-

Officials from the Federal Reserve Bank of New York, Bangladesh Bank and payments network Swift vowed Tuesday to catch the thieves who took $81 million out of the Bangladesh central bank's account at the New York Fed.

May 10 -

ACH Alert has been providing fraud protection for Automated Clearing House, debit and wire transactions at banks for more than six years, but it's probably never been in a better position to draw attention to its real-time process.

May 10 -

Six months after the credit card fraud liability shift, merchants who have not implemented chip card technology are complaining about a larger number of chargebacks than they expected. But there are steps that can stem the tide.

May 10 eMazzanti Technologies

eMazzanti Technologies -

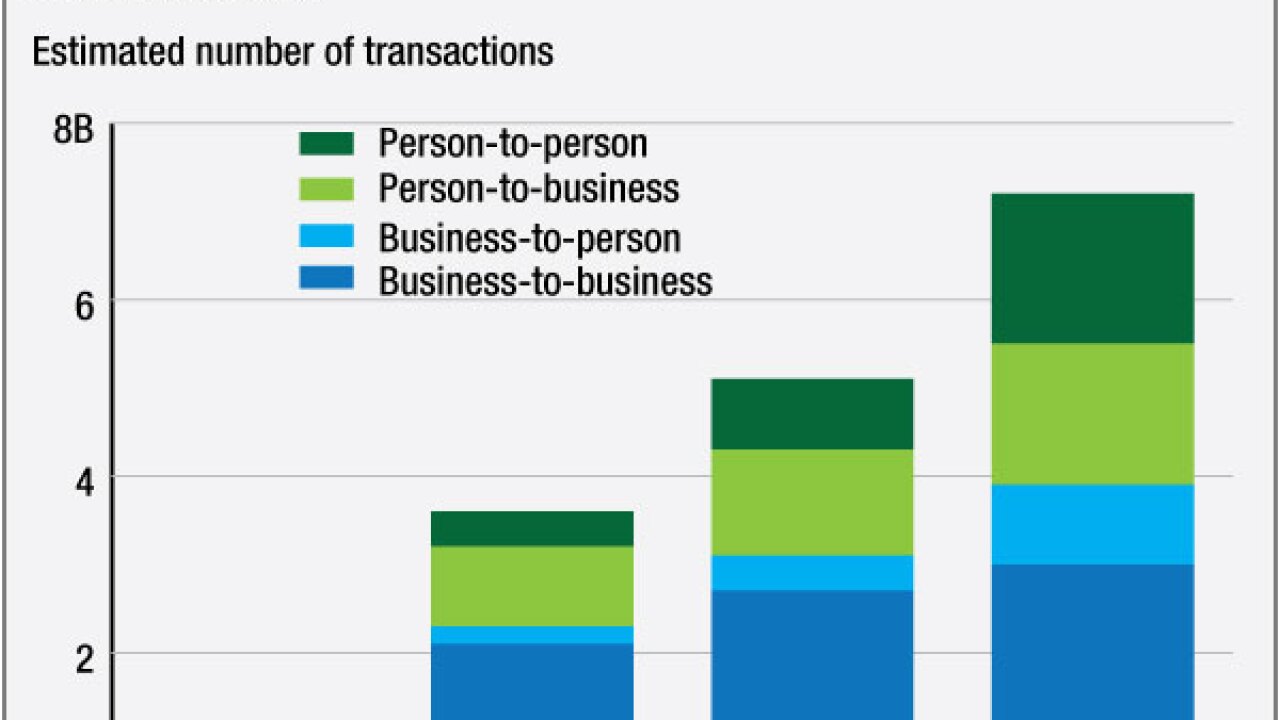

The Clearing House, Dwolla and Ripple Labs are among more than 20 companies that are vying to play a lead role in modernizing the U.S. payment system.

May 9 -

Many bank security people will undoubtedly shrug off Anonymous' claim that it's trying to bring down banks all over the world. There are a few reasons to take it seriously.

May 6 -

Maria Vullo, still stuck in limbo as acting superintendent of the New York State Department of Financial Services, is hindered from putting her mark on the agency until she gets confirmed. So a quiet guessing game is going on about how her supervisory philosophy will compare with her predecessor Benjamin Lawsky.

May 6 -

Counterfeit card fraud is finally on the way down as EMV creeps into the U.S. marketplace, but card not present (CNP) fraud through online channels is skyrocketing. It's too soon, however, to blame the EMV shift.

May 6 -

Multifactor authentication is high on the list of payment security requirements, including new standards from PCI. For any company on the fence on adding stronger authentication, there's plenty of examples of what can go wrong with basic identity management.

May 6 Tripwire

Tripwire -

Fueled in part by an increase in phishing attacks with malware attachments in the past year, fraudsters took only minutes to compromise a network in 93% of breach incidents, according to Verizon's 2016 data breach investigations report.

May 5 -

Requirements that banks share anti-money-laundering information should extend to fraud and cyber risks, to connect the dots between bad actors and their transfer of money.

May 5