-

Since stepping down as CEO of Webster Bank last month, James Smith has spent much of his time co-chairing a panel tasked with solving his home state’s fiscal and economic woes. Banks, and perhaps even fintechs, could be a part of its comeback story, he says.

February 26 -

A community group has secured a grant from the W.K. Kellogg Foundation to probe banks’ small-business lending practices. It follows a 2017 pilot study in which the group found that white shoppers posing as business owners were three times more likely to be invited for follow-up appointments than their black counterparts and twice as likely to be offered help in completing loan applications.

February 21 -

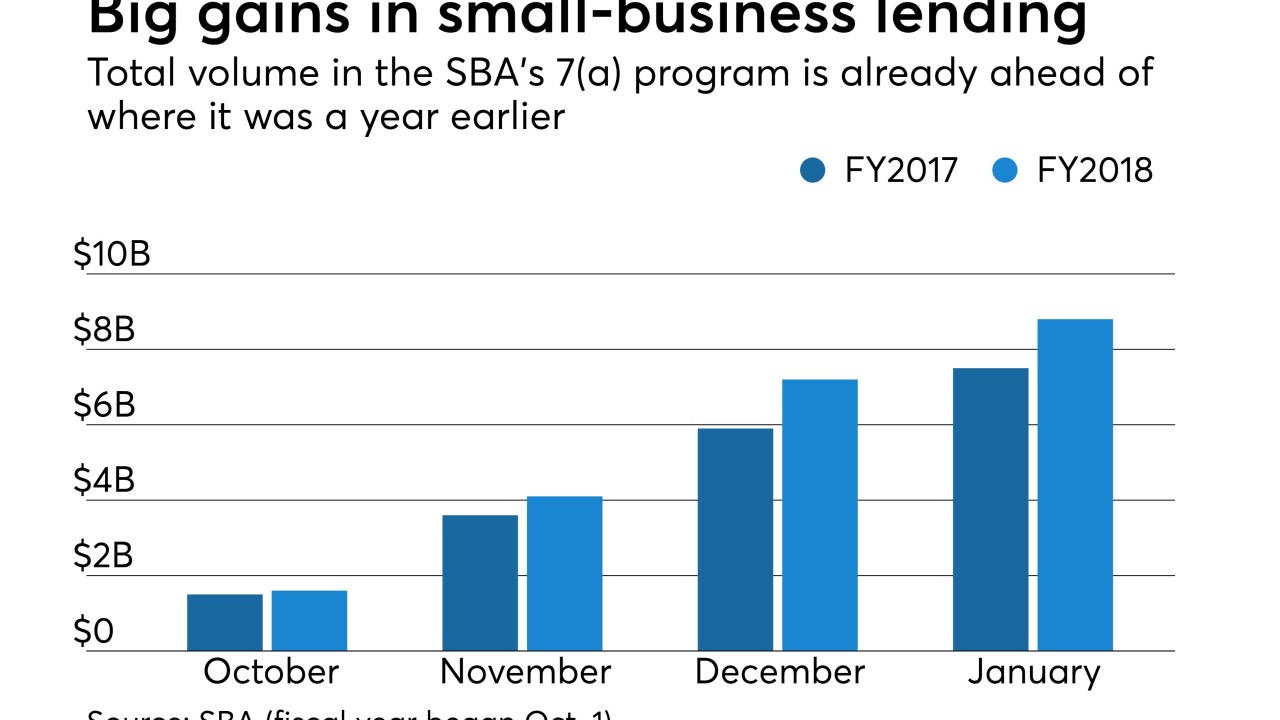

It’s too soon to gauge the true impact of recent tax cuts on loan demand, but anecdotes from bankers suggest that, after months of stagnation, pipelines are filling up again.

February 14 -

The online small-business lender is enjoying a payoff from its year-old push to cut costs and tighten underwriting standards. It is also set to announce another lending agreement with a major bank this year, its CEO said Tuesday.

February 13 -

Neptune Financial plans to use technology to improve the efficiency in making loans to companies with $10 million to $100 million in annual revenue.

February 13 -

Marquette Bank is proof that community banks don't have to be the fastest or flashiest to compete with online lenders. Instead, the Chicago bank closely mirrored fintech offerings while promoting personal service to set itself apart.

February 8 -

Patriot National in Connecticut planned to build a regional small-business lending operation on its own — until it had a chance to buy a national platform.

February 7 -

Patriot National in Connecticut would become the latest community bank to ramp up small-business lending with its $81 million deal to acquire Hana Financial's much larger SBA lending unit.

