First contact

“There are a lot of chatbots in the industry right now dealing with the easy tasks, reducing complexity by dealing with multiple people at once,” said Sumeet Vermani, a global marketing leader working for fintech providers such as Red Box Recorders. Chatbots are about “having a digital one-stop shop for customer communication and interaction. Customers are increasingly wanting a single point in which to communicate with their payments providers, whether it’s to transact in a messenger app, learn more about a product or lodge a complaint.”

And in the future, chatbots could be even better at up-selling customers than humans, able to parse through large amounts of data to determine the timing a specific product is needed.

Credit scores

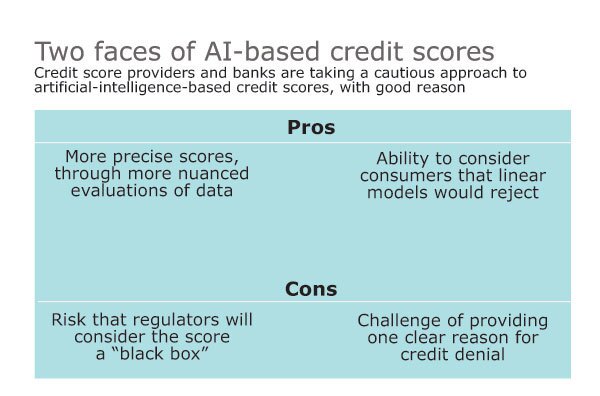

The use of AI offers lenders the ability to get a precise look into someone’s creditworthiness and score those previously deemed unscorable.

But such scoring techniques also bring uncertainty: What it will take to convince regulators that AI-based credit scores are not a black box? How do you get a system trained to look at the interactions of many variables, to produce one clear reason for declining credit?

There are two main reasons to use artificial intelligence to derive a credit score. One is to assess creditworthiness more precisely. The other is to be able to consider people who might not have been able to get a credit score in the past, or who may have been too hastily rejected by a traditional logistic regression-based score. In other words, a method that looks at certain data points from consumers’ credit history to calculate the odds that they will repay.

Machine learning can take a more nuanced look at consumer behavior.

“A neural network more closely mimics the way humans think and reason, whereas linear models are more dogmatic — you’re imposing structure on data as opposed to letting the data talk to you,” said Eric VonDohlen, chief analytics officer at the online lender Elevate. The more complex reasoning of artificial intelligence can find things in the data that wouldn’t be apparent otherwise.

Automating alternative payments

"There's information that 'wants' to get out there," said Dell, whose new company, financial management provider

Clarity has developed software that analyzes a user's spending and payment habits, then seeks a "better" option to either make recurring payments less expensive, choose a card with lower fees, or spot ways to save money through changing habits, Dell said. As is the case with AI, the more the software is used, the better it should work for a particular user.

In this scenario, the consumer has better and more detailed information when shopping for a financial product such as a credit card, savings account, debit card or branded card, and can approach companies with a level of intelligence that is closer to the intelligence that the larger companies have for marketing and cross selling, Dell said.

Revitalizing 3-D Secure

One of the criticisms of 3-D secure has been that in its earliest deployments, it can be disruptive to the checkout process. 3-D Secure was commonly implemented as an additional password for payment card users to input when shopping online.

Palo Alto, Calif.-based Simility developed its

Simility says that by using 3-D Secure as the last step in its heavily layered, constantly adapting system to filter out potential fraud, it’s delivering to merchants the best of what 3-D Secure offers—a solid technology with broad payment industry backing—without the high number of false negatives and friction that have prevented 3-D Secure from catching on broadly with merchants.

Customized e-commerce

Along with Cross Culture Ventures, Muse Capital, Lowercase Capital and Arnold Venture Group, Madrona, whose e-commerce portfolio includes Amazon, ShareBuilder, Redfin and Farecast, just led a $6.5 million investment in ReplyYes, a Seattle-based company that combines e-commerce and mobile messaging to make it easier for consumers to buy and pay for things on social media recommendations.

The technology guts behind ReplyYes aren't rocket science, but artificial intelligence. ReplyYes uses AI to "learn" from consumer feedback to personalize each user's experience. Besides music, ReplyYes also powers recommendations over text and Facebook for the Origin Bound graphic novel store and Lowercase Alpha, which allows consumers to test new mobile apps before launch.

Credit Union investment

The

"Machine learning and artificial intelligence have become table stakes due to the growing sophistication of today's fraudsters," said Al Pascual, a senior vice president and research director for Javelin Strategy & Research. "Fraudsters are diversifying their schemes and leveraging automation in such a way that most institutions, which are overly reliant on manual prevention and detection of fraud, have become increasingly vulnerable."

Though AI's use in this area is still early, CO-OP sees AI as a dynamic innovation that can enhance existing IT strategy in resource management, security, authentication and digital transactions.

Wiping out false declines

Artificial intelligence can change the game, but only if it is smart enough to adapt its expectations based on the conditions of each transaction, according to Ajay Bhalla, president of enterprise risk and security for Mastercard.

"Behavioral analysis has been done for some time," Bhalla said, adding the challenge is to perform this analysis at vast scale, with speed and to accommodate dynamic data. "Artificial intelligence can help us do this globally for any account or any card in the world that we want. This was not an easy thing to do before."

Mastercard's new service, Decision Intelligence, assesses and scores every transaction, and applies analysis of the transaction to improve the product—a process generally referred to as "machine learning," a staple of artificial intelligence.

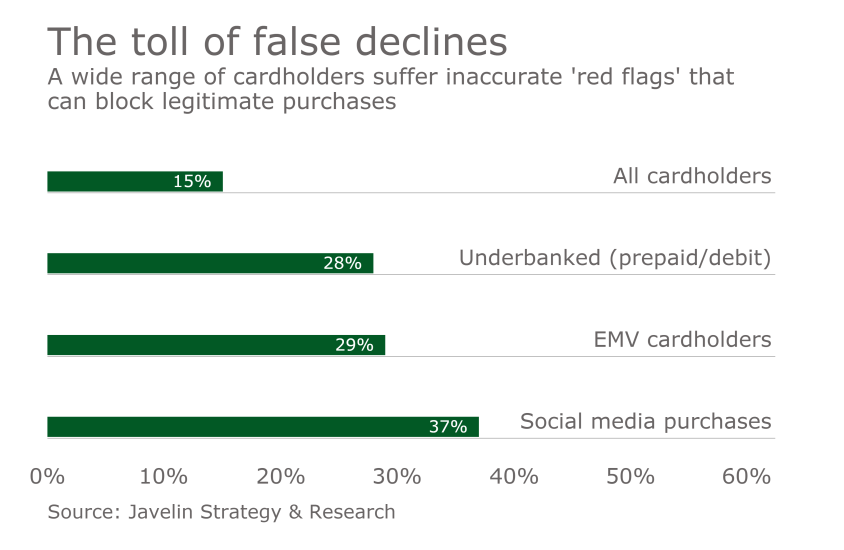

The problem the card network hopes to address—'false declines'—is actually worse than fraud, Mastercard contends. Citing data from Javelin Strategy & Research, Mastercard says false declines in the U.S. alone are about $118 billion yearly, with global numbers totaling more than $200 billion. In the U.S, card fraud totals about $9 billion yearly, according to the Javelin numbers.

"Consumers are being inconvenienced, merchants are losing sales and banks are losing transactions," Bhalla said, adding the inconvenience of a rejected transaction usually results in the consumer moving on to another store or another card. "There is a huge opportunity out there."