-

Flaws in testing may be real source of Wells Fargo's tech failure; BB&T-SunTrust deal throws talent and deposits up for grabs, threatens banking's middle tier; what JPMorgan Chase's JPM Coin means for Ripple and Swift; and more from this week's most-read stories.

February 15 -

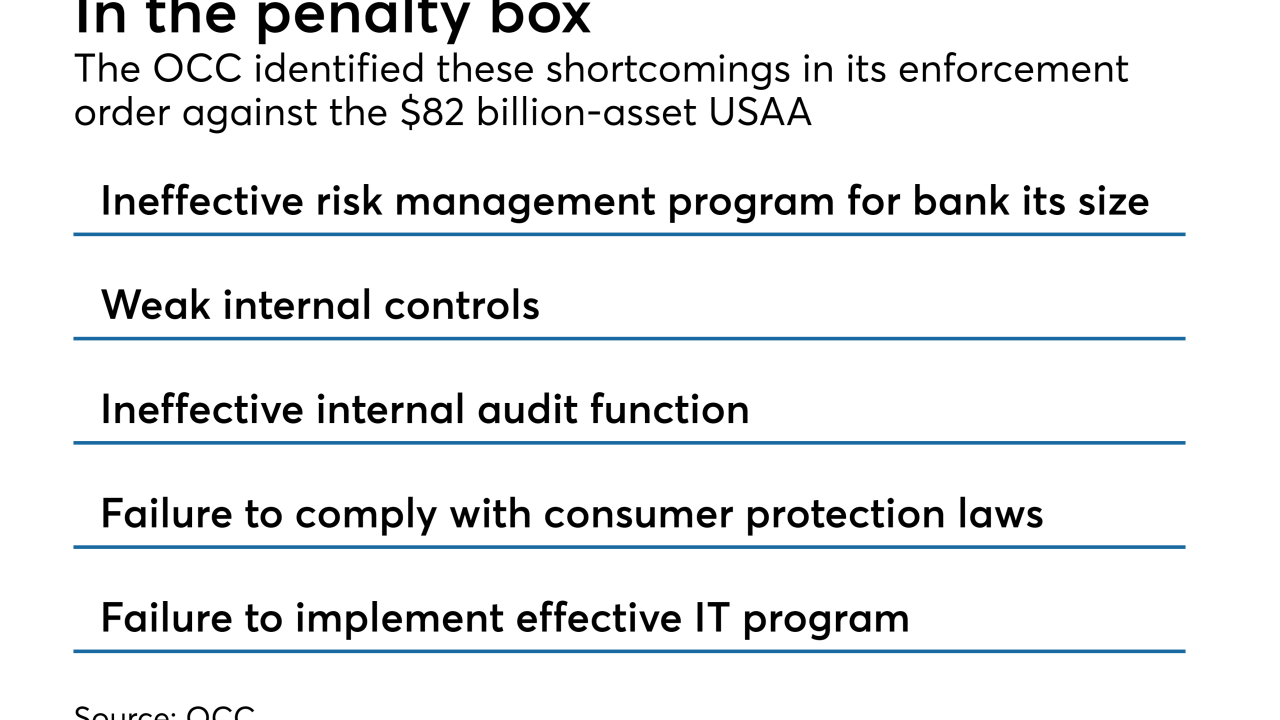

The enforcement action from the OCC comes on the heels of a CFPB consent order that said USAA reopened customers' accounts without consent and neglected stop-payment requests.

February 15 -

Banks want to encourage innovation by extending access to outside developers, but customer data remains vulnerable while in use by an application.

February 15 -

Unauthorized exposure of any type of customer data, for any period of time, is a serious issue, writes Carl Wright, chief commercial officer of AttackIQ.

February 15 AttackIQ

AttackIQ -

The JPM Coin will be used to expedite payments transfers for its corporate clients; customers of Spain’s largest retail bank will be able to withdraw cash without entering a PIN.

February 15 -

To take full advantage of AI’s opportunities, employers must understand and overcome lingering doubts from their employees.

February 15 -

JPMorgan is prototyping its own digital currency to be used for cross-border payments and, later, other purposes. Will banks find this a palatable alternative to today's most well-known options?

February 14 -

JPM Coin is not meant for consumer payments, but rather is a specific technology for a specific use case that the bank controls. Its value comes not from JPM Coin's appeal, but from JPMorgan's titanic wholesale payments business.

February 14 -

The Credit Union National Association and several institutions sued the fast food business after a data breach in 2016.

February 14 -

JPMorgan Chase successfully tested a cryptocurrency it plans to use in trials for clients of its wholesale-payments business. Dubbed JPM Coin, it's based on blockchain technology, the bank said Thursday in a presentation on its website.

February 14