-

Why banks want in on Google checking accounts; readying new tech tools to tackle anticipated rise in delinquencies; more institutions opt to sell PPP loans as heavy lifting nears; and more from this week’s most-read stories.

August 7 -

On Mar. 31, 2020. Dollars in thousands.

June 15 -

On Dec. 31, 2019. Dollars in thousands.

March 23 -

Members of the House Small Business Committee expressed concerns to SBA Administrator Jovita Carranza that the rule could harm poultry farmers.

February 26 -

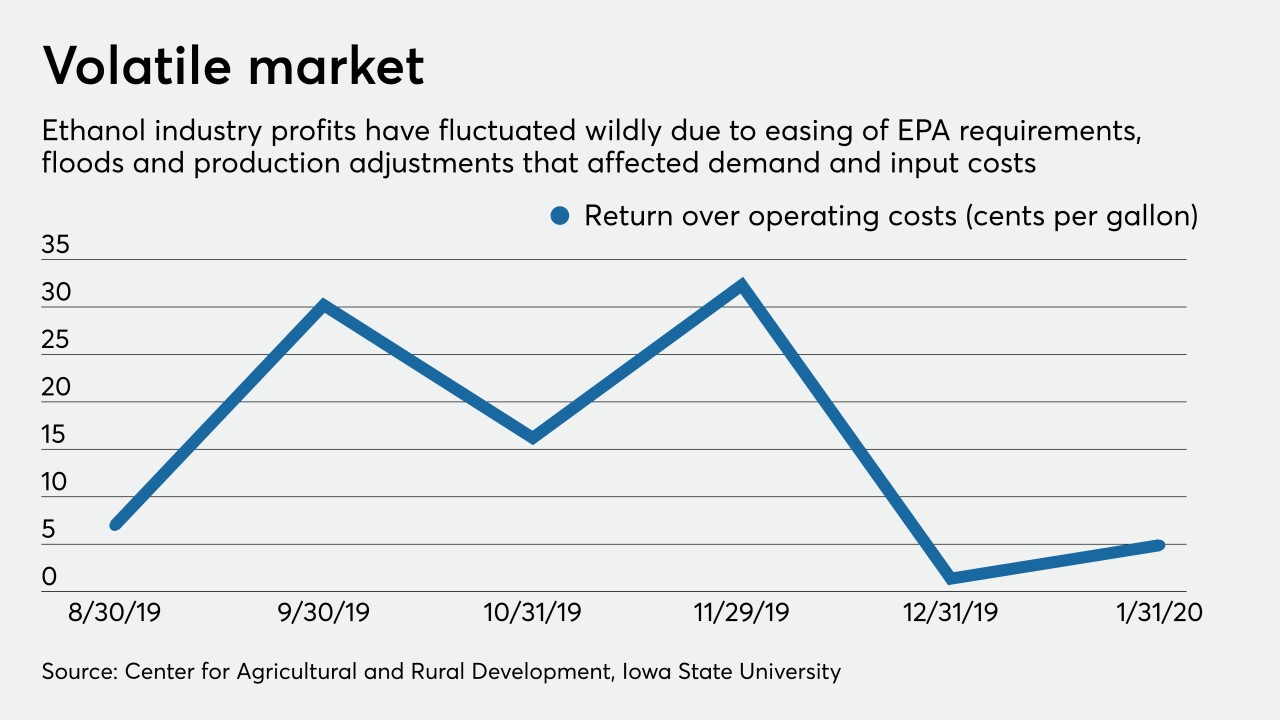

Ag lenders say the Trump administration’s waivers for oil refineries threaten another source of revenue for corn growers and ethanol makers.

February 12 -

Ken Karels will be succeeded by Mark Borrecco, who had been CEO of Rabobank's U.S. bank.

February 11 -

To guard against headwinds in the agricultural sector, the Federal Deposit Insurance Corp. recommended that institutions consider the “overall financial status” of farm loan borrowers.

January 28 -

On Sep. 30, 2019. Dollars in thousands.

December 16 -

The percentage of farm lenders losing money hit a six-year high in the third quarter, according to the FDIC.

December 5 -

So far farm loans are holding up well, but bankers gathered at an industry conference this week said they are growing increasingly concerned that credit quality will weaken if the U.S. and China don’t reach a deal soon.

November 12 -

Maine Harvest Federal Credit Union, which will serve farmers and the food industry, opened this week and aims to make $12 million in loans over the next six years.

