-

Readers react to Capital One's massive data breach and The Bancorp's expansion in CRE securitizations, defend fintechs offering retirement plans and more.

August 1 -

The bill, similar to legislation that passed the chamber last year, would permit the inclusion of items such as rent and telecom payments to help consumers build their credit profiles.

July 25 -

A study by FinRegLab of six nonbank lenders' use of cash-flow data in underwriting decisions finds this type of "alternative data" helps predict loan performance.

July 25 -

Since last fall, when the value of digital money plummeted, lenders have been pushing people who have paper profits to leverage them into cash by borrowing against their cryptocurrencies. And the fact that there's no tax bill on the transactions is a big selling point.

April 2 -

Some fintechs have figured out how to provide international students and immigrants with credit cards and loans. Machine learning makes the underwriting possible.

March 31 -

The tricky part: raising awareness without appearing to take advantage of borrowers at a time when agencies like the SBA are out of commission.

January 11 -

One bank's push to use Ripple's XRP in cross-border payments; LendUp spins off credit card business, names new CEO; a worrisome resurgence of rivalry among the banking agencies; and more from this week's most-read stories.

January 11 -

CU*Answers is working with VantageScore, and now its institutions will be able to get additional information on members' credit history.

December 7 -

A paper released by the agency’s Center for Financial Research says aspects of someone’s digital footprint — including whether they use Apple or Android — help predict likelihood of default.

October 4 -

Allowing alternative data such as rent and utility payments has bipartisan support, but some say it could create more problems than it solves.

July 30 -

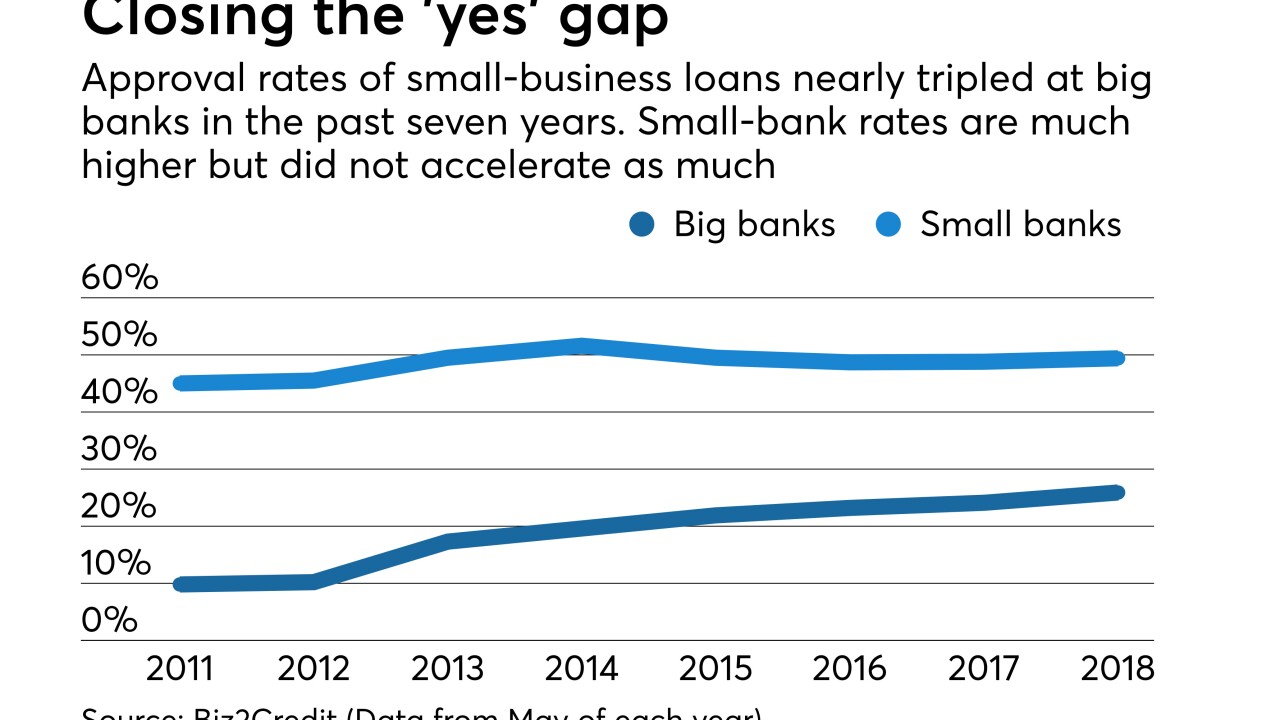

Approval rates for small-business loan applications were up at small and larger financial institutions as the labor market continued to improve.

June 15 -

Cereal is looking at the aspects of the market that could be considered the most stable. By encouraging more mining activity, Cereal also promotes the viability of the cryptocurrencies being mined.

June 5 -

For one California bank, the biggest challenge was finding equity investors to participate in deals.

April 30 -

Some fear that the removal of such data from individual credit reports could lead lenders to believe a consumer is a better bet than they really are.

April 2 -

The digitally savvy lender MyBucks, which has lent money through a smartphone app and chatbots on WhatsApp and Facebook Messenger, could be a good role model for U.S. banks thinking of using AI in credit decisions.

December 28 -

BankMobile, the digital-only subsidiary of Customers Bank in Wyomissing, Pa., is planning to use software by Upstart to offer its first credit product to graduates and other young consumers with little to no credit history.

December 20 -

Lenders on the fringe of the financial industry are now pitching a solution to bitcoin investors in need of funds but wary of cashing in: loans using a digital hoard as collateral.

December 14 -

The risk to Canada's financial system from tapped-out borrowers is merely shifting — this time to a market where there's no oversight from the country's national bank regulator and new stress-test rules don't apply.

December 13 -

The Consumer Financial Protection Bureau issued its first "no-action letter" to an online lender that uses alternative data to determine creditworthiness and loan pricing.

September 14 -

Bank earnings rose nearly 11% in the second quarter, according to the FDIC; Goldman lobbying to kill or weaken the rule to boost its bond trading performance.

August 23