February 6 -

Its small, locally owned banks were as decimated after the crisis as in any big city. But community bankers say changes to the economy and their lending practices offer them a shot at challenging the big banks that dominate their market.

February 6 -

Credit standards for commercial loans to medium and large firms showed some signs of easing over the last three months of 2017, even though demand stayed relatively unchanged.

February 5 -

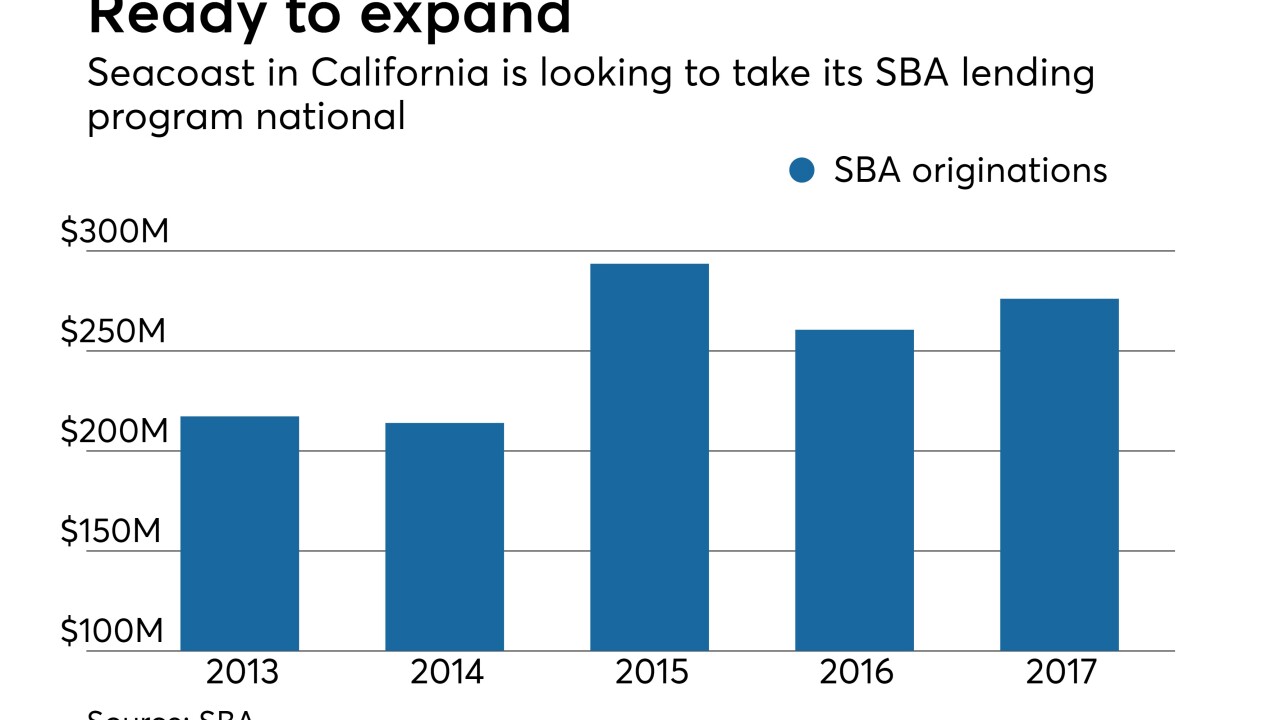

Seacoast Commerce is San Diego is already one of the biggest Small Business Administration lenders — half the loans on its books are tied to SBA programs. But will its underwriting hold up outside its traditional markets?

February 2 -

The tool runs the numbers and tells small-business people if they would qualify for an SBA loan, and if not, what they need to do to become eligible.

January 31 -

The cloud-based vendor was formerly a division of Live Oak Bank.

January 31 -

The credit union’s members want products to help with cash flow, working capital and business expansion

January 30 -

The online lender to small businesses is expanding its business deeper into traditional banks’ territory with larger loans.

January 30 -

The proposed legislation would give the agency authority to increase funding for the 7(a) program — with several caveats designed to manage exposure.

January 26 -

The proposed legislation would give the agency authority to increase funding for the 7(a) program — with several caveats designed to manage exposure.

January 26 -

StreetShares seeks to tap into the loyalties of military veterans, bringing together borrowers and savers through an online platform.

January 24 -

The online lender is integrating itself with several popular software programs to provide lending as a service. It’s an open-banking road map for skeptical banks.

January 22 -

The Minneapolis bank is the first bank to join Community Reinvestment Fund's online service that matches small-business borrowers who don’t qualify for bank loans with community development financial institutions.

January 8