Artificial intelligence

Artificial intelligence

-

Amazon's voice assistant will soon be in cars and even microwaves, but banks have not yet proven to customers they can serve them with conversational tech.

September 21 -

AI and blockchain technology are going to change the financial services business. How much? Steve Brown, aka "The Bald Futurist" suspects you're underestimating.

September 19 -

An AI-powered virtual assistant could be used in a variety of ways, including helping customers to prequalify for mortgages, easing compliance and detecting problems.

September 18 -

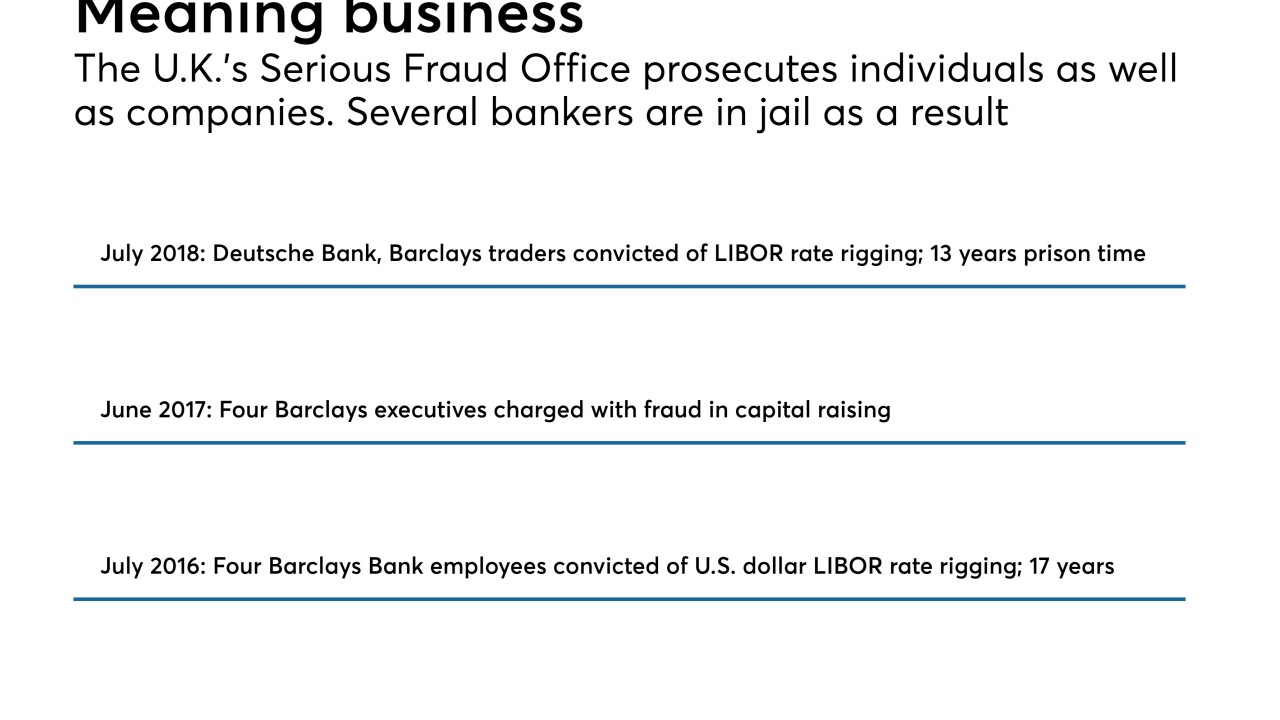

The U.K.'s Serious Fraud Office employs software that can read discovery documents about 2,000 times faster than human lawyers and can find previously unknown patterns between people, enabling quicker investigations and penalties.

September 17 -

Concentration risk, threats to data privacy and the potential for discrimination are among the unintended consequences of letting fintechs and tech giants dabble in financial services without bank-like regulation, an expert says.

September 6 -

The agencies are looking into firm's forex pricing; the Fed is accused of stalling on a novel banking idea.

September 6 -

It is critical that banks blend data science and their industry knowledge to better identify and mitigate compliance risk, says a director at Promontory Financial Group.

September 5 -

Venture capitalist Spiros Margaris talks about which regions are leading in fintech and AI; Byron Reese, CEO of GigaOm, discusses his new book about AI.

September 4 -

A recent editing snafu illustrates an important lesson for credit unions using AI and machine learning.

August 27 -

The forum, which is best known for its annual Davos economic conference, offers insights on what many get wrong about artificial intelligence and how banks should be thinking about using it.

August 26 -

KeyBank will deploy Mastercard's advanced transaction decisioning technology, boosting the card network's push into artificial intelligence-powered authorization.

August 24 -

Citigroup was so impressed with a test drive of AI software it invested in its maker; the FBI's warning of a cyberattack targeting ATMs came to pass — expect more to come; debating whether state AGs can serve as de facto CFPBs; and more from this week's most-read stories.

August 24 -

The 100 dismissals in asset management follow job cuts in other divisions; the agency cites the lack of protections against fraud and market manipulation.

August 23 -

Citigroup was so impressed after a two-year test drive of software from the AI vendor Anaconda it decided to invest in the firm.

August 20 -

Financial institutions are hoping to get ahead of the growing and seemingly insurmountable problem of payment card fraud not just by looking at who cyber-attackers are going after currently but who they are likely to defraud in the near future.

August 17 -

The bank is working with SpringFour and Genivity, two graduates of its mentorship program, and plans more such partnerships.

August 17 -

IBM claims that by monitoring customer behavior first and foremost, banks can make suspicious activity reporting far more accurate.

August 16 -

Proximity to the client is crucial. Only by understanding your client’s perspective on AI can you deliver a project that is truly worthwhile, writes Naomi Bowman, managing director at Berkeley Research Group.

August 15 -

Bci Miami is one of the first banks in the U.S. to publicly acknowledge using AI this way, when many still consider the technology to be new, risky and unsanctioned by regulators.

August 9 -

Voice assistants impress at tech demos, but new research shows bank customers aren't ready to ask a speaker about their accounts just yet.

August 8