-

The technology platform powerhouse is betting on integration, but competitors eye disruption.

May 15 -

A need for risk-focused data aggregation and analytics tools is at the heart of IBM's latest acquisition for its bank consulting portfolio.

May 15 -

Regalii has changed its name to arcus and switched from cross-border bill payment to helping banks use tokenization to reissue lost, stolen or breached cards.

May 15 -

Fair Square Financial has received a $100 million equity investment from the Orogen Group to fund a credit card designed for underserved U.S. consumer segments.

May 14 -

As more consumer data is shared across banks, fintechs and data aggregators, the industry is asking for regulators to step in with better guidance.

May 11 -

It can be difficult for financial services companies to glean customer insights from the abundance of information they have.

May 11 -

The bank is using AI in its chatbot, in trading and other areas. It also has concerns about the potential for bias to creep into the software.

May 11 -

A new set of principles by Envestnet’s Yodlee, Quovo and Morningstar's ByAllAccounts aims to settle a much-debated issue in data sharing: which party is liable when a hack occurs.

May 10 -

The move is part of a larger trend to provide enterprise customers with tech capabilities available to retail customers.

May 9 -

Manuela Veloso, head of the machine learning department at Carnegie Mellon University, will join the bank in July.

May 9 -

Citigroup, Synchrony and other banks are using so-called "journey analytics" to spot weaknesses along the entirety of a customer's interactions with the bank.

May 9 -

The program has expanded to seek startups in Chicago and Wisconsin for mentoring and potential partnerships.

May 8 -

More than 1 million jobs will be lost to AI by 2030, according to one estimate. But new jobs are also being created. Are banks and their employees ready?

May 7 -

More than 1 million jobs will be lost to AI by 2030, according to one estimate. But new jobs are also being created. Are banks and their employees ready?

May 7 -

Onboarding technology isn't enough if the account opening process is too cumbersome, a J.D. Power survey finds.

May 4 -

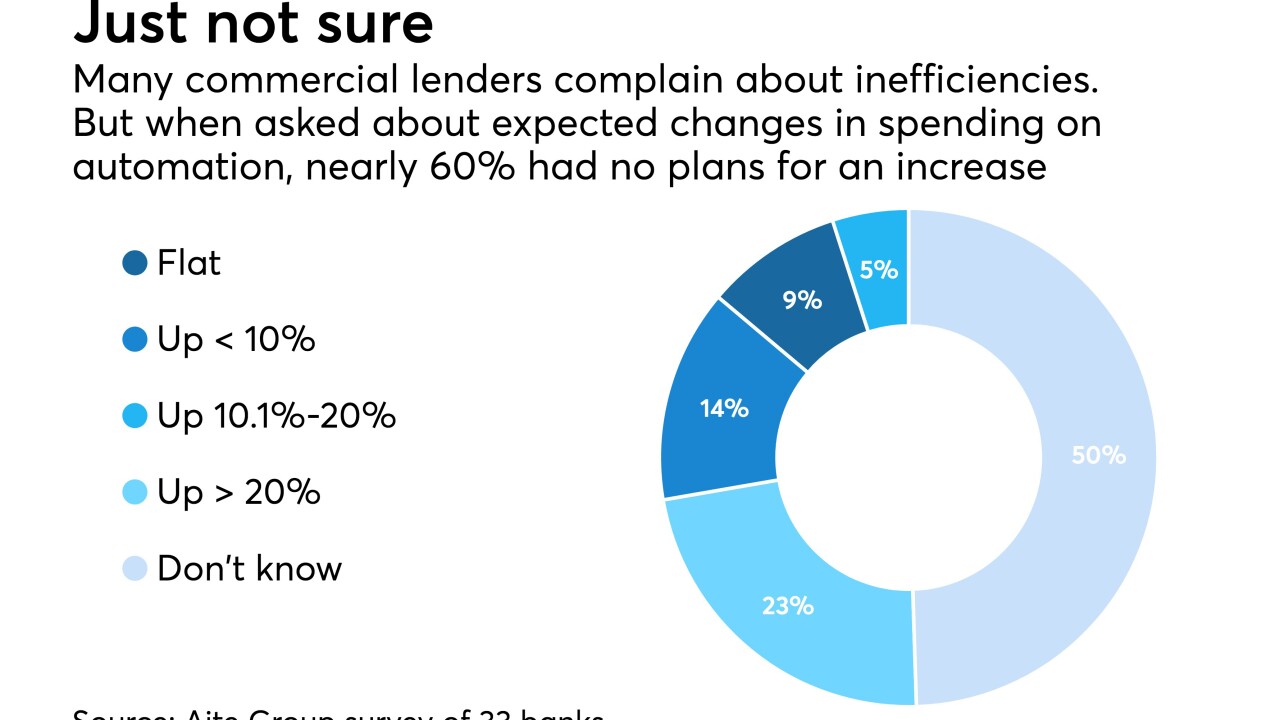

A bank that can deliver a loan decision a little faster, or ask a client to input information just once, could get a leg up on the competition. But some executives are skeptical of software sales pitches and fear overpaying.

May 3 -

Leader Bank says it can land property managers as commercial clients by helping them handle tenant deposits — and possibly create opportunities to boost CRE lending.

May 3 -

The fintech wants to facilitate loans for elective surgeries, auto repairs and jewelry purchases, but regulatory uncertainty — at the state and federal levels — casts a cloud over its business model.

May 2 -

Prometheum wants to win the SEC’s approval of its own token offering, paving the way for others shortly afterward.

May 2 -

The investment bank has asked Rob Rooney, an executive who wore multiple hats at the company, to focus full time on the data-oriented strategy he has devised for its wealth management, capital markets and other functions.

May 1