-

Patriot National in Connecticut would become the latest community bank to ramp up small-business lending with its $81 million deal to acquire Hana Financial's much larger SBA lending unit.

February 6 -

Its small, locally owned banks were as decimated after the crisis as in any big city. But community bankers say changes to the economy and their lending practices offer them a shot at challenging the big banks that dominate their market.

February 6 -

Credit standards for commercial loans to medium and large firms showed some signs of easing over the last three months of 2017, even though demand stayed relatively unchanged.

February 5 -

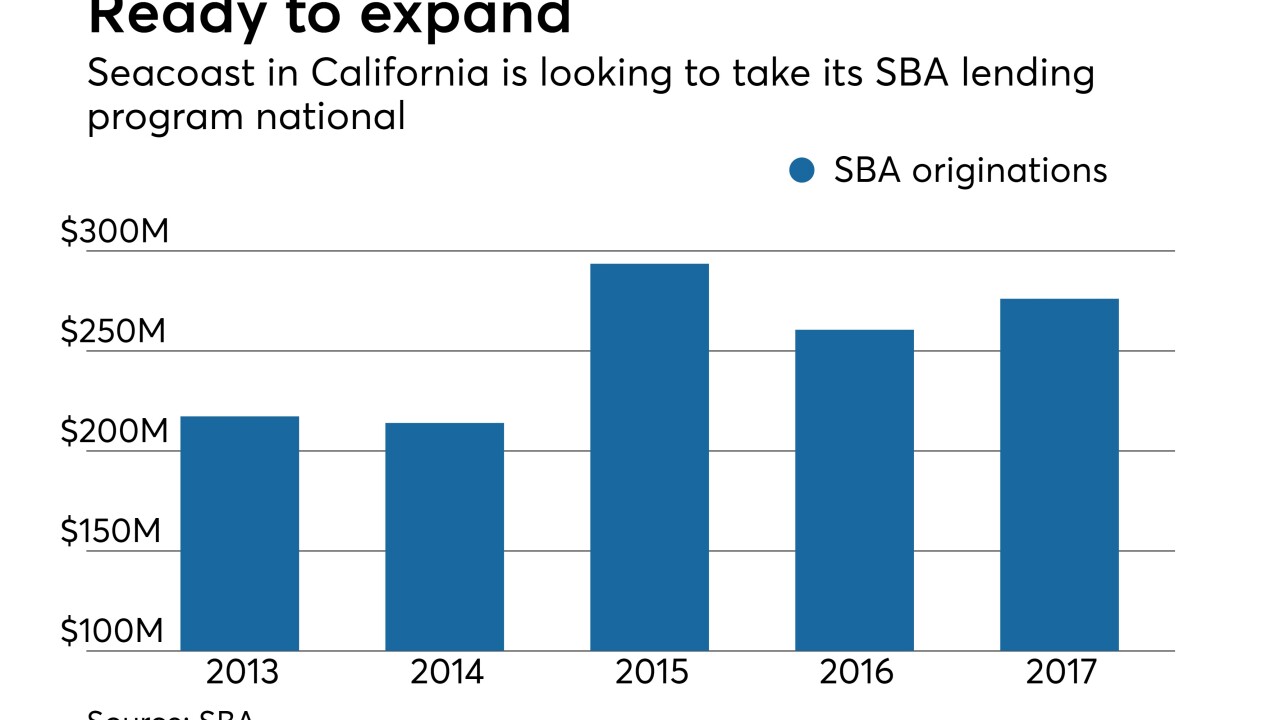

Seacoast Commerce is San Diego is already one of the biggest Small Business Administration lenders — half the loans on its books are tied to SBA programs. But will its underwriting hold up outside its traditional markets?

February 2 -

The tool runs the numbers and tells small-business people if they would qualify for an SBA loan, and if not, what they need to do to become eligible.

January 31 -

The cloud-based vendor was formerly a division of Live Oak Bank.

January 31 -

The credit union’s members want products to help with cash flow, working capital and business expansion

January 30 -

The online lender to small businesses is expanding its business deeper into traditional banks’ territory with larger loans.

January 30 -

The proposed legislation would give the agency authority to increase funding for the 7(a) program — with several caveats designed to manage exposure.

January 26 -

The proposed legislation would give the agency authority to increase funding for the 7(a) program — with several caveats designed to manage exposure.

January 26