-

Brick-and-mortar merchants that have shifted to online have changed their risk profile, causing conflicts with the fintechs like Square that handle their payments. And that could be an opportunity for banks.

June 25 -

Borrower relief is necessary in a national emergency, but if the exclusion of the deferred loans from troubled-debt restructurings is extended past the end of the year, safety and soundness could be compromised.

June 25

-

Business continuity plans should be used constantly, not just when the crisis is at its peak, says the New York Fed’s head of financial services.

June 24 The Federal Reserve Bank of New York

The Federal Reserve Bank of New York -

The pandemic and the Black Lives Matter protests have changed the way banks interact with their customers, communities and employees. Here's how.

June 23 -

Square has begun holding onto a portion of some sellers’ payments, demonstrating how liquidity shortages challenge the recovery for both businesses and the companies that process their payments.

June 23 -

Consumers are parking their funds at financial institutions as lending slows and interest rates remain near zero, making it difficult for credit unions to deploy these deposits.

June 22 -

The Maryland company said the additions, including a former bank CEO, will strengthen its “overall operational and strategic management."

June 16 -

The agency flagged faulty risk management and other issues at the Federal Home Loan Bank of Des Moines and Federal Home Loan Bank of San Francisco in exams conducted last year.

June 15 -

The acting head of the agency says it cannot continue relying on web-based exams put in place during the coronavirus and will start sending staff into banks.

June 11

-

The Federal Housing Administration's move to insure loans with forbearance could help support homeownership opportunities constrained by the coronavirus if one change was made to it, trade groups said.

June 10 -

Credit unions have been encouraged to help members in a prudent and fair manner but that also means properly documenting the decision-making process.

June 8 ACES Risk Management

ACES Risk Management -

Prior to the outbreak, members were banned from covering their faces inside branches for security reasons. Now institutions must devise ways to keep everyone healthy and safe.

June 8 -

Past is not prologue, and a successful strategy for becoming a top-performing bank in 2020 is very different from what it might have been just six months ago.

June 5

-

Two years ago, the Tulsa, Okla., company expanded its Native American casino lending business nationwide. It seemed like a great plan until the coronavirus pandemic struck.

