-

Bankers have claimed that the Small Business Administration's procedures to counter fraud and improper lending have ensnared legitimate Paycheck Protection Program applications.

February 10 -

Banks and nonbanks are expected to vie for more commercial business this year, and nonbanks already have signaled a willingness to ease lending standards in order to win business.

February 9 -

The biggest U.S. banks reduced the portion of their collective balance sheets they’re dedicating to loans to a new low, extending a trend that’s seen the largest lenders put less and less of their firepower behind everyday borrowers.

February 8 -

On Sep. 30, 2020. Dollars in thousands.

February 8 -

Only 18% of businesses that received a Paycheck Protection Program or other loan from an online lender were satisfied with customer service, while 42% said they were dissatisfied. Banks, credit unions and CDFIs fared better in the Federal Reserve survey.

February 3 -

The Los Angeles company agreed to buy $105 million of loans and a servicing portfolio that covers another $295 million in originations.

February 3 -

Any business loan growth the industry sees this year will be closely tied to mass vaccination efforts and a broader economic recovery, meaning it may take until at least the third quarter for pent-up demand to translate into new opportunities.

February 3 -

The number of Paycheck Protection Program loans to U.S. small businesses more than doubled in the third week of the latest round of pandemic relief aid, as Bank of America and JPMorgan Chase each processed more than $1 billion in funding.

February 2 -

Long hours by bankers and the streamlined resolution of Paycheck Protection Program loans helped lenders collect more fees than anticipated in the fourth quarter. It was a rare bright spot at a time when revenue is being pinched.

February 2 -

The U.S. unit of Toronto-Dominion Bank merged its corporate and specialty team with its commercial banking group, putting the fast-growing operations under the same leadership.

February 1 -

A rule change that allows farms with just one employee tap the Paycheck Protection Program means more pandemic relief funds are flowing into such states as Nebraska, Oklahoma, Wyoming and North Dakota.

January 29 -

Businesses owned by minorities and women got a head start this week in a new round of $284 billion funding, and early anecdotal evidence suggests stronger demand coming from these businesses.

January 15 -

First Bank in New Jersey, Northeast Bank in Maine and others have warmed to the idea of using software to streamline Paycheck Protection Program lending so that employees can be more hands-on with customers.

January 13 -

The pace of forgiveness for Paycheck Protection Program loans is expected to accelerate when the Small Business Administration issues guidance on additional steps meant to streamline the process.

January 13 -

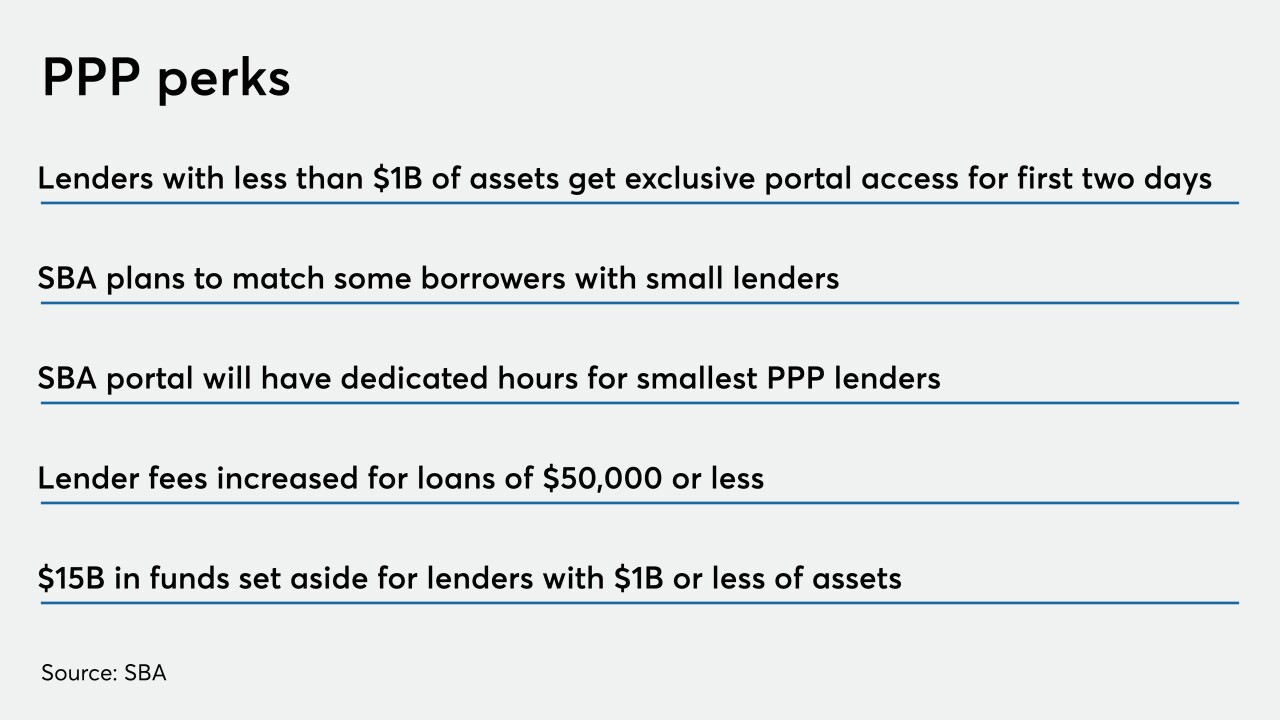

The Small Business Administration will allow lenders with less than $1 billion of assets to process applications in two days. The portal will open to all lenders on Tuesday.

January 13 -

Several community banks said they didn't have enough time to review the Paycheck Protection Program's application forms, forcing them to sit out Monday's reopening. The SBA is not saying when more lenders will be allowed to access its portal.

January 12 -

Bankers have several unanswered questions about the Paycheck Protection Program before it reopens to select lenders on Monday. Among them: When will forms be available, and which portal will the Small Business Administration use?

January 8 -

Community banks will have access to allocated funds and at least two days of exclusive portal access when the Small Business Administration relaunches the Paycheck Protection Program.

January 7 -

The Internal Revenue Service will allow businesses that got their Paycheck Protection Program loans forgiven to write off expenses paid for with that money, shifting policy after Congress passed new legislation last month.

January 6 -

Brian Argrett, whose City First Bank is being sold to Los Angeles-based Broadway Financial, would take the helm of the combined company at a time of increased national interest in reinvigorating minority-owned financial institutions.

January 4