-

Bryan Sullivan, the CFO at LoanDepot, talks about its growth prospects without fuel from an initial public offering, how getting consumers to opt for home equity lines of credit is tough, and why he considers the nonbank a disruptor.

November 24 -

Quicken Loans, the company that showed a mortgage business can operate successfully without face-to-face interaction with borrowers, is now giving customers the option to work without human loan officers.

November 24 -

On the first day Citizens Financial started financing iPhones it made more new loans than any bank ever did on one day, the head of the companys consumer lending said.

November 24 -

The rapid growth of competition from nonbanks has the potential to hit community banks harder than the mortgage meltdown.

November 24

-

The goal of adopting chip cards to provide tighter security is a noble one. But by going partway, authorizing transactions with signatures rather than four-digit codes, banks are watering down that security, at least for lost and stolen cards.

November 23 -

Diebold and Wincor Nixdorf which plan to merge under the name "Diebold Nixdorf" were already in the midst of major projects to digitize bank branches and retail stores before the pressure from mobile devices led them to join forces to keep pace with innovation.

November 23 -

The proliferation of easy-to-use analytics tools has allowed community banks to do what used to take teams of quants to accomplish. Some are using it to get an edge in M&A, others are using it to improve efficiency.

November 23 -

As shopping goes digital, so does fraud. The rise in technology at shoppers' fingertips provides many new channels for scammers to exploit, often leaving banks holding the bag.

November 23 -

Diebold Inc. agreed to buy German rival Wincor Nixdorf AG for about 1.8 billion euros ($1.9 billion) to create the biggest maker of cash machines and security systems with more than $5 billion in sales.

November 23 -

With the outlook for mobile payments improving, American Express has brought together several initiatives in this area under a new umbrella dubbed Amex Enabled Digital Solution.

November 20 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

November 20 -

Forward-thinking companies could get a reputation lift from being first out of the gate with interesting apps. Banks could also be first to help protect customers from the inevitable privacy leaks that the IoT will make possible.

November 19 -

The New York Department of Financial Services' letter indicating potential cyber rules are prompting concerns that the state's plans could lead to more stringent measures throughout the industry.

November 18 -

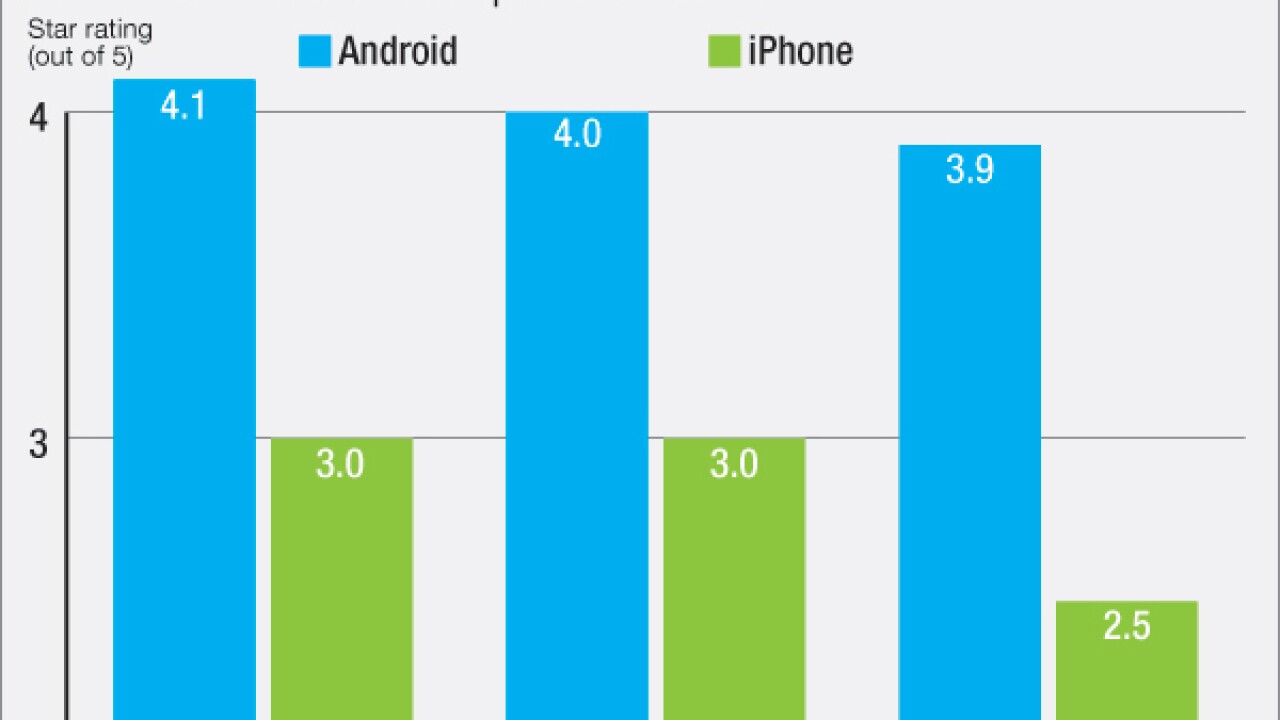

U.S. Bank recently updated its mobile app to a system that would allow it to react more quickly to new technology. It's going to need that flexibility now that consumers are complaining about missing features in the latest upgrade.

November 18 -

The trade group is calling for increased scrutiny of tech companies that are increasingly encroaching on banks' turf, but Georgia banker Dan Blanton says banks also need to be thinking about ways to team up with these new players in payments and lending or figuring out how to beat them at their own game.

November 18 -

A man accused of operating a bitcoin exchange allegedly owned by the mastermind of a criminal enterprise that hacked at least nine big financial institutions and publishing firms, including JPMorgan Chase, pleaded not guilty to money laundering.

November 18 -

In one instance, a single complaint in the Consumer Financial Protection Bureau's database was counted as 35 different ones while in another, a complaint against a payday lender was filed against an unrelated bank. Current and former officials say that's par for the course, leading to inflated complaint numbers and inaccurate data.

November 17 -

Regions Financial in Birmingham, Ala., has hired FBI veteran John Boles to oversee its investigations of cybersecurity and international threats.

November 17 -

The Cybersecurity Information Sharing Act, which has advanced far on Capitol Hill, promises to help businesses and government thwart cybercriminal attacks. But privacy advocates say the bill would make misuse of consumer data even easier.

November 17 -

Quality control should come early in the production line, just as Japanese automakers discovered when they began to gain market share.

November 17