October 9 -

On Jun. 30, 2019. Dollars in thousands.

September 16 -

Banks are taking back more farmland through foreclosure than at any point in the past three years as low crop prices, epic flooding and the Trump administration’s trade spat with China have left many farmers struggling to pay their debts.

September 11 -

The Unity, Maine-based institution, which should open in the fall, will provide member business loans and other products to local farmers.

August 23 -

President Trump is expected to sign legislation soon that would expand the number of farmers who could file under the more lenient Chapter 12. Ag lenders are worried because farm bankruptcies recently rose and the trade war with China could worsen.

August 11 -

Growers Edge is adapting retail financial technology to compete with traditional banks in ag lending and crop insurance.

August 8 -

County Bancorp is a small dairy lender in Wisconsin with an exposure to milk prices, and Bank OZK is a larger bank in Arkansas coping with out-of-market real estate trends. Their stories show how market sensitivities can vex specialists.

July 19 -

America's farms have taken on near-record levels of debt in recent years, and commodity prices and trade wars are putting pressure on farm country. That could spell bad news for bankers that lend to them.

July 18 -

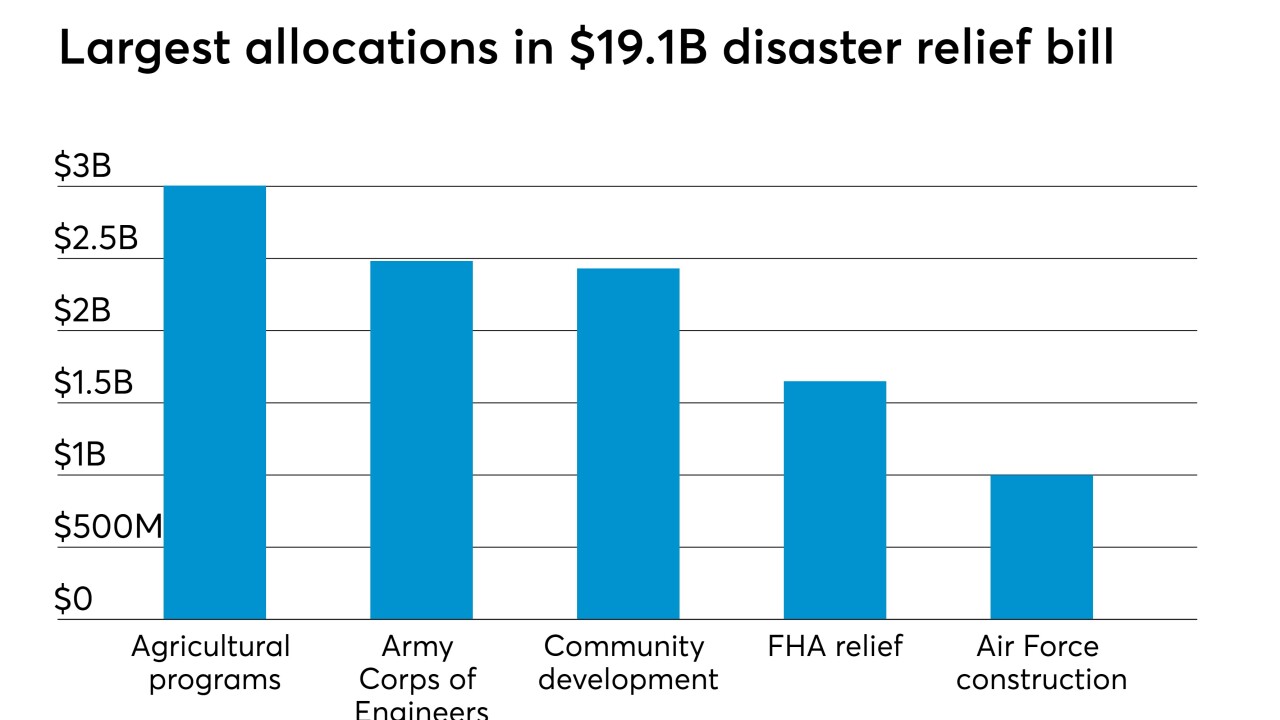

A $19.1 billion aid package signed into law earlier this month is welcome news for credit unions in Nebraska and a host of other regions that have suffered from recent natural disasters.

June 18 -

On Mar. 31, 2019. Dollars in thousands.

June 17