Zions Bancorp.

Zions Bancorp.

Zions Bancorporation, National Association provides various banking and related services primarily in the states of Arizona, California, Colorado, Idaho, Nevada, New Mexico, Oregon, Texas, Utah, Washington, and Wyoming. The company offers corporate banking services; commercial banking, including a focus on small- and medium-sized businesses; commercial real estate banking services; municipal and public finance services; retail banking, including residential mortgages; trust services; wealth management and private client banking services; and capital markets products and services.

-

The Salt Lake City company also benefited from increases in investment securities and several large loan recoveries during the quarter.

July 25 -

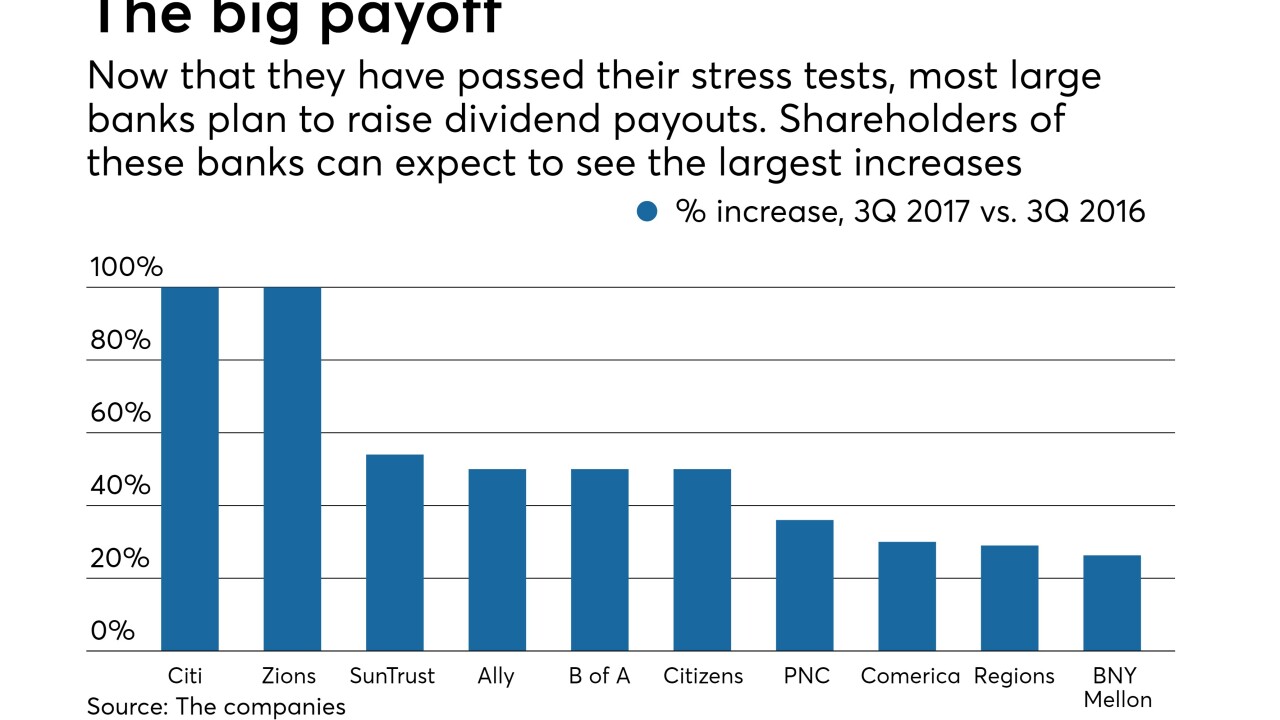

Higher dividends and more aggressive repurchase programs are bound to attract more investors, which could boost stock prices and prompt more dealmaking, analysts said.

June 29 -

Oil prices are dropping again, but some lenders think now is the time to recommit to energy lending as long as they underwrite them a certain way for certain borrowers in certain regions.

June 20 -

Following are notable cases where banks were tripped up by the Fed's stress tests either by flunking the numbers (or quantitative) part of the test or raising red flags on a qualitative basis.

June 19 -

Some executives are shrugging off recent defaults as isolated incidents, but others say states’ uneven embrace of the Affordable Care Act, as well as potential changes to the law itself, have escalated the risks in lending to health firms.

May 4 -

Even as units of a larger holding company, local banks fight the perception that they can’t provide sophisticated services like corporate or private banking. Executives say that unifying the brand will help Synovus better compete against larger players.

May 3 -

Zions beat expectations on several bits of good news, but it reported about $30 million of chargeoffs tied to a single commercial borrower.