June 3 -

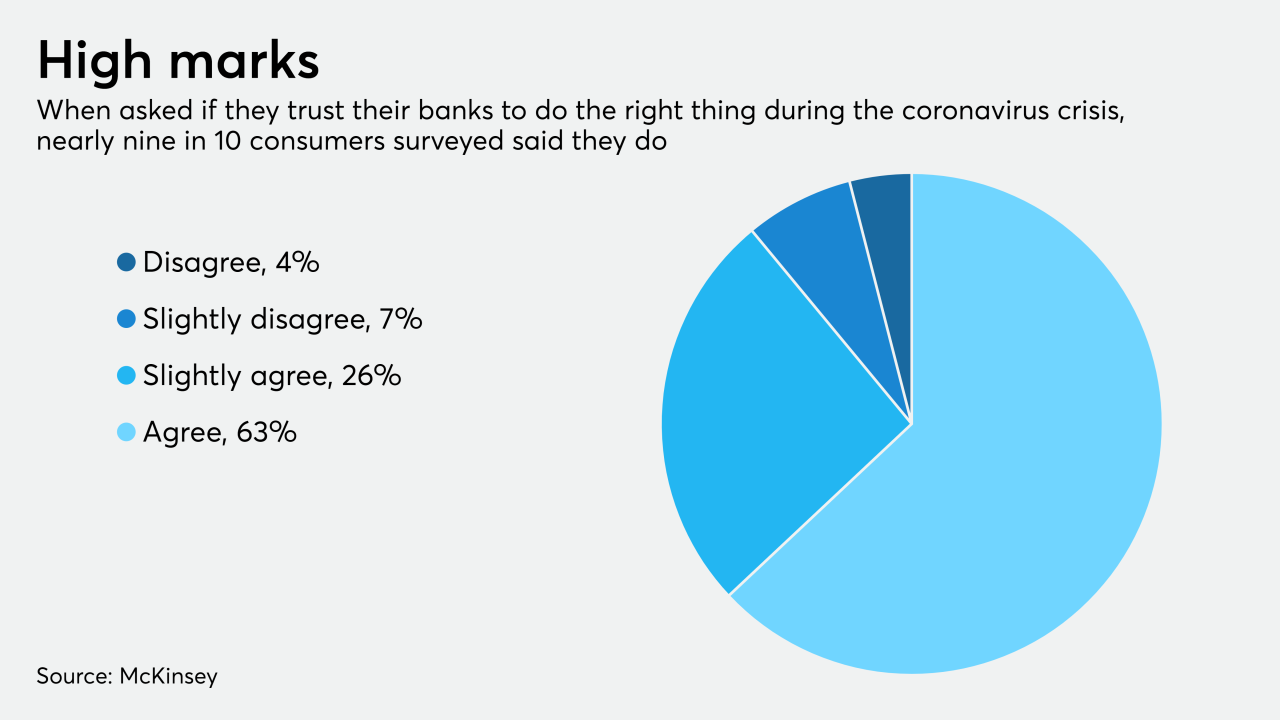

John Dugan says a successful effort by banks to alleviate the economic damage of the pandemic could boost the industry's reputation.

June 3 -

Periods of significant loan defaults are tough on banks and force unpleasant choices. Here are steps to evaluate collateral in such uncertain times.

June 1 Ludwig Advisors

Ludwig Advisors -

The takeaway from the PPP rollout is that bankers must protect their reputations and limit their risk appetites as they participate in further government-backed rescue programs.

May 29 -

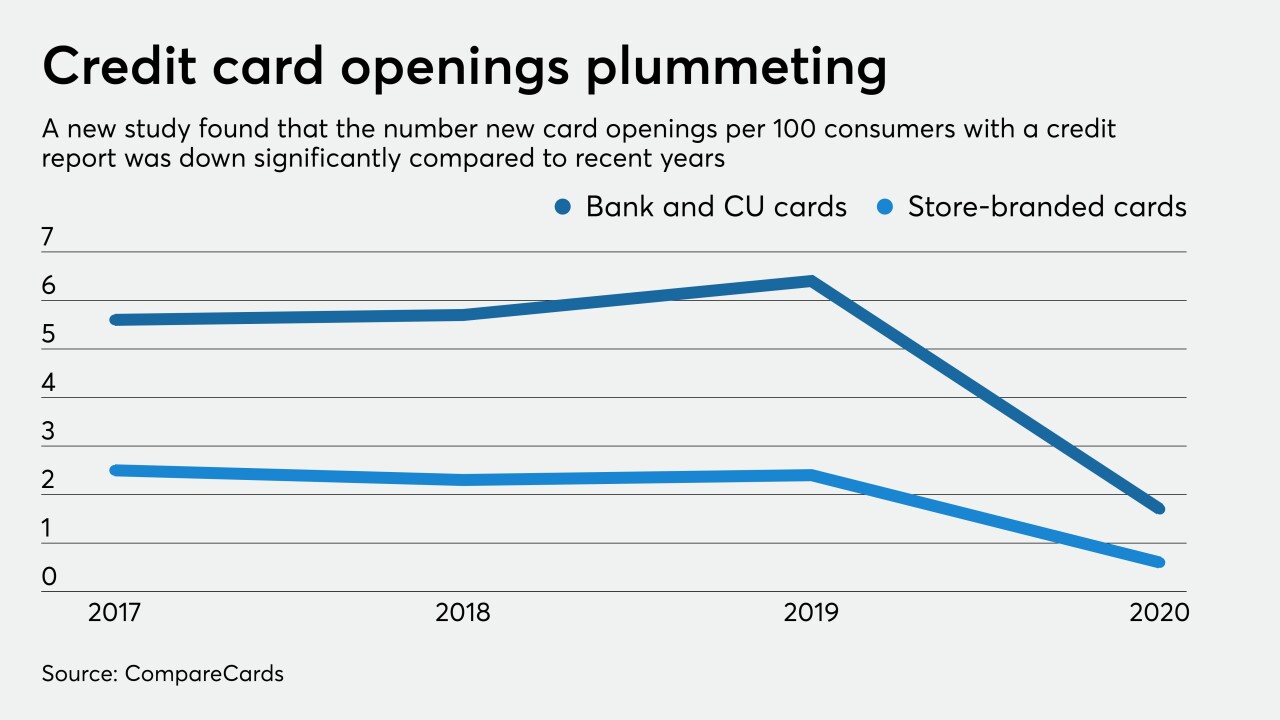

The drop is likely from both a decline in consumer demand and lenders becoming more cautious, according to CompareCards.

May 22 -

Lenders are scrambling to pause ranchers’ loan payments as meat processing plant shutdowns during the pandemic threaten $25 billion in losses for the livestock industry.

May 19 -

The regional wants to “play offense” with the proceeds of its $17 billion BlackRock stake; shares of some bank shares jumped 6% Thursday but remain well behind the rest of the market.

May 15