-

Banks should rethink even existing services, such as the branch experience, said top executives at the Oracle Industry Connect conference.

April 13 -

Bank of America is investing heavily in videoconferencing at unstaffed branches, Citigroup is experimenting with gamification and Union Bank’s PurePoint Financial is going entirely paperless.

April 12 -

The bank says its partnership with Lender Price will help streamline and simplify its home loan process.

April 12 -

Dominic Venturo, chief innovation officer at U.S. Bank, shares his vision for digital banking ten years from now. It includes ambient computing – interconnected devices, machines and sensors that are sensitive and responsive to the presence of people.

April 12 -

The Cleveland bank's CIO, Amy Brady, said it had to start replacing legacy systems now to position itself as a leader in the future.

April 11 -

Applications can now be made on the bank's app or website, but closings will still be in person. With this move, BofA joins Quicken Loans, Lenda, SoFi and others offering a mostly digital mortgage. The trend is sure to continue.

April 11 -

With consumer privacy issues in the spotlight, Citibank is betting its app — as an offering from a trusted data partner — will be more appealing than those from unknown brands or companies that have less liability if security breaches occur.

April 10 -

AccessFintech lets financial firms track trades and aggregates data in order to get a sense of risk across a number of systems.

April 10 -

AI in a car can be fatal. What could go wrong with AI in a bank? A new council established by BofA and Harvard hopes to minimize unintended consequences that could jeopardize consumers' financial well-being or discriminate against them.

April 10 -

The self-regulatory body says working with data aggregators increases risk of cyber fraud, unauthorized transactions and identity theft. But aggregators say other links in the information chain are more vulnerable.

April 9 -

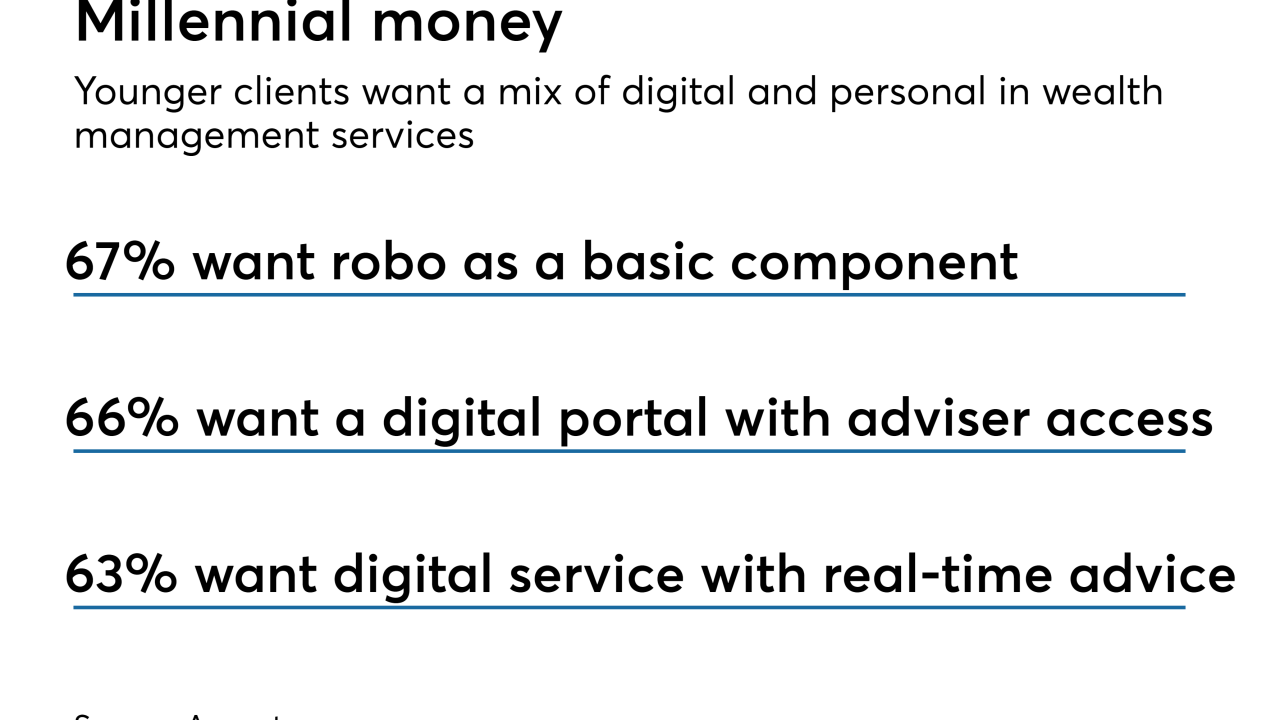

BMO Wealth Management aims to modernize its investment service and give advisers better equipment. Others offering automated advice solutions include UBS, Wells Fargo and JPMorgan.

April 6 -

Millennium Bank in Tennessee has quickened approval times on loan applications by using software that frees lenders from repetitive, manual tasks. The result: Loan balances have increased by more than 50% in less than two years.

April 5 -

Some speculate that the banks who do business with credit reporting agencies may be looking for alternatives after mounting concerns about their ability to keep information private. But breaking up is hard to do.

April 4 -

While the banking industry is divided on the use of conversational technology, the San Francisco company believes chatbots can make it easier for customers to discuss their finances.

April 3 -

The software firm MonetaGo and three Indian factoring exchanges have launched a blockchain that can identify invoices that have already been financed.

April 3 -

Some fear that the removal of such data from individual credit reports could lead lenders to believe a consumer is a better bet than they really are.

April 2 -

The funding round comes on the heels of what BitPay cited as a record year in 2017 in processing more than $1 billion in bitcoin payments.

April 2 -

Customers are sprinkling symbols into their texts, and it's a challenge for banks to fine-tune systems to support the use of the cartoon code in communications.

March 29 -

The bank is providing Merrill Edge's do-it-yourself clients with more automated stock and portfolio research, but it plans to hire more financial representatives for those who want in-person advice in branches.

March 29 -

The Canadian bank becomes the largest institution to implement the fintech firm’s Bank Operating System technology.

March 28