-

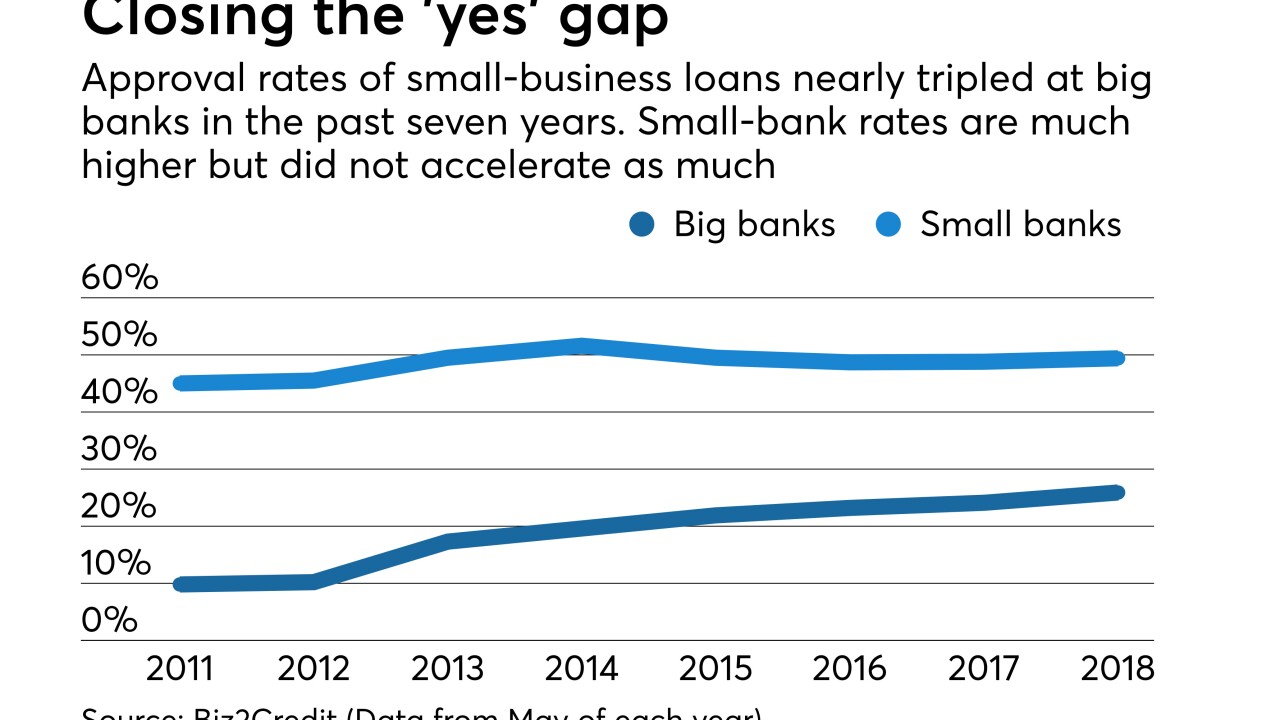

Approval rates for small-business loan applications were up at small and larger financial institutions as the labor market continued to improve.

June 15 -

Cereal is looking at the aspects of the market that could be considered the most stable. By encouraging more mining activity, Cereal also promotes the viability of the cryptocurrencies being mined.

June 5 -

For one California bank, the biggest challenge was finding equity investors to participate in deals.

April 30 -

Some fear that the removal of such data from individual credit reports could lead lenders to believe a consumer is a better bet than they really are.

April 2 -

The digitally savvy lender MyBucks, which has lent money through a smartphone app and chatbots on WhatsApp and Facebook Messenger, could be a good role model for U.S. banks thinking of using AI in credit decisions.

December 28 -

BankMobile, the digital-only subsidiary of Customers Bank in Wyomissing, Pa., is planning to use software by Upstart to offer its first credit product to graduates and other young consumers with little to no credit history.

December 20 -

Lenders on the fringe of the financial industry are now pitching a solution to bitcoin investors in need of funds but wary of cashing in: loans using a digital hoard as collateral.

December 14 -

The risk to Canada's financial system from tapped-out borrowers is merely shifting — this time to a market where there's no oversight from the country's national bank regulator and new stress-test rules don't apply.

December 13 -

The Consumer Financial Protection Bureau issued its first "no-action letter" to an online lender that uses alternative data to determine creditworthiness and loan pricing.

September 14 -

Bank earnings rose nearly 11% in the second quarter, according to the FDIC; Goldman lobbying to kill or weaken the rule to boost its bond trading performance.

August 23 -

Working with Sungage Financial will help NBT Bancorp diversify its consumer loan portfolio and learn from a fintech startup with a speedy credit approval process.

July 13 -

Readers this week highlighted the need for banks to upgrade payments systems, debated a small bank’s decision to ditch its legacy core vendor, lamented populist initiatives of the GSEs, and more.

July 7 -

The promise of fintech is that it might offer underbanked consumers access to financial products. But some are worried that relying on algorithms to make credit decisions could open up problems of its own.

June 30 -

Dan O'Malley, who until very recently ran the fintech incubator at Eastern Bank (and before that was at Capital One), now has a startup called Numerated Growth Technologies and software that he says can process loans in five minutes.

June 13 -

Bill would replace much of Dodd-Frank but is unlikely to become law; online retailer is expected to expand Amazon Lending program to small businesses in the U.S., U.K. and Japan.

June 8 -

More business lending is shifting from banks to "murky" trusts as the government imposes more restrictions to reduce risky loans; 11 states advance suit as Justice Department retreats.

June 5 -

Fed Gov. Jerome Powell says central bank will provide more information to banks about how it conducts annual tests; bank CTO discusses its 2018 blockchain test.

June 2 -

Online lenders are evading New York regulations by claiming their loans are “made” by federally chartered or out-of-state partner banks, Department of Financial Services Superintendent Maria Vullo told lawmakers Monday.

May 22 -

Archaic regulatory frameworks are curbing progress in fintech. We must modernize our rules so they address an internet- or mobile-based economy.

March 24 Georgetown University Law Center

Georgetown University Law Center -

Banks are losing wealthier underbanked customers to alternative lenders — an undercurrent that is halting progress in expanding credit access for all.

March 17 Aite Group

Aite Group