Regions Bank

Regions Bank

Regions Financial is a regional bank headquartered in Alabama, with branches primarily in the Southeastern and Midwestern United States. Regions primarily provides traditional commercial and retail banking and also offers mortgage services, asset management, wealth management, securities brokerage, insurance, and trust services.

-

The pressure is on for banks to lean more heavily on capital markets, wealth management and other nonmortgage sources of fee income. That could get tougher in upcoming quarters.

October 23 -

Increased third-quarter revenue outweighed higher operating expenses at the Alabama regional.

October 23 -

Our 16th annual Most Powerful Women in Banking rankings; why Regions did away with teller jobs; small banks lagging in deposit share; and more from this week's most-read stories.

September 28 -

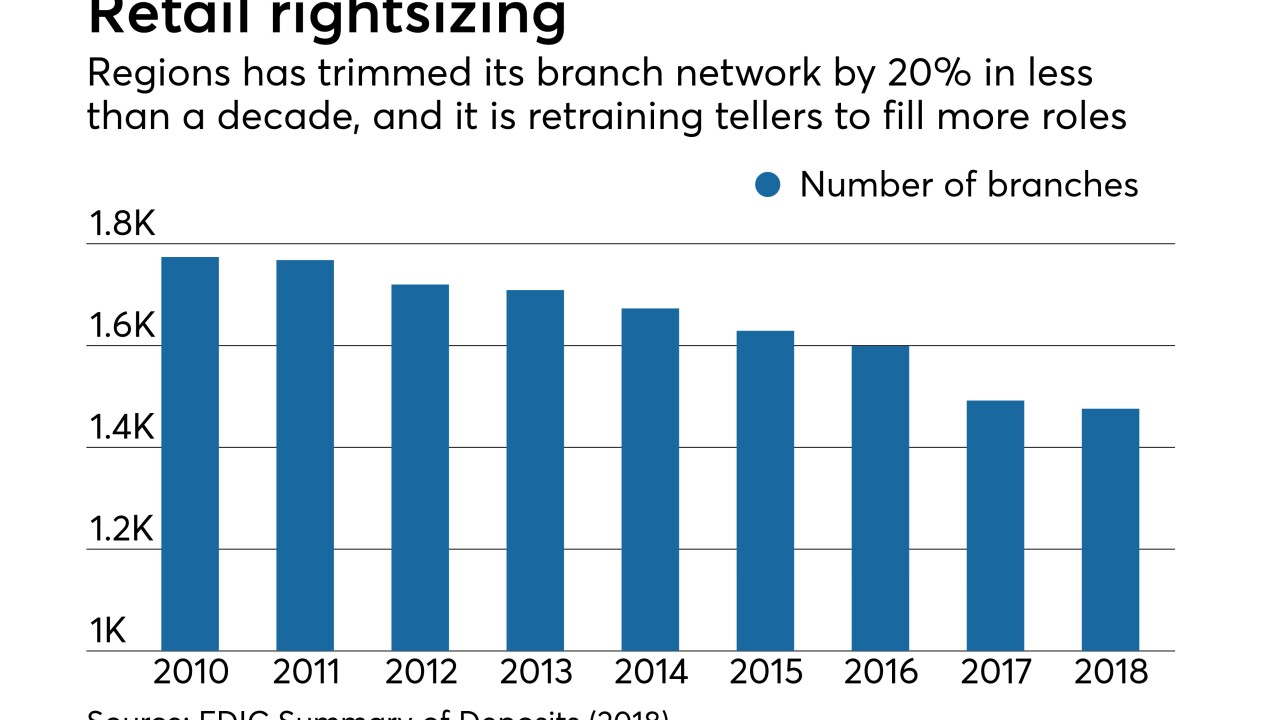

When the Birmingham, Ala., bank was rethinking its branch strategy, it had to reconsider the role of its tellers. Ultimately, it decided to transition those workers to a more general banker role that emphasizes meaningful conversations with customers and continuous career progression.

September 20 -

“Who’s to know when the economy may turn?” the head of the Alabama bank said in describing its weak business-loan growth as the byproduct of cautious pricing and underwriting.

September 13 -

Just before the end of summer, several major banks have put new faces in key executive positions.

September 6 -

Clara Green will head the Diversity and Inclusion Center of Expertise at the Alabama bank.

August 6 -

John Turner, who became CEO of the Alabama company this month, has promoted John Owen to COO. Its Turner’s second executive appointment this week.

July 26 -

Leroy Abrahams had previously served as president of the bank's North Central Alabama region.

July 23 -

Despite some green shoots in key credit segments, total loan growth was light at many banks last quarter. Rate hikes are threatened, and deposits will get pricier — where will the earnings come from?

July 20 -

The Birmingham, Ala., bank also saw lending decline in the quarter as strategic reductions in certain business lending lines offset gains in C&I and consumer.

July 20 -

Flagstar Bank raids Regions for its director of retail banking; prosecutors allege bank CEO got access to Trump in exchange for approving Paul Manafort mortgage; a potential turning point in fintech regulation; and more from this week's most-read stories.

July 13 -

Flagstar Bank, which is in the process of buying more than 50 branches from Wells Fargo, has hired Ryan Goldberg as a director of retail banking.

July 10 -

An inquiry into the sales practices of more than 40 banks launched in the wake of the Wells scandal found several systemic issues and hundreds of problems at individual institutions. The OCC completed the review in December but is not making the results public.

June 5 -

While industry officials welcomed a bulletin from the Office of the Comptroller of the Currency encouraging banks to develop alternatives to payday loans, they are making no commitments to offer such products.

May 24 -

Investments in analytics and a focus on courting midsize businesses have helped regional banks add non-interest-bearing deposits even as they struggle for other types of deposits. Can they keep it up as rates rise?

May 1 -

The Birmingham, Ala., company is also looking to bulk up in Atlanta, Houston, Memphis and Knoxville, Tenn.

April 30 -

Grayson Hall has served as CEO since 2010. He will leave the post in July but remain executive chairman through the end of the year.

April 25 -

After nearly two years of sputtering commercial loan growth, regional bankers are counting heavily on expanding their portfolios of personal loans and other types of consumer credit.

April 20 -

The regional bank's net income rose 37% thanks to those factors and others.

April 20