Tape, batteries and attaboys: A natural-disaster checklist for banks

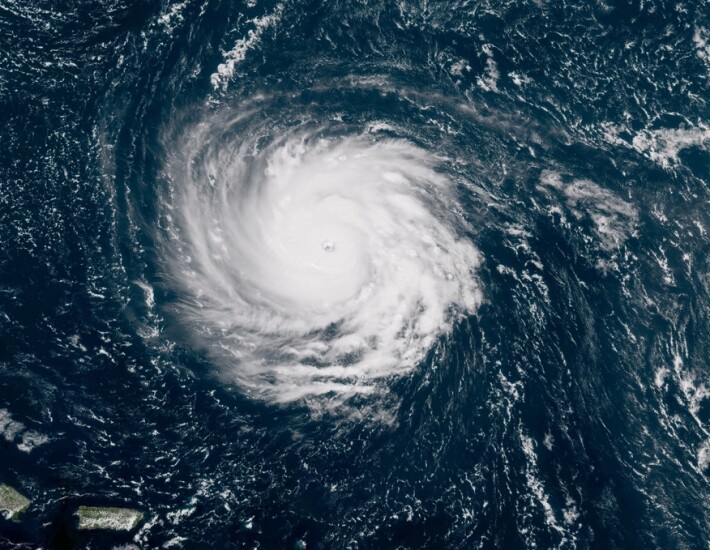

The storm, which the National Weather Service upgraded to Category 4 on Monday afternoon, could wreak havoc from South Carolina through the Mid-Atlantic. The National Weather Service warned that Florence “is expected to be an extremely dangerous major hurricane.”

Preparing for a storm can be challenging. For one, storms have varying characteristics. Last year hurricanes Irma and Maria delivered crippling winds that destroyed buildings and cut off communication, while Hurricane Harvey brought with it severe flooding that ravaged houses and knocked scores of branches out of commission.

Hurricane responses are also varied. The severity and longevity of a storm will determine how quickly branches reopen — if they ever reopen at all. Employee availability and customers’ needs will also differ based on the damage unleashed on a particular market.

Having an emergency preparedness plan is necessary for dealing with the aftermath of a storm. At the same time, bankers must also have a backup plan for their backup plan.

Bankers staring down Florence can learn from how others have responded to natural disasters. American Banker hosted a panel of bankers earlier this year — Bill Penney of Marine Bank & Trust, Beth Corum of Capital City Bank, Kyle Puchta of Regions Financial and Andy Lapierre of Frost Bank — who shared their lessons from last year’s hurricane season.

Six of those follow. Applying these lessons could put banks in better shape to respond to Florence and other types of disasters.

Distribute spare cellphone chargers

Take care of employees

Help clients make payroll

Educate customers in advance

Improvise

Regions’ first portable-branch customer — disappointed when his regular bank office remained closed — asked to open an account, something that caught employees off guard. Puchta, Regions’ vice president of incident response and workplace safety, said the company now has packets ready for future opportunities to bring on new customers.