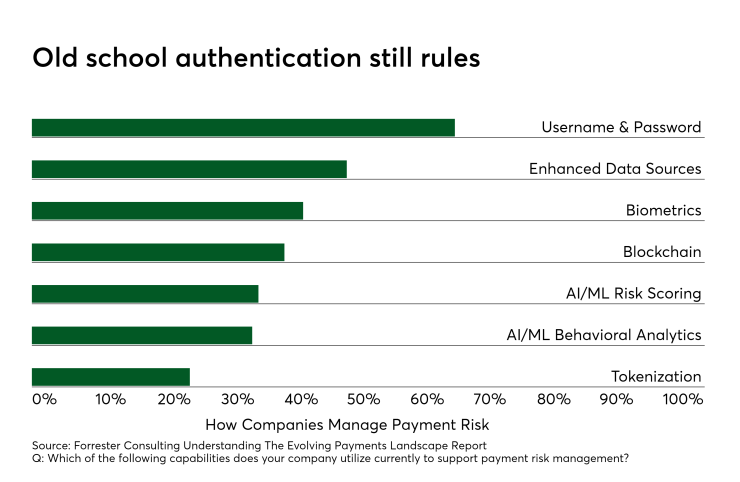

Developers have expanded availability of digital identity and biometrics, but traditional methods are holding strong.

Most companies still rely on usernames and passwords, though a significant portion are using enhanced data sources such as connected device data.

“Consumers are beginning to adopt these new technologies to make payments and companies are responding by investing in them to meet consumer demand. However, when you see a lot of [consumer] adoption you also see increased trepidation due to the increased level of payment fraud risk,” said RL Prasad, senior vice president of payment system risk at Visa.

A commissioned study conducted by Forrester Consulting on behalf of Visa found a strong expectation of rising consumer adoption of digital payment types over the next two years. Despite that, the most advanced forms of authentication such as biometrics and tokenization still lag, though there is forward momentum. The study included input from 566 international banking, technology and merchant executives.

While passwords are holding strong, biometric authentication is expanding.

“Biometrics is still some way off in widespread adoption,” Prasad said. “Biometrics will increasingly play a greater role in payments. These [biometric] tools are an extremely safe and convenient way of payment authentication.”

The study reported that banks, technology companies and merchants are worried about adequately addressing security as new payment technology expands. Their top concerns are successfully navigating identity verification, transaction monitoring, data privacy and two-factor authentication.

“It is always a balance of dealing with consumer friction with fraud detection,” noted Prasad.