April 24 -

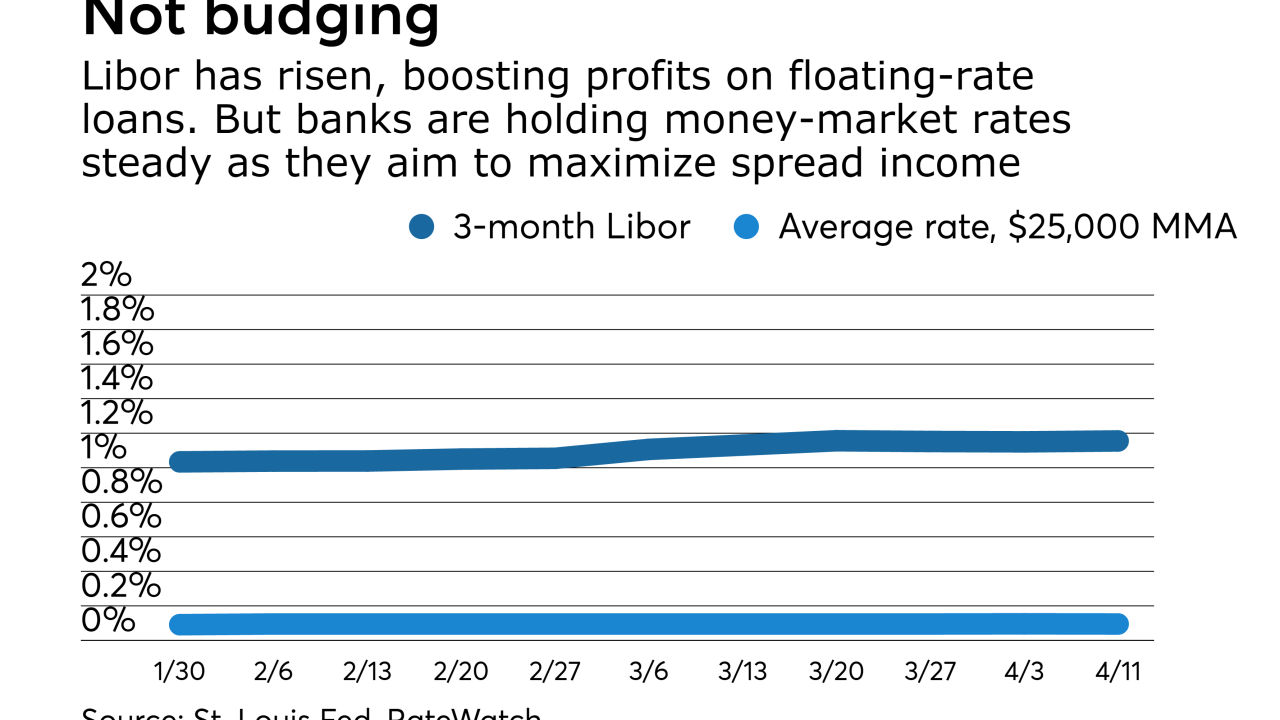

Even with net interest margins improving, banks are reluctant to raise rates on deposits until more floating-rate loans reprice. But how long can they wait before depositors start demanding higher yields?

April 24 -

Bank earnings could be hurt this year as big retailers close stores and file for bankruptcy. The situation has sparked a debate about how much CRE and C&I books will suffer just as lenders were putting other commercial woes behind them.

April 11 -

Vacancies and rent-slashing have some banks worried that certain markets are overheating, but others say the decline in nonperforming loans is a sign the sector has never been healthier.

March 3 -

Connected cars are going to create new revenue streams, not just for automakers, but also for financial services providers.

January 29 -

Empowering women to become more financially independent has been a hallmark of Lori Chillingworth's career as a small-business banker. Now she's on an even bigger mission: to help more women in Utah gain seats on corporate boards and compete for political office.

October 7 -

Zions Bancorp. and its vendor, Tata Consultancy Services, shared more details Tuesday about the bank's ongoing core system conversion- a rare project, especially for financial institutions this size.

November 5 - WIB PH

For years Zions First National Bank has been a top SBA lender in its markets, but Lori Chillingworth keeps finding ways to make this highly profitable business even stronger.

September 18 -

Zions' Lori Chillingworth is part of the 2008 Most Powerful Women in Banking rankings.

October 1 -

SALT LAKE CITY — Nearly a year after its deal for hometown rival First Security Corp. unraveled, Zions Bancorp.has taken a deep breath and set out to prove it is back in the game.

February 13