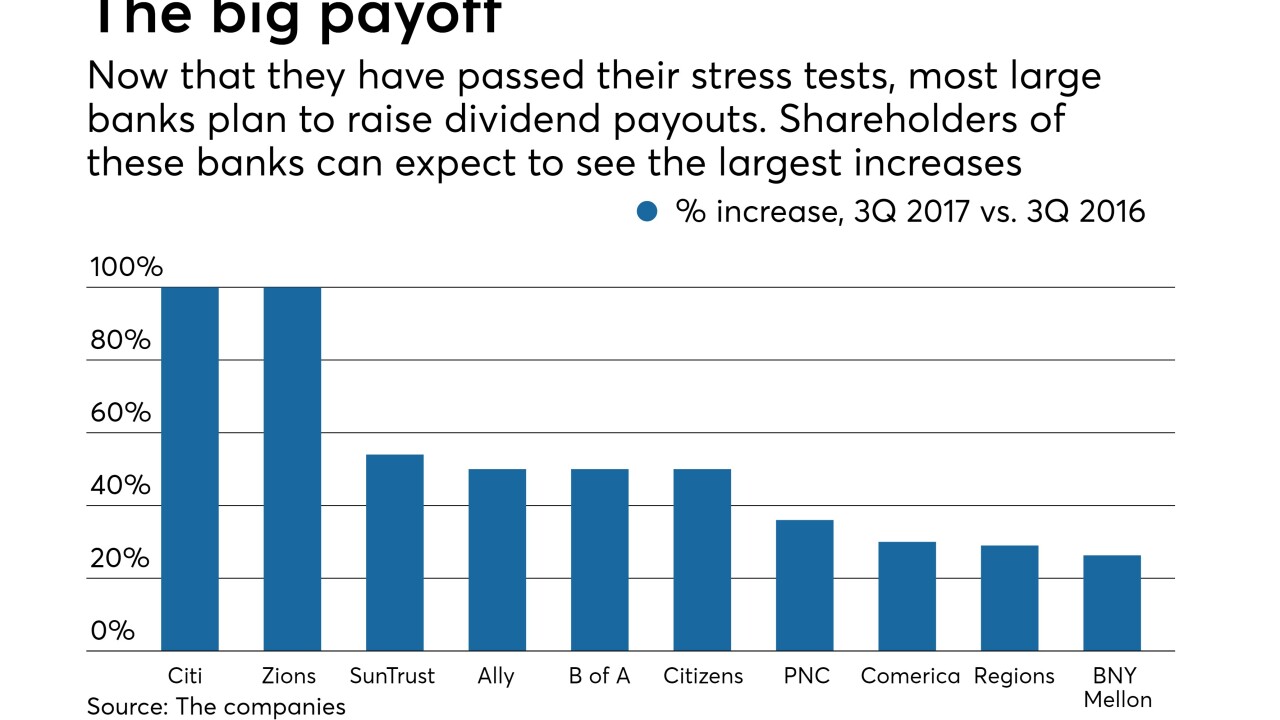

Higher dividends and more aggressive repurchase programs are bound to attract more investors, which could boost stock prices and prompt more dealmaking, analysts said.

June 29 -

Oil prices are dropping again, but some lenders think now is the time to recommit to energy lending as long as they underwrite them a certain way for certain borrowers in certain regions.

June 20 -

Following are notable cases where banks were tripped up by the Fed's stress tests either by flunking the numbers (or quantitative) part of the test or raising red flags on a qualitative basis.

June 19 -

Some executives are shrugging off recent defaults as isolated incidents, but others say states’ uneven embrace of the Affordable Care Act, as well as potential changes to the law itself, have escalated the risks in lending to health firms.

May 4