-

Fintechs sought to acquire the rights and privileges of bank charters in various ways this year, from de novo applications to buying up banks.

December 31 -

The Mortgage Bankers Association is examining the data to see if the high ratio warrants a new push for a premium cut but said rising arrears call for caution.

December 31 -

Visa and Mastercard logged increases in holiday spending, an industry group called for increased BNPL regulation in the U.S., and more in this week's global payments roundup.

December 31 -

Conditional approval of a national bank charter used to be a virtual guarantee that an institution would open its doors. But the OCC's recent treatment of Erebor Bank suggests that banks with conditional approvals still have work to do.

December 31

-

When Congress returns from its recess in 2026, a number of financial legislative issues will be teed up, including crypto market structure, deposit insurance and supervisory disputes.

December 31 -

New Jersey-based OceanFirst Financial slid in its planned $579 million acquisition of Flushing Financial just before the end of the year. The private equity firm Warburg Pincus is also participating in the transaction.

December 30 -

Credit unions hit new highs in membership, deposits and loans in 2025. But it was also a chaotic year for the industry's governing body, and the sector faced renewed attacks by banks.

December 30 -

U.S. District Judge Amy Berman Jackson said the administration must request funds from the Federal Reserve, rejecting a Trump DOJ legal theory.

December 30 -

The year was marked with six state regulations, new entrants, product and market expansion from existing EWA providers and buy-in from investors.

December 30 -

The fintech IPO drought ended this year with several large public exits by firms such as Chime, Klarna and Circle.

December 30 -

There is a narrow window of opportunity for banks to position tokenized deposits as an alternative to stablecoins for customers seeking the convenience of cheap, blockchain-enabled payments.

December 30

-

As stablecoins become an increasingly prominent feature of the financial landscape, Noelle Acheson gives us her top five trends to watch out for.

December 30 -

-

It's not just Capital One Cafés; banks all over the country are repurposing branches and offices. Marketing experts call it innovative, but critics say some lenders are crossing a legal boundary between banking and commerce.

December 30 -

Under a proposed rule, the agency would let most nationally chartered firms off the hook for heightened regulatory standards. The rule would raise the bar from $50 billion to $700 billion of assets and leave only eight firms subject to heightened regulation.

December 29 -

Stories about data breaches, fraud and one neobank were reader favorites this year.

December 29 -

The Federal Reserve is slated to undertake a number of important rules and regulations in 2026, but decisions around agency leadership and the Trump administration's avowed effort to exert greater control over the central bank are likely to leave a lasting legacy at the agency.

December 29 -

National ad campaigns are impressive. But few things create more goodwill or lasting impact than visible, hands-on support of a community's youth, no matter the size of the bank.

December 29

-

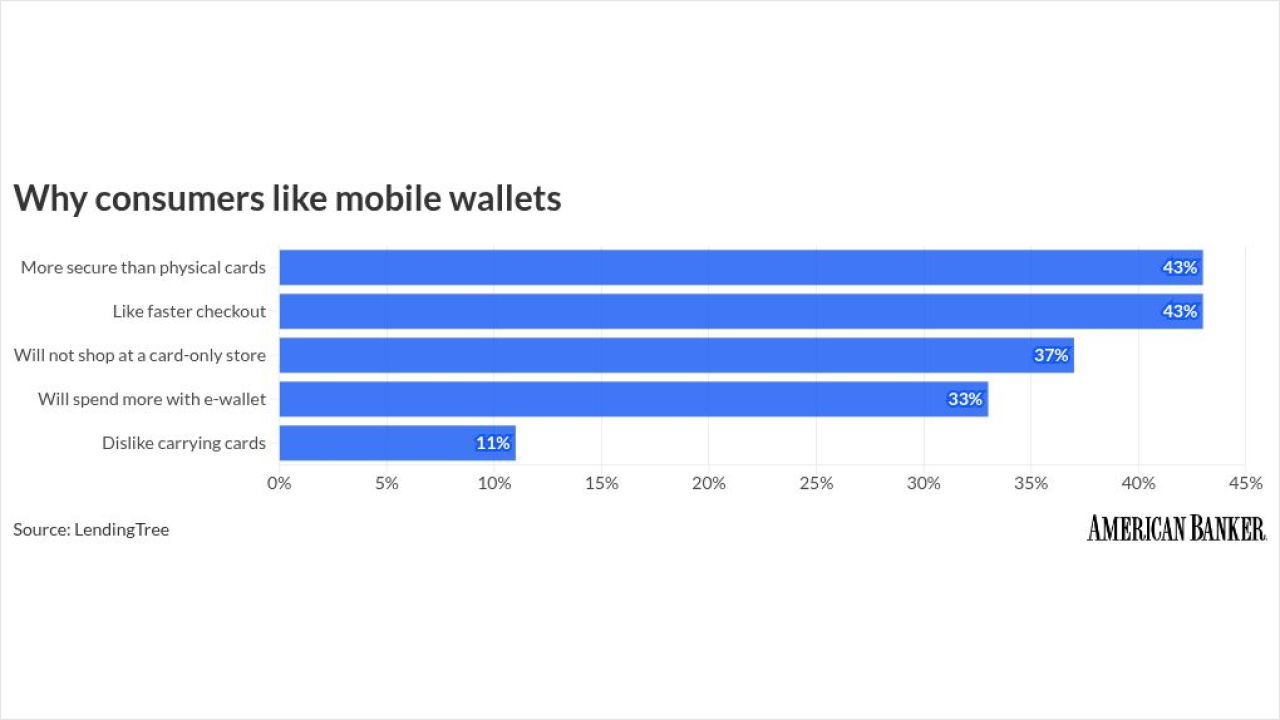

Consumer appetite for mobile wallets is growing, challenging banks to innovate to stay ahead.

December 29 -

As commissioner of Virginia's Bureau of Financial Institutions since 1997, Joe Face emphasized strengthening the dual banking system.

December 29